{{item.title}}

{{item.text}}

{{item.text}}

A high-growth opportunity

Saudi Arabia’s vibrant and rapidly growing entertainment and media (E&M) industry is making an important contribution to the country’s culture and its economic diversification. In particular, the TV market is undergoing transformation and the over-the-top (OTT) video market is dynamic and developing as new technologies emerge. Globally, audiovisual content has become a respected cultural artefact and is experiencing record levels of demand—in which Saudi Arabia can now participate.

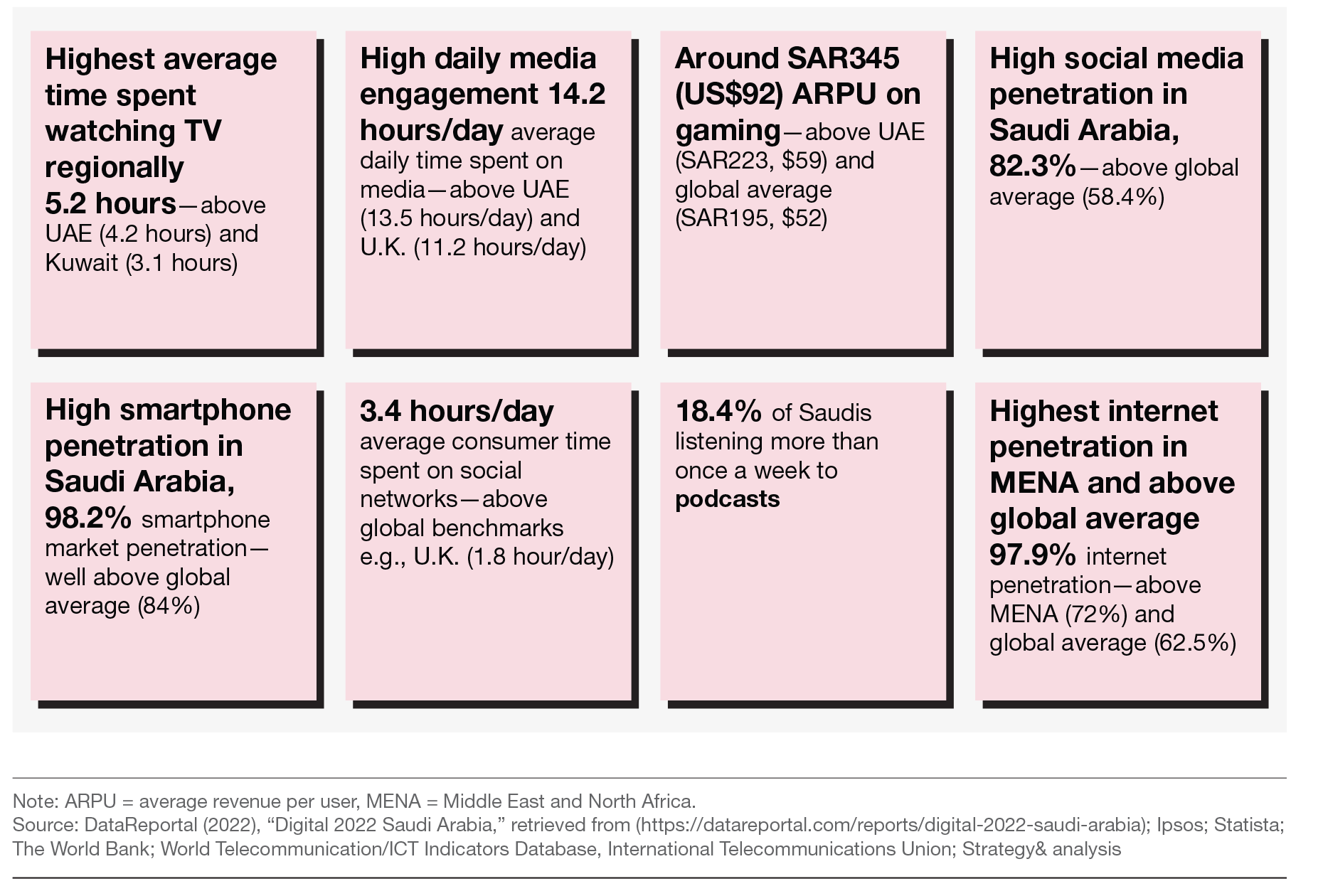

The Saudi market’s E&M growth potential stems from its distinct features—high rates of content consumption, including TV, streaming, video sharing, and gaming; impressive adoption of smartphones; robust social media; fast connectivity; and advertising growth opportunities. Indeed, while streaming and mobile penetration are changing how video is consumed, TV retains a majority share of viewership. Digital technology allows viewers to blend linear and streaming, curating their own content.

To grab more of this market, TV and video players should know their viewers intimately so that content producers can predict programming needs, grow viewer numbers, and create content to gain audience share domestically, regionally, and internationally. Media companies should continue with extending their offerings to on-demand streaming, digital transformation, innovation, data analytics, social media engagement, and digitally enabled advertising. To support such customer-centric change, media players should deepen partnerships with telecom operators, technology companies, and content creators, while building their internal capabilities to become more innovative.

The Saudi TV and OTT video market is dynamic and continuously developing as new technologies emerge and the audience embraces new genres of content. Saudi viewing habits have been transformed as mobile devices, optical fiber network connectivity, and video on demand (VOD) platforms have become mainstream.

