Executive summary

Telecom operators are uniquely positioned to become pivotal players in the rapidly developing commercial unmanned aerial vehicles (drone) market. Drone applications enable various types of companies to transform their operations and gain efficiency, in terms of cost and time, by capturing and analysing datasets to improve decision making. The range of commercial applications — known as drone-powered solutions (DPS) — is already immense and constantly growing. However, individual companies require significant investments and specific capabilities to conduct drone operations internally. A separate player, meanwhile, can offer DPS for all companies. Telecom operators can play this role because of their capabilities in connectivity, cloud, big data, and analytics.

Two specific opportunities exist for telecom operators. First, they could offer DPS by building partnerships in areas related to drone procurement, data processing, and data delivery, and by leveraging their internal capabilities across the value chain. We expect the market for DPS, excluding drone procurement, in the Gulf Cooperation Council (GCC)1 to reach US$1.5 billion by 2022. This market can be served through multiple business models, such as end-to-end commercial drone services, on-demand live video data acquisition, or a fully autonomous system operated at a client’s premises.

Second, telecom operators could help to establish a drone traffic control centre (DTCC) that would enable control of drone operations, and ensure compliance with regulations. They would facilitate the technology components of the DTCC, from end to end, by supplying and managing data storage, connectivity, cybersecurity, professional services, and applications, including a drone traffic management system and real-time reporting and analytics.

Telecom operators should develop a tailored strategy and implementation road map for commercial drone applications. Drones represent a unique opportunity for telecom operators to diversify their revenue sources and spur new growth.

Telecom operators as providers of drone-powered solutions

Telecom operators are an obvious choice to offer DPS to companies across different industries. To seize this opportunity, operators need to develop a way to play within each of the four key components of the DPS value chain. These are:

- Drone procurement

- Drone operations

- Data processing and analytics

- Data storage and delivery

Drone procurement

Drone procurement entails providing the physical device (drone) with the information systems, sensors, and additional features that enable it to capture massive amounts of data and execute critical tasks. In the main, there are two types of drones: fixed-wing and multi-rotor. Which drone type to select depends on the intended use. Telecom operators can purchase drones from vendors rather than developing their own in-house. There are many well-established global players that offer a good selection of commercial drones. In-house development of drones is costly in terms of hardware and software, and demands advanced technical and manufacturing capabilities.

Drone operations

Telecom operators can carry out drone flights to execute necessary tasks, such as collecting images and video footage, or transporting goods to the end client. Professional pilots should operate the commercial drones. Operators can hire skilled pilots or train staff internally within a few weeks, and then issue them with the necessary licenses and certifications. Because drone flights should be conducted very frequently to gather data, and it is relatively easy to recruit or train pilots, it is more efficient for operators to build and acquire capabilities internally rather than outsourcing.

Data processing and analytics

Telecom operators can process and analyse the collected aerial data by using qualified experts, such as photogrammetrists and analysts connected through advanced systems. Raw data are transformed into meaningful geospatial products, such as digital terrain models, orthophotomaps, and 3D models, while image data analysis leads to insights.

Building capabilities in data processing and analytics is certainly within reach of telecom operators, which have to manage the cost of acquiring data processing software and analytics tools. Operational expenditure, meanwhile, mainly consists of experts’ salaries and software licenses.

To build these capabilities, primarily within aerial imagery analytics, telecom operators can forge partnerships with leading data processing and analytics service providers. The telecom operator and the partner would execute this function as a joint enterprise in the first phase. Over time, the telecom company should aspire to conduct processing and analytics internally when capabilities mature, as this step is critical in terms of operations and market value.

Data storage and delivery

DPS require data storage and data delivery to clients via online portals such as geospatial tools, with cloud storage and delivery systems the main elements. Telecom operators employ extensive cloud platform capabilities and can use these to store, manage, and deliver data to clients. Telecom operators could build partnerships with service providers to deliver and visualize data through a state-of-the-art platform for data presentation on geospatial tools.

