As GCC telecom operators confront an increasingly challenging environment, they are searching for their next growth engine. Legacy markets are stagnating, competition from Over-the-Top (OTT) platforms is intensifying, and regulations are becoming more stringent. An unexpected candidate has emerged to fill this role: wholesale telecom. Once considered a back-end function, wholesale is now positioned to play a pivotal role in helping telecom operators survive and thrive. To unlock its full potential, however, wholesalers must evolve into the "third generation" of wholesale telecoms.

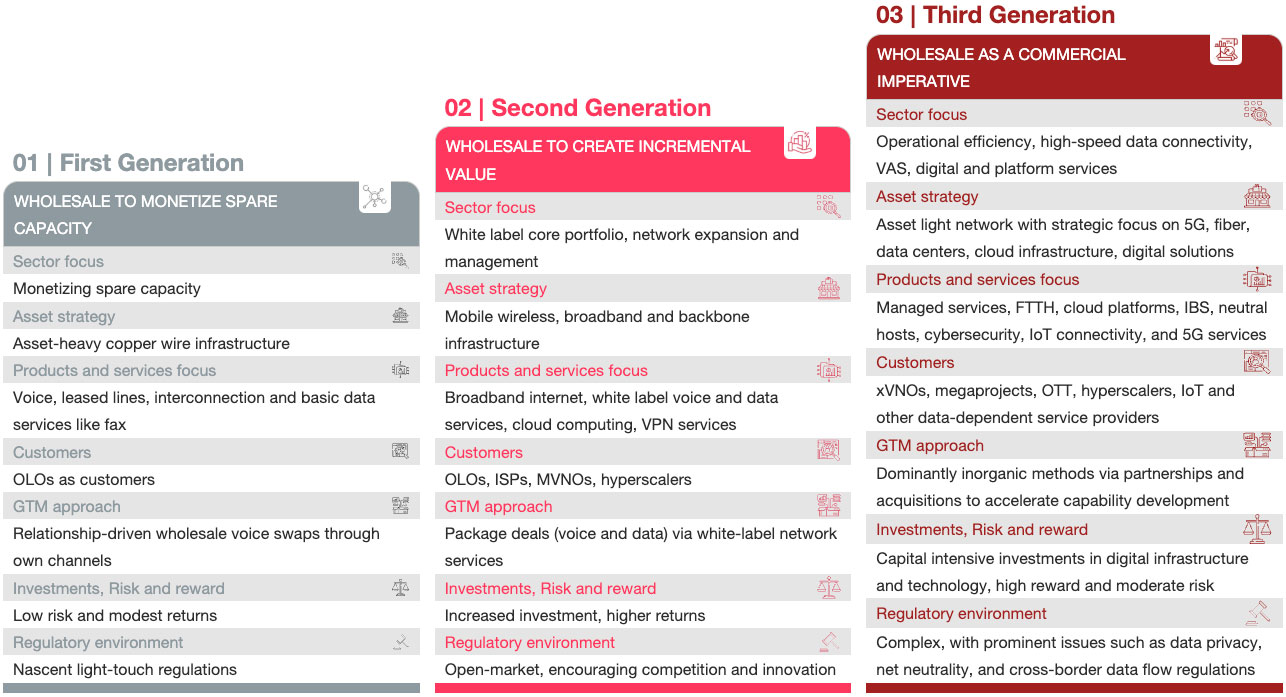

In the first generation, wholesale focused on supporting the telecom operator’s retail arms. In the second generation, wholesalers shifted from cost centers to revenue generators by leasing out surplus network capacity. Now, a third-generation model is emerging—one that embraces a broader and more dynamic role, from diversifying revenue streams to supporting digital transformation across sectors. Wholesalers that successfully make this shift can create a sustainable competitive advantage and become vital to the future growth of telecom operators.

