{{item.title}}

{{item.text}}

Download PDF - {{item.damSize}}

{{item.text}}

“True advantage comes from having a steady stream of offerings that only distinctive capabilities can deliver.”

A company’s products and services are its most visible activities, to its customers and the outside world. However, too few companies create a product and service portfolio that truly aligns with their strategy. Instead, most companies compose portfolios based on short-term financial performance and shoehorn a strategy to fit around that portfolio.

Mergers and acquisitions are a powerful way to modify a company’s portfolio. But too many companies do deals to become bigger, rather than focusing on becoming better.

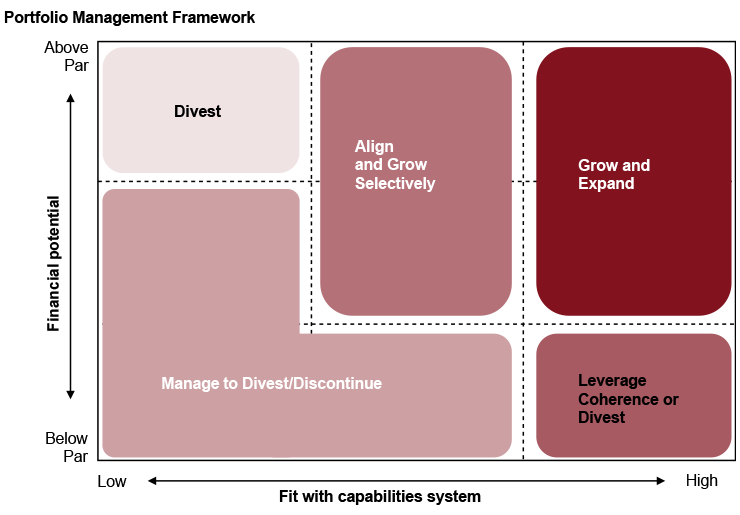

Companies should manage their portfolio in a way that allows them to become more coherent. This may entail divesting profitable products and services that don’t fit a certain capabilities system and finding ways to better integrate those that do fit. By applying the same capabilities across an entire portfolio, companies get better at the few things that matter most and can give their smaller businesses, which would otherwise not warrant the build-up of such distinctive capabilities, a great competitive advantage. Success comes from building relevant scale behind a differentiating capabilities system.

At Strategy&, we have found strong evidence that capabilities-driven deals — those that leverage the buyer’s key capabilities onto new products or help it acquire new capabilities that round off its capabilities system — produce significantly better results, on average, than deals with limited capabilities fit. The pay-off of a capabilities-driven view on portfolio and M&A; strategy is immediately visible.

Read the article: Deals that win

Companies that follow this capabilities-driven approach to portfolio and M&A; strategy become better every day at what matters most to their customers. They grow bigger and more coherent and can invest their higher returns in further building out their competitive advantage. They become what we call supercompetitors, dominating the part of the market they have chosen to focus on and becoming almost unstoppable.

Read the article: The New Supercompetitors

In turbulent times, your strategy matters more than ever. The world's greatest companies weather adversity and uncertainty much more adeptly by operating from their core strengths. A strategy built on these differentiating capabilities helps you outpace the competition, achieve faster growth, and earn the right to win.

Whatch the video - Why strategy matters

Far too many strategies fail when it comes time to bring them to life. In fact, more than two-thirds of executives say they don’t have what they need to execute their strategy. Find out how your company can avoid falling into the strategy-through-execution gap by asking 3 questions.

Whatch the video - Take your strategy from paper to pavement

Supercompetitors have a special recipe for success. It’s fuelled by capabilities and it makes these iconic companies so powerful that they’re actually influencing and reshaping entire industries. Find out how you can use smart strategy to transform your future.

Whatch the video - Transform your company and your industry