{{item.title}}

{{item.text}}

{{item.text}}

Open banking has the potential to transform payments in Saudi Arabia. What open banking does is provide third parties with access to a bank’s systems and customer data in order to create new products and services. This access significantly lowers the barriers to entry for financial technology (fintech) startups and unleashes their potential to innovate and disrupt.

The Saudi Central Bank (previously known as the Saudi Arabian Monetary Authority, or SAMA) has announced the launch of an open banking framework expected to go live in 2022. The announcement underscores the country’s commitment to diversifying its financial-services sector, a key objective of Saudi Vision 2030 and a step toward making the country a regional and global fintech hub.

Open banking has significant implications for incumbent banks, which have traditionally monopolized payment services. They must rethink their business models to remain competitive in the new era, in which financial services will be embedded in customer experiences, such as self-checkout and “buy now, pay later” products. They will need to abandon their conventional model in which the bank is the sole producer and distributor of products and services. Banks will have to rethink their strategies, moving from the traditional pipeline optimization model to a co-creation platform model that involves different players in the ecosystem. Numerous countries already have open banking initiatives underway, offering some lessons for Saudi policymakers, incumbent banks, and fintechs as they plot their course in this new environment.

The Saudi Central Bank has announced the launch of the country’s open banking framework, expected to go live in 2022. It is the latest step in the country’s plans to diversify its financialservices sector and become a regional and international hub for financial technology (fintech) innovation. Over the next 18 months, the central bank plans to work with market participants to design and implement the framework.

Open banking regulations require banks to expose their systems and data to third parties with customer consent. By using open application programming interfaces (APIs), those third parties can use that data to build products and services for the financial institution’s customers. Open APIs lower the barriers to entry for startups, and thus result in increased competition and innovation.

This change poses a challenge to incumbent banks. They could lose their tight control of customer data and their near monopoly over payment services. In this new environment, they must rethink their business models to remain relevant and competitive. That means finding ways to improve their own offerings and partnering with fintechs and third-party institutions to create value for customers.

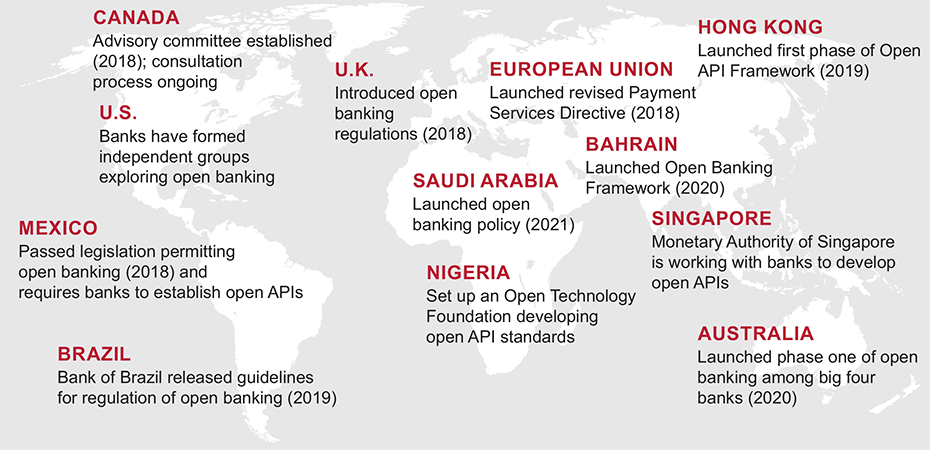

The Saudi Central Bank initiative comes at a time of considerable international interest in open banking. Many countries are planning for open banking, and regulators in those countries are taking a wide variety of approaches to encourage the adoption of open banking practices ( see “Open banking goes global” ).

Although open banking is a global movement, regulators have taken a variety of approaches to encouraging adoption, such as facilitating market-driven initiatives or being more prescriptive and enforcing a high degree of standardization. These examples offer valuable lessons for Saudi Arabia’s policymakers, incumbent banks, and fintechs as they plot their own course ( see Exhibit ).

Advances in global open banking

For example, Bahrain, the E.U., Hong Kong, and the U.K. have taken a prescriptive approach. Regulators have mandated open banking and are enforcing compliance:

In other markets, such as Singapore and the U.S., regulators are being less prescriptive. Instead of issuing formal open banking regulations, they are acting as facilitators, providing nonbinding guidance and coordination.

