Executive summary

Over the past decade, a strong market for private education has attracted increasing numbers of investment companies and strategic investors to the education sector in the Gulf Cooperation Council (GCC).1 This trend will likely continue unabated given the regional growth in student populations, a widespread consumer preference for private education, and governmental privatization initiatives.

It will not be enough, however, to simply buy into the strong market for private education in the GCC and ride its growth. The sector’s projected growth is already being priced into valuations, and the high levels of investment capital earmarked for the sector should ensure that valuations continue to rise. As a result, investors will need to identify the investment plays best suited to their risk/return profiles, and utilize a tailored set of value creation levers. Only those who do this will unlock the full potential of their investments.

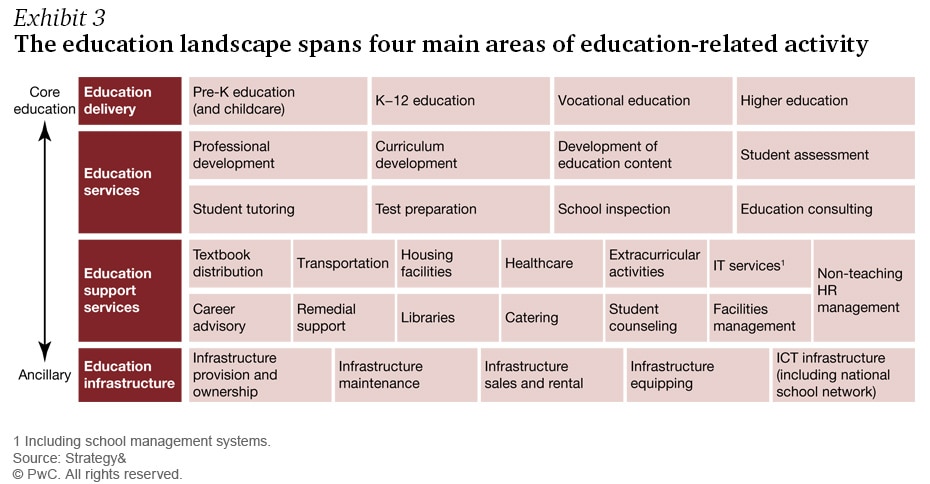

The question for investors is how to capitalize on the opportunities the sector offers. They can pursue one or more of four plays in the GCC education sector: Growth-focused acquisitions are best pursued in the education delivery subsector in the GCC because it is relatively mature and well-populated with established local institutions. Greenfield ventures are best pursued in the nascent subsectors of education services, such as online tutoring and student assessment services, and education support services, such as school management systems. Consolidation plays are rare in the GCC, but they will become more common as the sector matures and investors seek to optimize fragmented investments, realize scale advantages, and unlock incremental returns. Real estate sale-leasebacks are best pursued in the education infrastructure subsector and typically target the campuses of companies operating in the education delivery subsector. Each of the four plays offers its own risk/reward ratio and cash flow profile.

The investment landscape in the GCC education sector

The investment landscape in GCC education spans four subsectors: education delivery, education services, education support services, and education infrastructure (see Exhibit 3). Currently, education delivery, from pre-K through higher education, and education services, ranging from professional development to education consulting, account for a majority of the deals we have examined in the sector. As the sector matures, new opportunities are likely to emerge in education support services, such as textbook distribution and catering; and education infrastructure, such as property maintenance and information, communications, and technology networks.

Conclusion

As the second-most-active sector in GCC deals, the education sector continues to beckon private equity and strategic buyers with attractive returns. The demand for private education is strong as it is driven by an expansion in the student population, discretionary income growth, a consumer preference for private education, and governmental privatization initiatives.

However, to capitalize on these deals, investors in GCC education will have to remain mindful of the value creation levers that enable the achievement of target returns. They will identify opportunities in market segments that feature favorable combinations of curriculum, price point, and geography. They will ensure that their targets and partners have reputable brand names and attractive customer value propositions. Moreover, they will seek scale to unlock cost benefits and proactively safeguard their business models in the event of changes in the market. Investors who do these things will garner handsome returns.

1 The GCC countries are Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and United Arab Emirates.

Contact us

Menu