{{item.title}}

The global energy system stands at the threshold of a new era of abundance that will transform energy economics. Thanks to rapidly declining renewable energy costs and technological advances, hydrogen can become the medium of choice for transporting cheap clean energy across the globe. The growing importance of hydrogen is part of a broader trend toward decarbonization that the COVID-19 pandemic has accelerated by reducing hydrocarbon demand substantially.

Although many countries have ambitious plans for green hydrogen, the GCC states also have unique advantages that could allow them to lead the hydrogen economy. They also have an incentive to move away from fossil fuels. By seizing the green hydrogen opportunity, GCC countries can lay the foundation for economic growth in a decarbonized world and ensure their continued influence in the energy market.

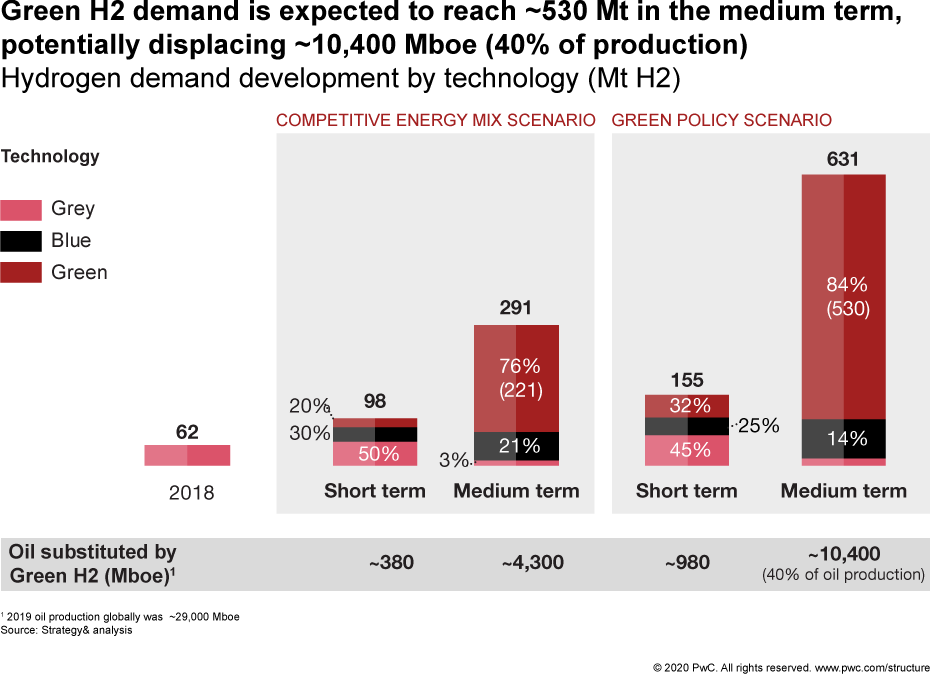

We project the demand for green hydrogen to grow significantly in the medium term, reaching about 530 million tons and potentially displacing roughly 10.4 billion of barrels of oil equivalent (37 percent of current global oil production) by 2050.

Hydrogen has a wide range of industrial applications, from refining to petrochemicals to steel manufacturing. It is also a rich source of energy, far more efficient than other fuels. Hydrogen demand has been increasing at a steady pace over the past four decades and reached 62 million tons in 2018, over three times its level in 1980.

Green hydrogen is formed by using renewable energy to power electrolysis that splits water molecules into their constituent elements: hydrogen and oxygen. Advances in electrolysis technology and the falling cost of renewable energy are enabling the mass production of “green hydrogen,” which is more environmentally sustainable. Green hydrogen is a clean energy source that can be stored for a long time and transported over considerable distances.

These developments have altered the calculus for hydrogen and created a significant opportunity for countries to boost economic growth and move away from fossil fuels. Previously, the traditional means of producing hydrogen generate large volumes of carbon dioxide.