Multiple business models

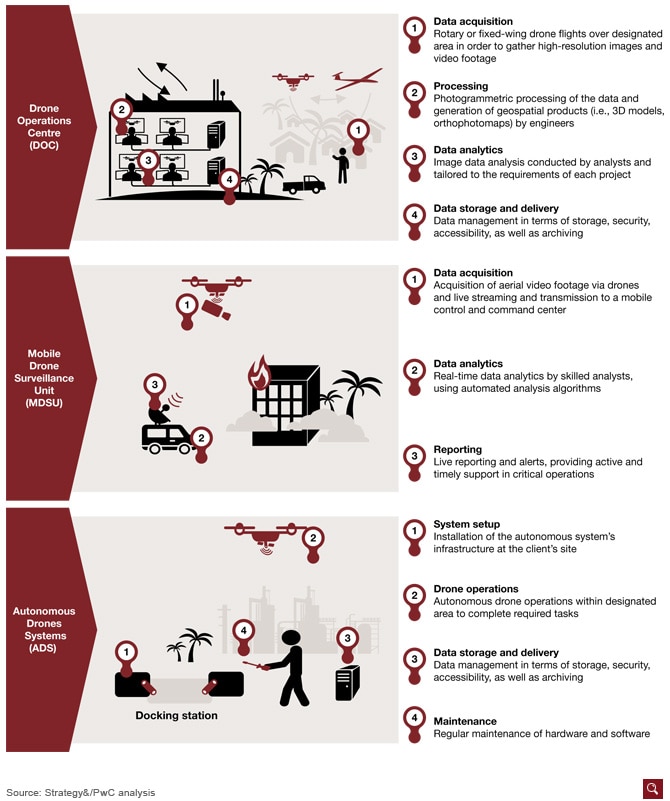

Telecom operators could adopt multiple parallel business models that differ according to the type of DPS provided, the capabilities required, and the particular pricing methodology. These business models are: to establish a drone operations centre (DOC), develop a mobile drone surveillance unit (MDSU), and resell autonomous drones systems (ADS) (see Exhibit 5).

Drone Operations Centre

Telecom operators could build a DOC that offers end-to-end drone-powered services for businesses (surveying and mapping, investment supervision, inventory management, and maintenance monitoring). Clients would contract the DOC for individual projects, and would agree on key requirements, such as the area or surface to be assessed, or the required analyses and indicators. The DOC then sends drones to the designated area to gather data through high-resolution images and video footage. Data are transmitted for photogrammetric processing and then for analytics. The DOC offers the client access to a geospatial platform to visualize the data, including high-resolution illustration, and precise area and volumetric measurements. It would also deliver analytical business reports containing the required analyses and indicators. Pricing therefore depends on the size of the assessed surface and on the extent of the required analysis, such as the number of items of equipment that are analysed.

Mobile Drone Surveillance Unit

Telecom operators could also build a MDSU to meet clients’ demand for surveillance and video coverage during critical events. The MDSU provides on-demand live aerial video coverage through mobile teams of drone pilots. A stream of data is transmitted in real time to a control room where it is analysed by technicians, using automated analysis algorithms. Recent advances in cameras and sensors are spawning innovative functionalities, including thermal imaging, face recognition, and crowd counting. The MDSU could be used for various purposes, such as emergency operations, traffic management and monitoring, or simply news coverage. Pricing would be calculated according to the duration of operations in hours or days.

Autonomous Drones Systems

Telecom operators could resell ADS for surveying and mapping, investment supervision, inventory management, maintenance monitoring, and surveillance. A telecom operator might establish the infrastructure of the autonomous system at the client’s site, maintain the hardware and software, and if necessary provide support in daily operations such as technical help and photogrammetric analysis. The drone then autonomously carries out the required tasks. Data gathered are stored on the cloud, with the client able to access it easily through a user-friendly interface. Clients are charged by operating year.

Telecom operators could also operate or provide semiautomated drone systems for the transport of small packages, such as goods and medical products. A package is attached to the drone in the delivery unit located next to the dispatching centre, and then the autonomous flight to its destination is carried out with operational safety assured. The drone leaves the package in the destination area marked by the client and then returns to base. Pricing could be based on the number of deliveries or per operating year.

Conclusion

Drones will have a tremendous impact on multiple sectors in the GCC in coming years. There will be deliveries of goods to homes by drones, there will be traffic control aided by drones, and the region’s oil and gas sector will deploy drones for a variety of purposes. The disruption caused by drones will also present an important opportunity for the GCC’s telecom operators to target new sources of growth, build capabilities, and position themselves as leading players in digitization.

1 The GCC consists of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

Menu