{{item.title}}

{{item.text}}

{{item.text}}

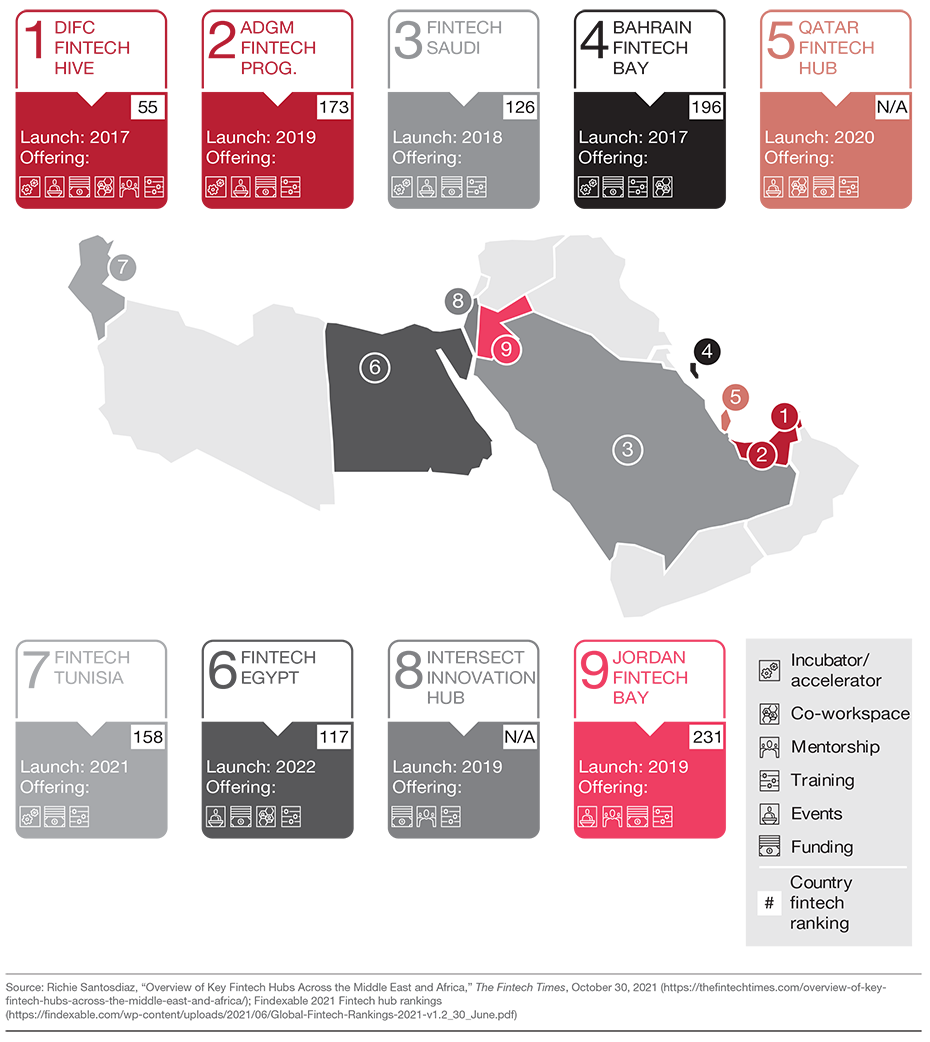

The Middle East and North Africa (MENA) region is steadily building its financial technology (fintech) sector. Fintech hubs have emerged across the region and are channeling significant funds to dynamic, small companies. MENA region startups received more than US$2.5 billion in funding in 2021 alone. Trends in the first half of 2022 indicate this year will surpass that, given the $1.73 billion that has been raised to date. A growing number of these companies are having successful initial public offerings (IPOs). In particular, the Gulf Cooperation Council (GCC) countries have moved decisively into fintech. Some of the GCC fintech hubs are now so large that they are on the global fintech map.

The challenge for the GCC countries is to build on this momentum so the fintech sector becomes stronger and more sustainable. That will have an impact beyond financial services as it will increase these countries’ economic diversification and further their goal of becoming more innovative.