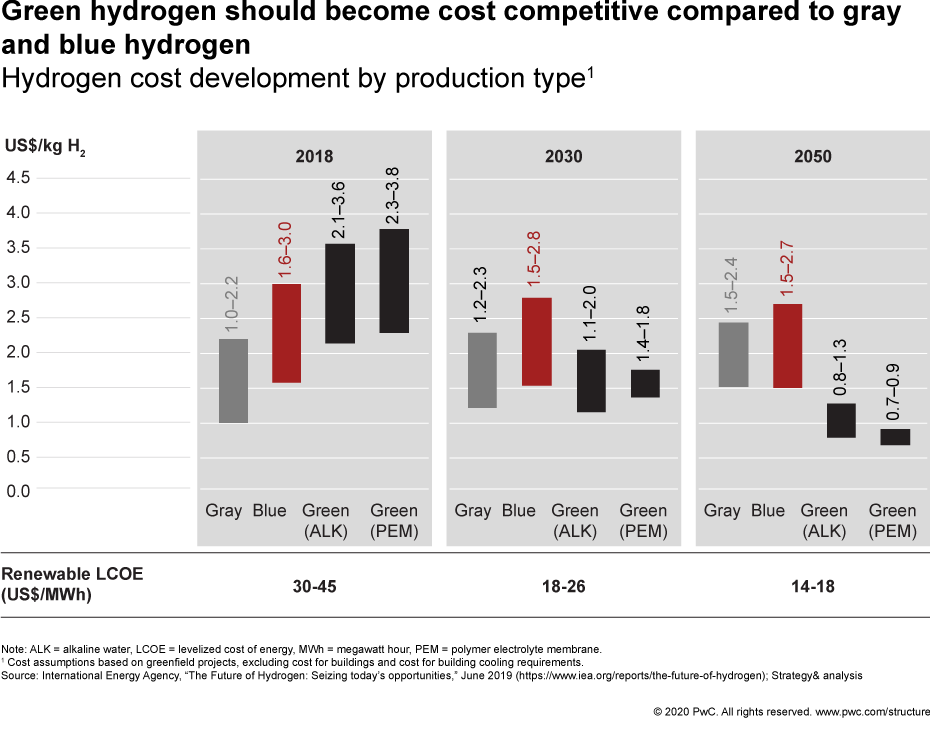

Developments in various electrolysis technologies over the past decade, specifically polymer electrolyte membrane, have increased system efficiencies to nearly 90 percent, and the operational lifetime of the process is approximately 80,000 hours. We estimate that new and cheaper materials will reduce the overall capital cost of polymer electrolyte membrane equipment, lowering the capital cost per kilowatt (kW), currently between $800 and $1,400, to as little as $200/kW by 2050.

Two major changes will make green hydrogen cheaper to produce:

Electricity represents a large share in the operating costs of electrolysis processes (roughly 50 percent for PEM electrolysis, assuming electricity prices of 4.5 cents/kilowatt-hour). However, we expect that the installation of more low-cost solar photovoltaic and wind power plants globally over the next decade will produce the required electricity for less than 2 cents/kWh according to the prices of recent tenders.

Yearly additions to electrolysis capacity, along with larger average project sizes, are creating larger economies of scale and a reduction in project capital costs.

Based on these factors, Strategy& estimates that the production cost of a kilogram of green hydrogen using the PEM technology will fall from $2.30-$2.80 in 2018 to $0.70-$0.90 by 2050.

Lower-cost green hydrogen will lead to benefits in a range of industries and advance the goal of making countries and companies more environmentally sustainable.

For example:

Barriers to entry in the green hydrogen production business are relatively low as the technology is easily accessible. However, only a handful of countries have the comparative advantages to become market leaders, with GCC countries at the top of the list.

These requirements include:

Green hydrogen production demands a streamlined supply of low-cost, sustainable energy throughout the year. GCC countries have some of the highest solar exposures in the world.

Countries will need to build large-scale renewable capacity to meet part of the 2050 global demand for green hydrogen. GCC countries have ample land that can be used to construct large-scale capacity of renewable energy and electrolysis plants.

We estimate that meeting green hydrogen demand in 2050 will require around 5.6 trillion liters of deionized water. For this, the GCC countries have ready access to sea water.

GCC countries can export most of their green hydrogen production, because electricity and gas are cheaper than hydrogen for these countries’ domestic energy requirements.

Based on our global supply and demand analysis, exporting countries can potentially capture a market of approximately 200 million tons of green hydrogen by 2050, worth $300 billion yearly. The green hydrogen export market can also create up to 400,000 operations and maintenance jobs, divided between 300,000 in renewable power generation, 100,000 at electrolysis facilities.

We estimate that the investments required to meet green hydrogen export demand in 2050 are around $2.1 trillion. Of this total, $1 trillion is needed to build the dedicated renewable energy capacity, $900 billion to set up the hydrogen conversion and export facilities, and $200 billion to develop the water electrolysis facilities.

Producers can adopt various transport modes such as compressed or liquefied hydrogen, hydrogen in the form of ammonia, or through an organic carrier molecule. For distances that fall below about 1,800 kilometers, transporting hydrogen through pipelines is the lowest-cost option. For longer distances, ammonia ships are the most economic solution.

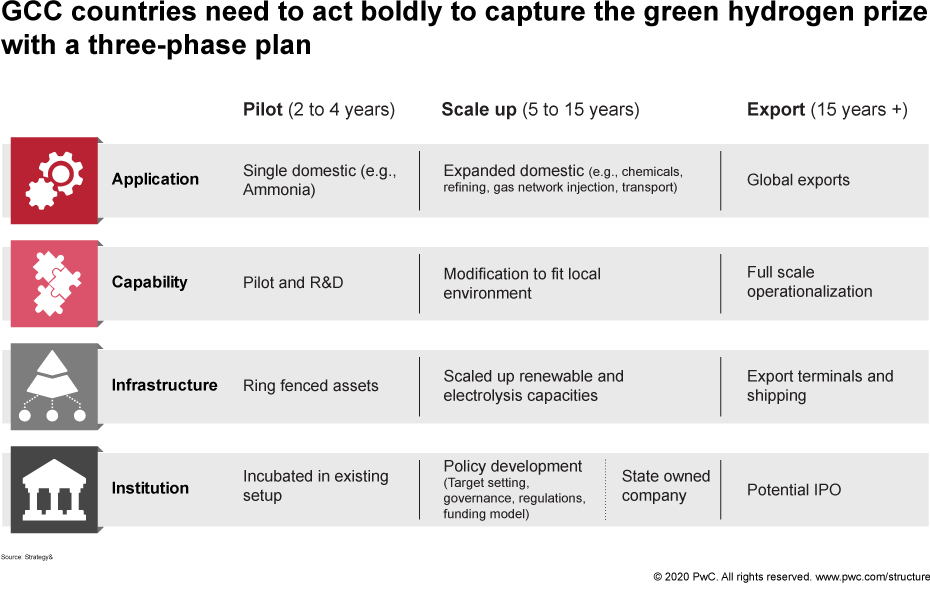

Given the dual shock of the global COVID-19 pandemic and steep decline in oil prices, GCC countries need to act boldly now to catch up and overtake these countries. GCC governments must act fast to implement a three-phase green hydrogen plan.

Menu