The Value Creation Analyzer’s web-based, data visualization platform empowers you with the facts you need to see where value is trapped and the insights to understand how improving internal capabilities — in operations and processes — can help you realize new opportunities.

How it works

With our customizable system of more than 350 questions covering 60+ key capabilities, we can create the right mix for your business to uncover the most relevant insights. Our questions are selected based on the type of company and industry. For example, questions on commercial excellence examine the level of margin transparency you have per customer, product, region, and channel; the level of granularity on your sales forecast; and the main contributors to your pricing activities.

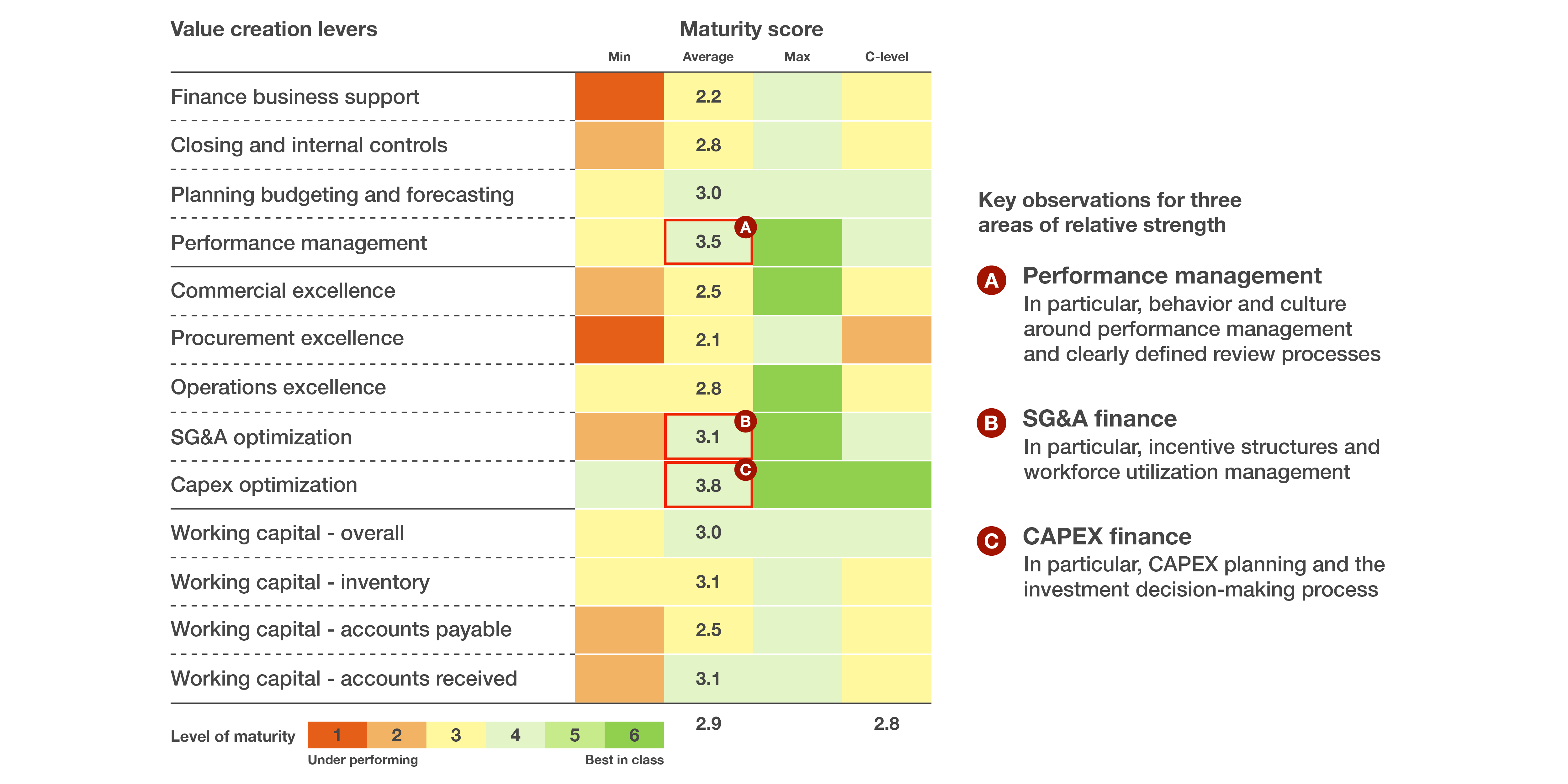

To give you a quick sense of how this easy-to-use tool works, take a look at a sample assessment. After surveying 45 executives from a manufacturing company in Europe, we saw that they clearly showed maturity and strength in three critical areas: performance management, SG&A, and finance and capital investments.

