Executive summary

The countries of the GCC1 spend US$130 billion each year on defence, much of which goes to contractors in other countries. As a result, the region has little to show in terms of local defence manufacturing capabilities. Based on our analysis, other countries that spend far less on defence are far more advanced in their ability to design and manufacture defence systems.

Given the current geopolitical uncertainty, GCC governments will continue spending heavily on defence, but they must spend more thoughtfully. By changing their approach, governments can develop a more vibrant manufacturing sector in the region, with more jobs for GCC nationals. In the next decade, demand for local defence products and services could grow to approximately $30 billion annually from a current level that we estimate to be around $6 billion.

To achieve this, however, all stakeholders need to make changes:

- GCC buyers will need to coordinate and consolidate purchases — rather than buying weapons and systems piecemeal, as they currently do. In this way, they can boost the interoperability among national forces and reduce complexity in maintenance and supply chains.

- Local contractors need to increase their capabilities, evolving from mere suppliers of spare parts to sophisticated partners that can guarantee military assets are available.

- Governments must invest to help the local defence industry advance, and foster direct collaboration among stakeholders.

Developing the emerging GCC defence market so that local industries become the main players will be a complex and lengthy process. GCC governments will keep spending large amounts on defence. However, these governments should ensure that it will be local industry that will benefit.

Appendix

Putting strategy into action

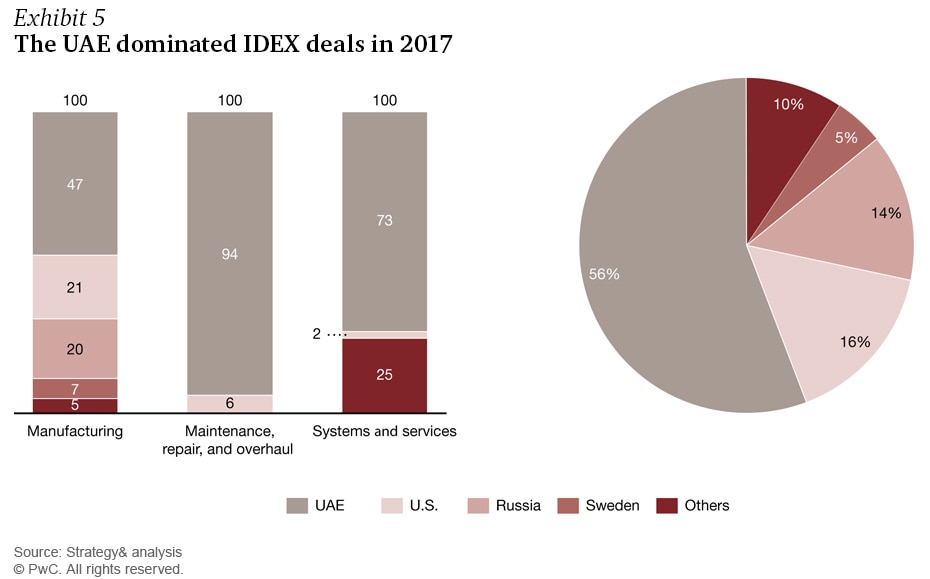

Deals announced at the most recent International Defence Exhibition & Conferences (IDEX) in Abu Dhabi in 2015 and 2017 show the shift in procurement to local contractors. At the 2017 event, nearly 60 percent of the deals announced were awarded to companies based in the UAE, which represented 56 percent of the more than AED 10 billion ($2.7 billion) in total deal value (see Exhibit). UAE suppliers dominated the contracting for MRO operations, with 94 percent of all deals.

UAE-based companies also won 73 percent of the services contracts, and 47 percent of the deals for manufactured products.

More notable is that the UAE military is aligned with the UAE’s defence industrial strategy and is deliberately — and consistently — choosing to buy from domestic companies. This is a positive indication for investment in the UAE, because local industry can grow only under the patronage of military buyers and users.

Conclusion

Developing a GCC military industrial base is an ambitious and attainable goal. Other countries have done more with less, including some countries with lower levels of economic development. The GCC has the advantage of large military budgets, a drive for efficiency, and the ability to capitalize on lessons learned in other regions. By changing their approach, GCC governments can invest in the region’s future and transform it from a defence consumer to a defence producer.

1 The GCC countries are Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

Contact us

Menu