Saudi Arabia made the transformation of its financial sector a priority when it established the Financial Sector Development Program in 2018 as part of Saudi Vision 2030, the national development plan. Over the next three years, a series of initiatives promoted financial sector innovation nationally and regionally. These initiatives included the launch of Fintech Saudi (the national platform to help Saudi fintech entrepreneurs build capabilities at every stage of their development), the issuance of Payment Services Provider regulations (allowing nonbanks to offer payment services such as digital wallets, payment initiation, and aggregation), and the introduction of a national quick response (QR) payment system enabling interoperability of digital wallets.

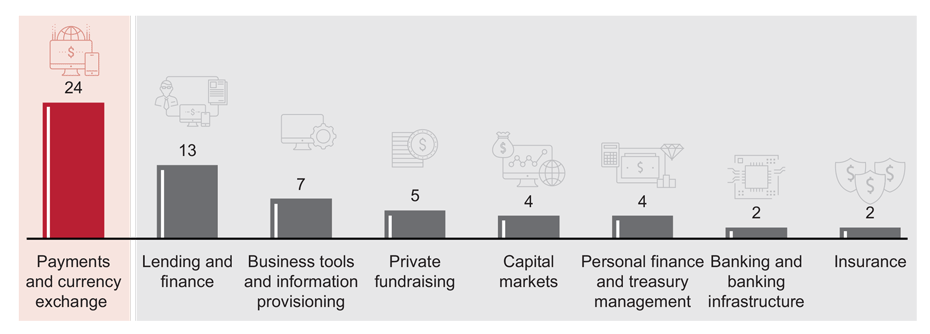

During this period, payment technology startups, so-called paytechs, built end-to-end services across the payment value chain. They are offering personal financial management apps, financial aggregators, “buy now, pay later” services, and other precisely targeted customer service offerings. As a result, the number of Saudi fintech startups went from 10 to 61 between 2018 and July 2020 ( see Exhibit ). About 40 percent of them operate in the payments space. Notably, among these startups is the country’s first so-called unicorn, STC Pay.

Number of active fintechs by industry vertical in Saudi Arabia (July 2020)

Several factors make the Saudi market ripe for disruption by open banking. The relatively small number of banks means that adoption and standardization could occur faster than in other markets. The country’s relatively young population has adopted payment technology enthusiastically. The budding fintech ecosystem has strong backing from the government and the central bank.

Moreover, the country already has a state-of-the-art payment infrastructure that Saudi Payments, the country’s payment railway and infrastructure provider, is continuously modernizing. In particular, Saudi Payments’ Electronic Bill Presentment and Payment system, known as SADAD, has facilitated precisely the kind of account-to-account payments that can become a launchpad for open banking. The platform, which has already been widely adopted by billers and customers, allows customers to pay billers from their bank accounts and avoid hefty card charges typically levied by merchants for card acceptance.

There remain some areas for improvement. For example, processing of payment from cards, which facilitates the transfer of funds between buyers and sellers, is not yet available in real time. In the best-case scenario, merchants receive their funds at the end of the day. Sometimes they wait several days. Meanwhile, Saudi consumers still cannot access a consolidated view of their finances across banks, which is essential to improving financial wellness and enabling personal financial management.

Open banking, in its most basic form, threatens the dominance that banks have in financial services. It marks the end of an era in which confidential financial information was accessible only to the bank and its customers. As a result, there are several strategic implications for incumbent banks:

Meanwhile, open banking puts payment startups in a better position by giving them access to customer information. This improved position, likewise, has strategic implications.

We expect these shifts to occur swiftly in Saudi Arabia, given the relatively small number of incumbent players, all of which are preparing themselves for open banking. It is also evident that collaboration among all players — banks, payment service providers, and the Saudi Central Bank — will be critical to accelerating the process and ensuring the best implementation of open banking.

In the new era of open banking, Saudi Arabia’s digital native fintechs are positioned to benefit. Incumbent banks will need to adapt their business models quickly and focus on partnerships and co-creation to enhance their value proposition. The year ahead will be pivotal for players, as Saudi Arabia continues to push forward to diversify its financial-services sector and realize its stated goal of becoming a regional hub of innovation. Banks, the central bank, and payment service providers must cooperate to gain public trust. First movers will help set the stage and write the rules for open banking, potentially emerging as winners.

Menu