Executive summary

Three global trends are reshaping travel distribution business models and threaten to weaken the connection between airlines and their customers. These trends are: shifting customer behavior on both retail and business sides, changing dynamics within direct and indirect sales channels, and the rise of digital technologies. The consumer trends involve an increasing use of online channels for search and booking, the use of multiple devices, and the growing popularity of social media. Meanwhile, changing dynamics within direct and indirect sales channels — online travel agents, traditional travel agents, and travel management companies — offer opportunities and pitfalls for airlines.

Airlines can benefit from this only if they undertake three major initiatives within a holistic strategy enabled by technology. They have to transform their travel distribution model in both direct and indirect channels. They must pursue closer partnerships with channel, content, and technology players. Finally, they should enhance internal capabilities (operating model, processes, skills, and technology) to capture the opportunities of the new distribution trends and so become centered on customers in their organizational setup. In particular, airlines need to adeptly manage digital innovation and use these technologies to improve areas of the business, particularly direct channel sales, marketing, cross-selling, and dynamic pricing and inventory management.

More digital opportunities

A wave of new digital technologies continues to provide strategic opportunities in the field of airline distribution.

Marketing

The lines are blurring between sales channels and marketing platforms (e.g., OTAs). Search engines, social media, crowd sourcing, and mobile are redefining the consumer journey, particularly in the “discover” and “research” phases. Consumers can now book directly from travel metasearch portals that were once strictly for research. Moreover, as the consumer journey becomes more digital and complex, there are more opportunities for suppliers to market across multiple touch points. Emirates, for example, uses Instagram posts that tout premium products and encourage consumers to imagine dream destinations. Finding the right touch points between social media and direct sales channels will be important for airlines.

New digital technologies also allow airlines to reach consumers in real time during their research phase. Airlines can further personalize the travel experience. TAM, for example, used Facebook profiles to personalize inflight magazines placed on the seat of each passenger to celebrate the 35th anniversary of its São Paulo to Milan route. Each cover bore a different passenger’s photo and name, in accordance with the seat assignments, and content was geared toward each individual’s interests and life experiences. Airlines need to improve their specific destination content and inspirational media if they are to stay relevant in the search/inspiration part of a consumer’s travel booking journey.

Direct channel

Airlines have a powerful array of digital platforms at their disposal that can help enhance direct revenue channels, while reducing reliance on indirect channels (e.g., GDS, consolidators, and tour operators). On their websites, airlines can change the search paradigms available to consumers from route-based searches to interest-based, theme-based, and map-based search experiences. By improving their landing pages to engage users and capture those directed from search engine pages, metasearch pages, and others, airlines can make the most of the direct channel.

Cross-selling and up-selling

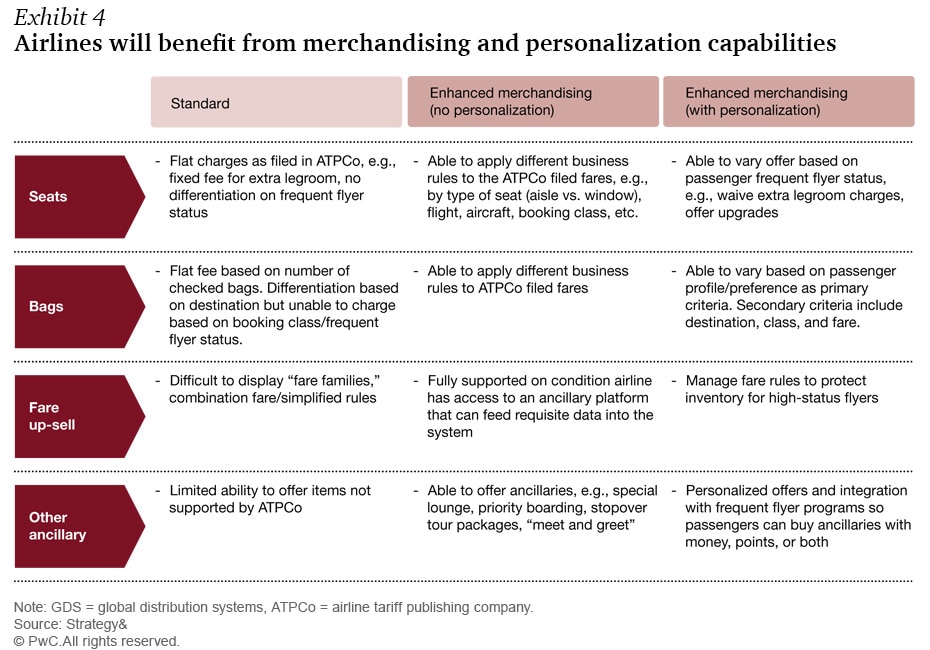

Emerging technologies also provide a platform for airlines to improve their merchandising capabilities, and to sell additional travel-related products and services (e.g., hotel stays) across both direct and indirect channels with and without GDS connections. This is because passengers are an airline’s greatest asset as they can be sold additional airline and non-airline products. These new technologies offer greater flexibility to set up and manage business rules, as well as high-margin ancillary products and more varied fare options. Here again, airlines can personalize offers based on frequent flyer information — such as status, flyer profile, past behavior, and so forth (see Exhibit 4).

Dynamic pricing

The ability to analyze big data increasingly allows airlines to predict with a high degree of certainty when a known passenger will be flying next, to where, and what his or her travel preferences are. For example, airlines can use the customer data gathered in airlines’ direct channels — e.g., customer segment, seasonality of flight, and flight timing — to make better and more targeted offers to customers. Furthermore, airlines can integrate this tailored pricing with marketing and promotions in real time to optimize bidding. Fully realized, dynamic pricing could usher in a new era of fine-tuned channel distribution strategies.

Loyalty

Loyalty programs are the main tool for airlines to collect a wide range of customer data. Supported by technology and increasing online penetration, loyalty programs can be the backbone of airlines' customer data centers. Coupled with analytical tools, these programs allow airlines to remain closely engaged with their customers, allowing them to build personalized offers, tailor a marketing campaign to specific profiles, and drive the sale of ancillary products and services. Moreover, with airline partnerships on the rise, harmonized loyalty programs could become a key differentiator in the marketplace.

Conclusion

Airlines need to identify the key opportunities and challenges from the new distribution environment, as well as the scope of their own internal capabilities, and put a plan in place to close any gaps and strengthen their travel distribution models. They can benefit from the disruption of travel distribution only if they build these capabilities and execute them in a holistic way with a smart usage of leading technology. In most cases, this will require strong partnerships with channel, content, and technology suppliers. Those airlines that master the new environment will be closer to their customers and will sell more in less competitive, direct channels than ever before. Such proximity to the customer will minimize the risk of dropping off the customers’ radar and losing them to the emerging travel distribution disruptors. Instead, the emerging and new travel distribution players will seek partnerships with airlines that succeed at this challenge, while diminishing the other airlines to pure transport providers.

Menu