Strengthening fintech requires more private-sector involvement and greater efforts to fill gaps in the fintech ecosystem. Scaling up is essential and difficult, given the fragmented regional market. There needs to be easier access to capital, including through increased venture capital (VC) funding. GCC fintech players need more liquidity, which the favorable macroeconomic context can provide.

One of the largest gaps in the fintech ecosystem is that of talent. The sector must attract experienced professionals who can improve the sophistication and delivery of systems and of support.

Back in 2015, we published a Viewpoint on the potential for the GCC to develop a fintech ecosystem, subtitled “Let’s get ready for take off.” Seven years later, GCC fintech has more than taken off. It has soared:

When viewing the progress that fintech has made in the GCC, it is important to consider the global context. Fintech has become fiercely competitive. Financial centers around the world are jostling for position as they seek to build their competence, improve the regulatory framework, and attract financing and talent. Various organizations publish rankings of fintech hubs or indices of performance. It is noticeable that despite this competitive environment, GCC centers, especially those from the UAE, tend to feature significantly in these rankings. The Lucerne University of Applied Sciences and Arts’ ranking, for example, puts Dubai just behind Paris and Madrid and ahead of Tel Aviv, Vilnius, Shanghai, and Beijing.

For all the progress of the past seven years, however, much remains to be done to make the recent successes sustainable and ensure that GCC fintech hubs stay competitive. Even with favorable regulation, market fragmentation can make scaling up difficult. Technological challenges include the level of cloud computing maturity and data sovereignty, such as requirements for the location of servers. From a financial perspective, a lack of exit opportunities can prevent growth.

Overall, there are three priority areas. Regional fintech must improve access to capital and liquidity, create more exit opportunities, and attract talent for tech systems and broader fintech support.

Given the GCC region’s prosperity, VC funding is less than it should be, even with the recent fintech growth. For example, the Saudi share of global VC funding is just 0.08 percent, whereas the country accounts for 0.9 percent of global GDP. Key players include sovereign wealth funds, which have broad mandates to invest, but can do more in terms of fintech. A variety of fintech categories are gaining traction in the region. Payments systems are attracting the most financing interest, while areas such as regulatory technology are less well funded. Until now, governments in the region have been the main sources of funding. In the future, the private sector will need to play a larger role by helping to create deeper markets that enable scale and so ensure sustainable growth. Organizations such as the Middle East Venture Capital Association, launched in 2018, can consolidate private VC activity, but more needs to be done.

The IPO market in most GCC countries is not very dynamic. Consequently, founders have relatively few opportunities to bring in other investors and to exit their initial investment. That can limit the opportunities for innovation and the growth of VC investment. In many instances, the only viable route is to sell to established players. This trend has not abated. Even though the MENA region had the most international and cross-market M&A plays across a group of emerging markets that included Pakistan and Türkiye (previously known as Turkey), only 21 exits across all sectors were announced during the first half of 2022. This trend illustrates the opportunity to further develop the IPO market.

One of the main challenges for GCC fintech is finding people with the right skill sets. This challenge is exacerbated by the rising demand for these skills throughout the economy. According to a recent Strategy& report, if the GCC region reaches the level of the most advanced digital economies, it could create an additional 600,000 technology jobs. That would, without the sustained development of in-country talent, rapidly drain the currently shallow pool of talent.

However, there are indications that employers are taking this shortage seriously. A recent PwC survey found that 75 percent of the employees who responded in Kuwait, 60 percent in Qatar, 58 percent in Saudi Arabia, and 46 percent in the UAE believed their country had a shortage of people with specialized skills. Interestingly, GCC respondents were more confident than the global survey average that their employers were making skills improvement a priority.

Concern is widespread about the availability of talent

Respondents who believe their country has a shortage of people with specialized skills

“The future market size for GCC fintech will depend primarily on how successfully the region can overcome regulatory and operational issues.”

The critical challenge for MENA fintech, and the GCC in particular, is to remain competitive in a fast-developing sector. Some of the forces that will shape the future of fintech in the GCC may be beyond regional control. Still, GCC stakeholders can make adjustments and improvements that will keep the sector moving forward. By focusing on the long-term imperatives of greater fintech scale, deeper capital markets, and talent development, GCC countries can become vibrant players in global fintech.

Menu