Crowdfunding in MENA: Game-changer or fad?

by The Ideation Center

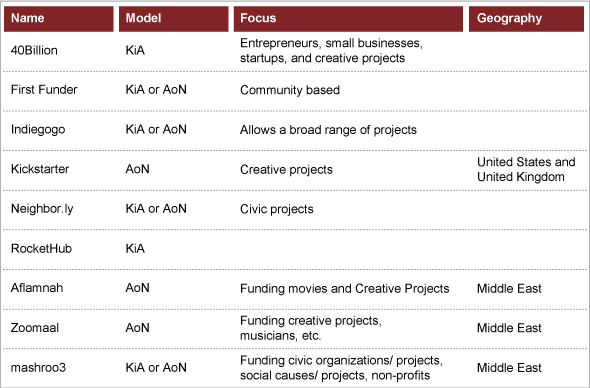

As the winds of change spin around the Middle East, a new breeze is emerging in the region carrying with it a seemingly promising opportunity. I am talking about Crowdfunding, which uses the wisdom of the crowd to validate and fund projects and ideas with small (micro) contributions. Over the past two years, the Crowdfunding space in the Middle East has built significant momentum and now boasts several local players across the region, each with a strong backing and support from the local venture capital and entrepreneurship biosphere (see Table 1).

Table 1: Examples of notable players in crowdfunding globally and regionally

Note: Keep it All model (KiA) = keep all funds raised; All or Nothing model (AoN) = keep the funds if the target is met/exceeded

As banks rein in on lending regulations due to tougher capital rules and greater regulatory scrutiny, Crowdfunding, which originated in the U.S., has expanded rapidly as an alternative source of finance. As a testament to its success, the Crowdfunding market is not a small by any means. In 2012, it grew over 80% worldwide by gaining over USD 2.7 billion in funds worldwide. This number is expected to almost double by some estimates to over USD 5 Billion in 2013 alone, with a greater shift towards funding start-up businesses and small firms rather than creative projects*, which remain the most popular category.

Exhibit 1: Crowsdfunding isn't entirely new; it has come about as a progression to other micro funding models

While North America still accounts for the bulk of the funding that is being raised from crowds, some Middle Eastern players seem to be working slowly but surely on importing this model into the region. These players, such as eureeca.com for equity investing, zoomaal.com and aflamnah.com for creative projects – just to name a few, seem to have found their way around the lack of regional regulatory frameworks that support or govern various Crowdfunding models. Other players have alternatively decided to only have a local presence, but offshored the payment side of their operation outside the Middle East to eventually avoid having to face off with any eventual regulations that could emerge and have a direct impact on their business model.

While going around a few regulatory bumps in the road bodes well for short-term viability, three immediate questions require validation before we can confirm the sustainability of Crowdfunding here in the Middle East. First, we have to prove that the Crowdfunding concept can be customized to local flavors and adapted to the Arab digital consumer’s behavior. Second, we need to get a better grip on what really drives and motivates the Arab consumer-investor to put money in “pies-in-the-sky”. Indeed, the American consumer-investor had decades, if not centuries, of civic and psychological training, supported by charity-promoting tax code, and omnipresent financial literacy. That is not the case of our Arab consumers who remain at an educational, cultural and psychological disadvantage when it comes to making like-for-like decisions as they consider investing or supporting comparable projects, ideas or opportunities – no matter how creative, charitable or lucrative these projects may seem.

Thirdly and most critically, it remains to be seen whether Middle Eastern project owners and “micropreneurs” will be able to live up to the expectations of high execution standards and transparency or disappoint their crowds. These project owners, who would normally benefit the most from such financing platforms, should consistently beat their audience’s expectations in order to really attract the early adopters (donors) from the demand side. The task becomes even harder when we consider that asking the typical disheartened, suspicious and burdened Middle Eastern consumer for support is no easy task. One could argue that gaining the trust of an Arab consumer will take much more psychological pitch gymnastics, supported by an unusual amount of communication to raise awareness and transparency. Without such efforts, the Arab consumer may not reach that tipping point after which their suspicious attitude is overturned. Indeed, having realized this, and to go around this initial trust issue, some of these new Crowdfunding platforms are reducing early adoption resistance risk, by jump-starting the process artificially. Before launch, the platform managers line up a group of investors (offline) and convince them to invest and support the pilot ideas once they get launched with the website inauguration. Upon pilot launch, these investors are then expected to chime in by closing any remaining funding gaps before the 90 day typical deadline and ensuring no project is left behind. This essentially guarantees a no-failure scenario for both platform and project, ensuring no negative publicity or wobbly starts.

By jumpstarting the investment process in the background through ‘invisible sponsors’, these platforms may gain the semblance of a winning proposition and generate some positive buzz from day one. However, the risk remains that the sustainability of both sides of the equation is not guaranteed: that is, to be able to attract ‘quality’ projects and ideas on the supply side, while ensuring that the real crowd will eventually be convinced by the viability of this model and be willing to jump on to the Crowdfunding bandwagon like their western counterparts who live in a much more stable environment and have a stronger need at the personal level to be part of something bigger and more meaningful, if not take some smaller risks or place bets on tiny ventures to spice up their peaceful lives.

Exhibit 2: Success rates and other interesting correlations

No matter how things shape up, Crowdfunding in a way is another form of democratization of financing. This fits perfectly within the current paradigm shifting that’s currently taking place across the region and making people feel more empowered to do things previously unthinkable only a few years back. Despite all the hurdles abovementioned, is it possible that the Arab consumer may just decide to rebel against the established financial system and opt to throw his or her support behind the small entrepreneur with a big dream, breaking yet another barrier on the journey to cultural and psychological emancipation?

Menu