(Please note that not all applications/tools are available in all countries and regions. To understand the possibilities for you in your territory, please contact us.)

Illustrative example

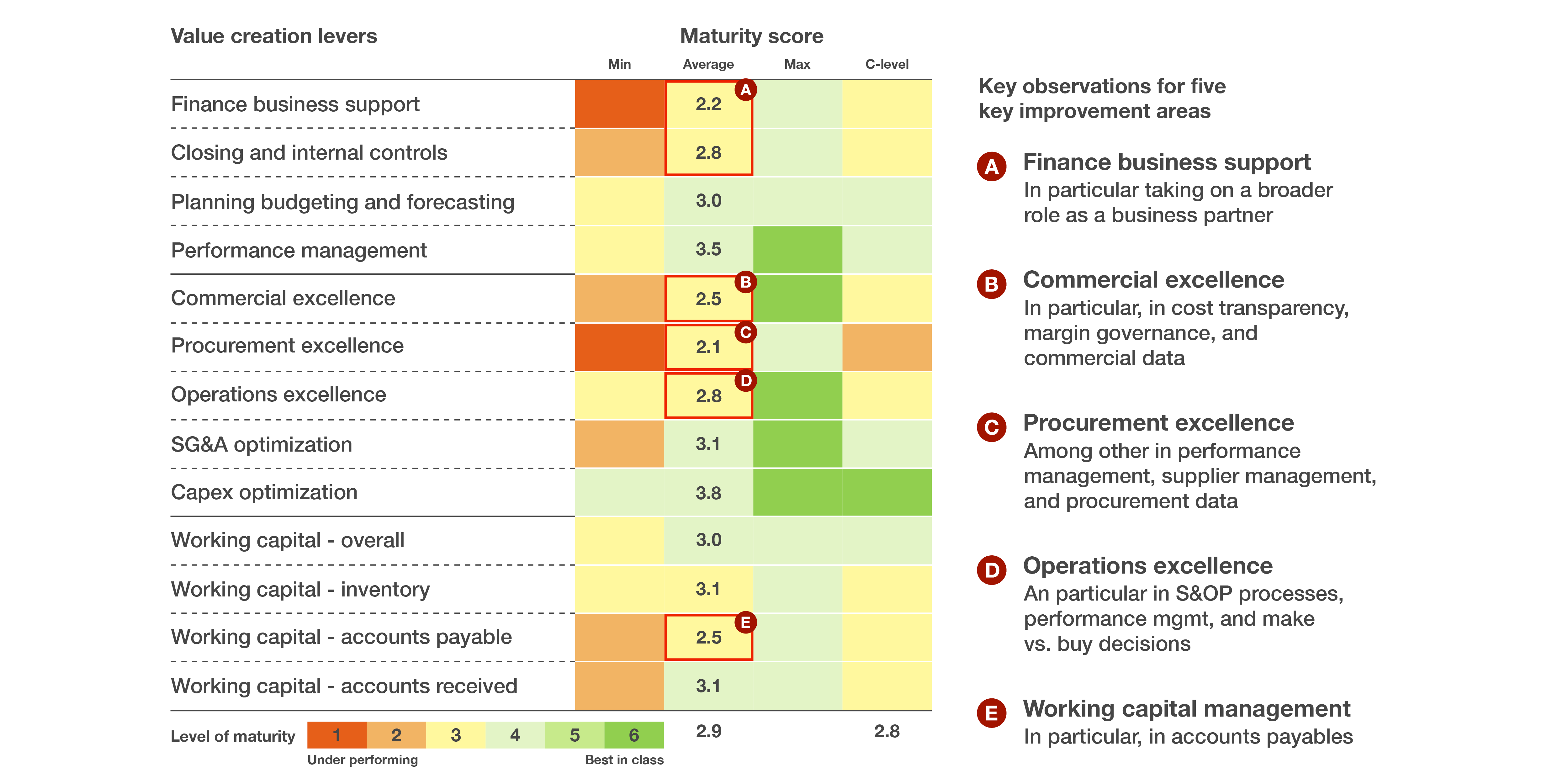

But we also uncovered value creation levers in five main improvement areas: finance business support, commercial excellence, procurement excellence, operational excellence, and working capital management.