TV is a strong performer and a key engagement platform, providing viewers with shared experiences, community, and content opportunities. Saudi media consumers are also increasingly using OTT VOD platforms due to the diversity, flexibility, and personalized experiences they offer. That means an OTT outlook for Saudi Arabia that outstrips the regional forecast. OTT revenues in Saudi Arabia are projected to grow at an 11.9 percent compound annual growth rate (CAGR) from 2019 through 2025, which surpasses the Middle East and North Africa (MENA) revenue growth outlook of a 10.4 percent CAGR.

The continuing expansion into digital consumption is a notable driver of change across the global TV and video industry. Advances in technology and in the delivery and distribution of content, namely the proliferation of OTT video on demand platforms and social media, have caused a shift in consumer habits, along with changes in the dynamics and business models of the industry. This shift was further amplified by the global pandemic, during which consumers stayed home and the use of in-home digital services soared.

The growth of on-demand consumption notwithstanding, TV remains the larger segment within video markets. TV is expected to retain this position, generating around 50 percent of total TV and video revenues. In 2019, TV generated 54 percent of total TV and video revenues, and is forecast to create 47 percent of the total in 2025.

The E&M growth outlook in Saudi Arabia is driven by a national audience that ranks among the most avid media consumers in the world. Stimulated by the social, economic, and cultural transformations set in motion by the Saudi Arabian government’s Vision 2030, Saudis are using a variety of media platforms to access, engage with, and create content.

Saudis are constantly connected. Smartphone market penetration is 98.2 percent—well above the global average—and internet penetration is 97.9 percent.5 Saudis are also sophisticated media consumers. They rank above global benchmarks in daily media engagement, social media use, and TV viewing.

Saudi Arabia is a high media consumption market

Saudi Media-Consumer Behavior

Although digitization is a powerful trend, TV is still able to deliver to mass audiences. With an average monthly reach of 84 percent of the Saudi population in 2021, TV remains popular and an essential medium among Saudi viewers, with series leading the ratings. According to Ipsos, Saudi TV viewers spent an average of 5.1 hours per day watching TV in both 2021 and 2020, compared to 4.5 hours in 2019.

The audience for OTT video is growing rapidly in Saudi Arabia as consumers adjust their media diets to increasingly personalize and control content. OTT platforms in Saudi Arabia, including international players such as Netflix and Starzplay, and regional players such as Shahid and Jawwi, are meeting this demand.

Saudi viewers can consume either advertising-based video on demand (AVOD) or subscription-based video on demand (SVOD), which usually offers a larger catalog of shows and live broadcasts.

For example, MBC Group’s content streaming platform, Shahid, which launched in 2009, now has 9.5 million unique users in the MENA region. The average number of unique viewers per month for Saudi Shahid AVOD has increased by a 28 percent CAGR in the last two years to reach an average of 3.4 million viewers in 2021 (not including the Ramadan period). Shahid VIP, which operates through subscription, reached a total of 2.25 million subscribers in Ramadan 2022. Saudi Arabia’s extremely high smartphone penetration rate explains why 77 percent of Saudi Shahid viewers use their mobile phones to view content on the platform.

Shahid unique viewers in Saudi Arabia are equally distributed between males and females, and the majority of viewers are relatively young compared to MBC1 TV viewers. More than 70 percent of Saudi Shahid viewers are below the age of 35; gen Z Saudis (ages 15 to 24 years old) account for 37 percent of Shahid viewers.

Saudi consumers are hungry for media experiences that are relevant to their interests and align with their needs. This imperative, combined with technological advancements, increased competition, and new advertising products, is driving the agenda for TV and video success in Saudi Arabia. The development of the Saudi TV and video market is also part of a broader cultural renaissance in which audiovisual content can play a key role. Saudi Arabia is seeking to diversify its economy, and the creative industries are one important avenue to that end.

TV and OTT video players can contribute by capturing an outsize share of the growth in the Saudi media markets in four ways:

Create a strong content strategy tailored to the tastes and preferences of local audiences

Use omnichannel viewing to enable consumers to follow their favorite content across platforms and help TV and video players retain viewers

Offer a more attractive value proposition to advertisers

Use cross-industry synergies to access new audiences while expanding and differentiating content offerings

Saudi consumers are hungry for media experiences that are relevant to their interests and align with their needs. This imperative, combined with technological advancements, increased competition, and new advertising products, is driving the agenda for TV and video success in Saudi Arabia. The development of the Saudi TV and video market is also part of a broader cultural renaissance in which audiovisual content can play a key role. Saudi Arabia is seeking to diversify its economy, and the creative industries are one important avenue to that end.

TV and OTT video players can contribute by capturing an outsize share of the growth in the Saudi media markets in four ways:

The TV and video opportunity in Saudi Arabia is ripe for harvest. Saudi viewers are eager and sophisticated consumers of media, and the advertising marketplace offers untapped opportunities. To have a competitive advantage in this market, TV and on-demand platforms can operate side by side to capture the attention of Saudi audiences. OTT video will continue to become mainstream among all audience segments. TV will use the advantages of its mass traditional reach, particularly through Ramadan, mega live events, and sports. Simultaneously, TV will adapt to streaming and on-demand models. The focus on Ramadan as a key season for audiences and advertisers along with content localization will remain important success factors, regardless of the content distribution channel.

Data analytics and digitization will play an essential role in Saudi TV and video, as well as the broader E&M market. These technologies allow players across the E&M industry to understand media consumers in ever more specific ways, to predict—rather than react to—consumer desires, and produce holistic omnichannel experiences. E&M players and advertisers that wish to succeed in the post-pandemic TV and video ecosystem will need to be collaborative, innovative, and agile. Those that are will be rewarded, and will help position the country as a cultural creator.

Menu