In the first generation, wholesale focused on supporting the telecom operator’s retail arms. In the second generation, wholesalers shifted from cost centers to revenue generators by leasing out surplus network capacity. Now, a third-generation model is emerging—one that embraces a broader and more dynamic role, from diversifying revenue streams to supporting digital transformation across sectors. Wholesalers that successfully make this shift can create a sustainable competitive advantage and become vital to the future growth of telecom operators.

To capture these opportunities, wholesalers should consider four key strategic moves. The first two are foundational, maximizing revenue from existing assets and networks. The last two are more forward-looking, creating new pathways for sustainable growth and business diversification.

Wholesalers should unlock untapped demand by prioritizing innovative commercial models for their current assets and customer base. These might include volume deals, take-or-pay contracts (which tie customers to a minimum amount of capacity), and dynamic pricing for excess capacity. Data analytics can play a critical role, enabling wholesalers to assess network utilization, optimize pricing, and identify areas for geographic expansion.

For example, Openreach introduced a five-year deal that offered up to a 40% discount on fiber lines through an innovative rebate scheme. This initiative aimed to increase fiber adoption among external internet service providers while discouraging churn to alternative networks. Despite intense regulatory scrutiny over commercial offers, Openreach successfully increased fiber uptake by 65% over three years, accelerating the scale-up of its FTTP1 network and advancing its plans to decommission its copper network.

Wholesalers should look to expand network coverage into new geographies to address growing demand for enhanced connectivity and support the region’s digital transformation initiatives. The GCC, with its new mega projects and smart cities, offers significant opportunities for expansion. By investing in neutral host networks (infrastructure shared by multiple carriers), implementing demand aggregation, and developing smart deployment capabilities, wholesalers can secure a dominant position in future infrastructure bids.

They also can expand through strategic mergers, acquisitions, or joint ventures. For example, T-Mobile NL partnered with Tampnet to provide affordable mobile service for North Sea wind farms, and Telenor Maritime teamed up with Starlink and OneWeb to deliver satellite connectivity to shipping fleets. These partnerships enable wholesalers to extend their reach into new markets and offer valuable services to nontraditional customer segments.

Wholesalers can enhance their relevance and revenue potential by expanding into adjacent services like the Internet of Things (IoT) and network digital solutions (such as cloud services, AI, and 5G networks). These offerings can help telecom operators capture a larger share of enterprise spending while extending the boundaries of traditional telecom services.

Elisa, for example, has pursued acquisitions to build a digital solutions ecosystem that includes advanced analytics for network performance monitoring and automated maintenance, which reduce downtime and operational costs. Wholesalers can better serve existing customers while attracting new ones by broadening their portfolio.

To tap into new markets, wholesalers should explore emerging technologies and forge strategic partnerships that allow them to deliver innovative services to nontraditional customers. For instance, stc partnered with SKYFive Arabia to introduce in-flight broadband connectivity and signed an agreement with flynas to provide air-to-ground connectivity services. Telstra, meanwhile, collaborated with Viasat to offer ground station as a service (GSaaS), allowing satellite operators to lease ground stations for communication and control of their satellites.

Such innovation not only opens up new revenue streams but also positions wholesalers as first movers in emerging markets, reinforcing their role as digital enablers across sectors.

These four strategies offer small- to medium-sized opportunities that wholesale telecoms should adopt simultaneously to drive growth. Pursuing these strategies successfully requires a lean, agile operating model focused on efficiency and scalability. Wholesalers must also prioritize customer satisfaction by enhancing the customer experience, optimizing networks, and digitizing core operations. Leveraging advanced technologies—such as blockchain for settlements, AI-powered fraud management, and network analytics for capacity planning—can drive both efficiency and innovation.

As competition intensifies and traditional growth avenues stagnate, GCC telecom operators must act now to embrace the next generation of wholesale telecom or risk reverting to cost centers. By moving with a clear vision and sense of urgency to innovate, diversify, and expand, wholesalers will be well-prepared to drive sustainable growth and lead the region’s digital transformation in a rapidly evolving market.

This article originally appeared in Samena Trends, April 2025.

Contact us

Menu