Illustrative example

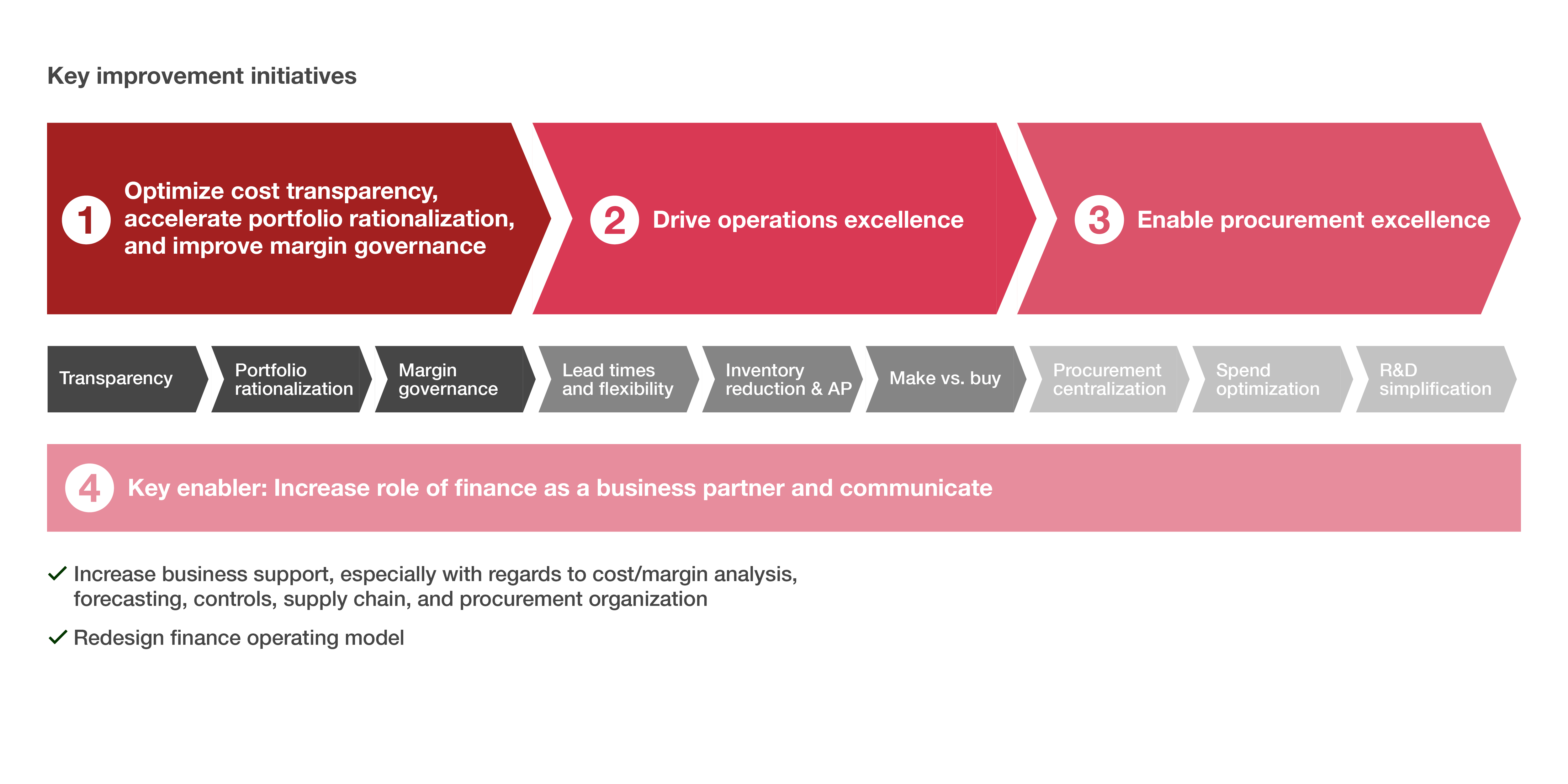

To drive impact, we worked together with the management team to define and prioritize key improvement initiatives. These initiatives focus on building those capabilities that matter most in executing the company’s overall strategy.

The payoff

- Unlock hidden value potential throughout your company.

- Discover your true capability levels through an unbiased approach.

- Have a fact-based dialogue among the top management team about your capabilities.

- Create focus on key capabilities that will enable your strategy.

Contact us