{{item.title}}

{{item.text}}

{{item.text}}

Real estate has long been a core economic sector and investment of choice in the Middle East region, buoyed by strong demand fundamentals from solid population and GDP growth, as well as excess liquidity from oil. Realizing its importance in shaping their nascent economies and its action as a catalyst for growth and diversifying the economy through reduced dependence on oil, many local governments have set up large national real estate development champions and pushed to establish ambitious mega-cities and urban developments. The sector was instrumental in addressing the needs of the region’s burgeoning youth, especially in housing and entertainment.

Albeit emerging, the regional real estate landscape has been rivaling the world’s leading markets, with plenty of media attention paid to the success stories of local champions and the grandeur of the many pioneering urban developments.

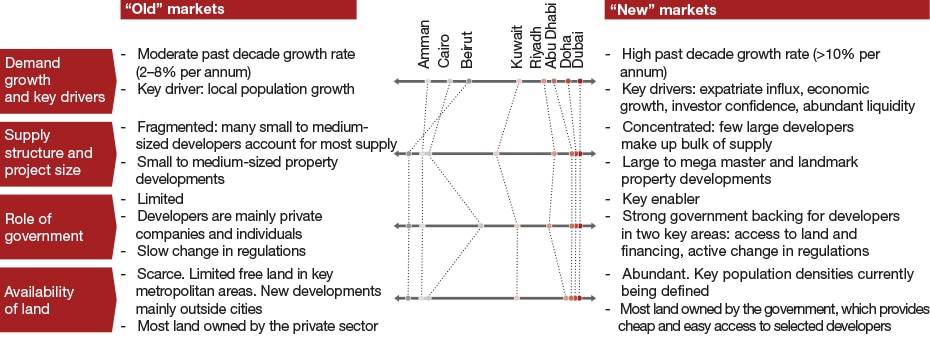

The region however is not a single uniform market, and remains divided into “old” markets and “new” markets, each with its own specificities that shape the real estate landscapes within.

Founded in the early 2000s, Strategy&’s Middle East real estate practice is the oldest dedicated practice for this sector among top-tier consulting companies in the region. We have supported over the years four main types of clients:

Over the past two decades, we have been working in tandem with our regional clients, offering end-to-end strategy-to-execution support across all facets of real estate — strategic diagnostics, strategy definition, digital and customer experience strategy, portfolio and asset management, operating model design, fund design and setup, project feasibilities and development support, and end-to-end implementation support.

Key industry trends across all real estate entities in the Middle East are as follows:

Whether in preparation for the next growth phase, or to moderate a slowdown, we support real estate players in identifying and understanding their key performance and capability gaps vis-à-vis best practices and their aspirations.

We help our clients achieve their growth aspirations and win in the market through end-to-end market and investment strategies.

We help our clients achieve customer service excellence and deliver on the latest customer trends and requirements with next-generation digital and value-added offerings, be it on the service, property, or master plan levels.

We help our clients activate their dormant land banks and extract maximum value from them.

We support our clients in maximizing value from their real estate portfolios and enhance their efficiency through our rigorous portfolio and asset management services.

We help clients take advantage of one of the fastest-growing financing trends in the region, by supporting them in defining and developing their real estate funds.

We help our clients reach operational excellence and develop best-in-class capabilities through our comprehensive operating model services.

We support our clients in creating, defining, and reviewing their mega-flagship developments by ensuring the optimal concept, commercial viability, and ability to secure partners and investors.

A diversified real estate developer with the largest single-segment operating property portfolio in its country was looking to chart its next growth phase that would see it rival leading international peers in terms of GLA size.

A national champion GCC developer that had recently expanded its mandate was seeking to redefine its role, business model, strategy, and operating model. Strategy& supported the client in all phases and provided a fully fledged transformation plan that would allow it to achieve its strategic evolution.

A mid-sized retail and residential community developer in Saudi Arabia aspired to become the local market leader.

A real estate developer and one of the largest real estate asset owners in Central America with a significant variability of returns from its widely varied assets needed to formulate a strategy to achieve future growth.

One of Saudi Arabia’s largest developers was looking to enhance the customer experience throughout its entire portfolio, with a focus on the retail and entertainment properties.

A ministry in a GCC country was seeking to establish a real estate investment company to monetize unutilized assets in its land bank. Strategy& designed the strategy and business plan for the undertaking.

A large listed company in Saudi Arabia with an unutilized land bank engaged Strategy& to determine four plot feasibilities for its real estate arm and develop its mandate, strategy, business plan, operating model, and financial forecasts over the next 10 years.

A GCC sovereign investor with a multi-billion dollar portfolio of local and international real estate and infrastructure assets was seeking to balance its portfolio.

A large regional mall operator was looking to improve the performance of one of its flagship super-regional malls, with a GLA upward of 100,000 square meters.

A large European retail bank with a vast portfolio of real estate assets in several countries had become fragmented in a number of ways.

The real estate development arm of a GCC family group with leasehold land was looking to develop the mega-plot into a flagship mixed-use city.

A nascent Qatari developer was looking to cut cost overruns on its only mega-project, and to evolve from a one-project developer into a full-fledged developer and operator.

One of the largest mall developers and operators in the GCC intended to file for an IPO. The client requested Strategy&’s assistance in assessing its IPO readiness, as well as our support in undergoing.

A government-controlled developer was seeking to develop the new downtown area in the capital city, on a large tract of government-owned land. The proposed town center would provide a focal point for ...

A large GCC family conglomerate with a real estate business was looking to develop two land plots in the capital city of its home nation. The client wanted to ensure the viability and feasibility of the projects,...

A leading developer acquired the rights to revitalize an island in a prime site in Malta. Although the developer has a 99-year lease, the government requires the site to be developed within the next eight years ...

Menu