Drilling for data: Digitizing upstream oil and gas

The upstream oil and gas sector is well behind other industries when it comes to being digitally enabled. The iconic image of “roughnecks” — overall-clad workers with oil-stained faces handling equipment on a drilling rig — has not changed much over the past few decades, even as the industry is recognized for its technological innovation. Yet look at a modern-day automotive manufacturing plant, where lines of workers assembling individual car parts already have been largely replaced by robots. The difference between the two images is clear.

That said, there is an enormous amount of interest in and expectation around the benefits that digital solutions can bring. Although many oil and gas companies are trying out new digital ways of working, no one can claim to have “cracked it” just yet. We believe there are some basic guiding principles that companies should consider when developing their digital business models:

- Digital transformation is not a technology-led solution. It is a business-led transformation that leverages technology.

- This transformation requires all aspects of the operating model (vision, strategy, process, culture, and behaviors) to encompass digitization.

- Digital solutions need to be holistic. All dimensions of a company and its operating ecosystem (its suppliers and external partners) need to be digitally enabled.

- Companies need to develop their own digital transformations because there is no “best practice” model in the sector to replicate.

- Getting the right weighting between technical (the engineers) and technology (the data scientists and software engineers) capabilities is critical.

The size of the prize is significant

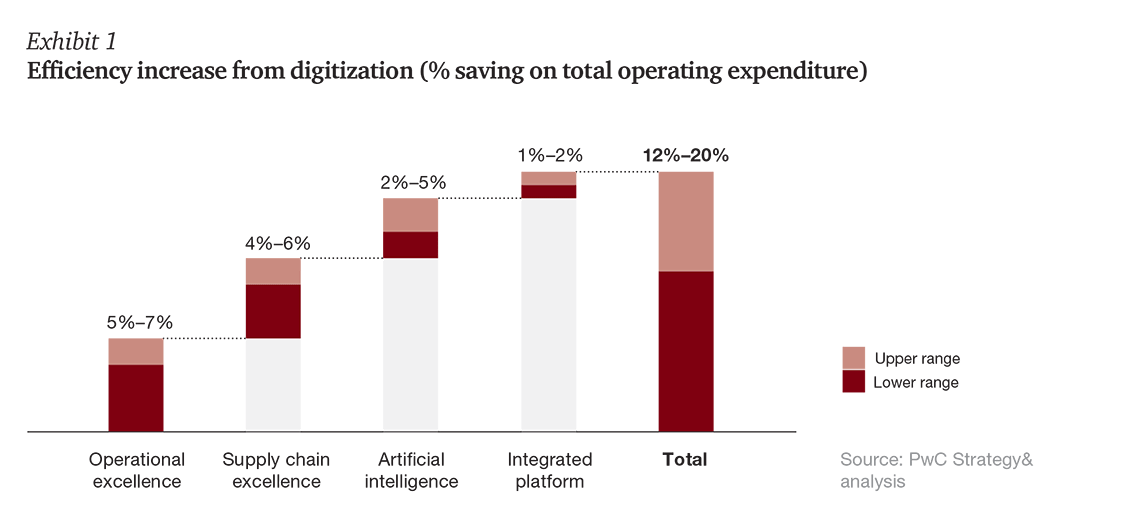

In its 2017 Digitization & Energy report, the International Energy Agency estimates that digital technologies could cut production costs by as much as 20 percent. We conservatively estimate that use of digital technologies in the upstream sector could result in cumulative savings in capital expenditures and operating expenditures of US$100 billion to $1 trillion by 2025. Our own experience confirms this significant potential. As illustrated in Exhibit 1, savings can be realized in operational excellence (such as more efficient maintenance and better operation of assets); in the supply chain; in the use of artificial intelligence; and in the use of integrated platforms (connecting the organization with external partners).

Signs of digital transformation emerging

Many upstream companies have for some time been using elements of digitization, which we define as the strategic business value of data-based technology that includes the Internet of Things (IoT), cloud computing, and artificial intelligence. Examples of these elements are 3D seismic technology, unmanned oil and gas installations in the Dutch and Danish parts of the North Sea, and advanced reservoir modeling.

The trend toward digital innovation is accelerating across the sector because companies are much more focused on cost and driving operational efficiencies in an era of relatively low oil prices. Some major companies are already fairly far down this path. Here are a few examples:

- BP has stepped up its capabilities by building its own digital workforce and running digital boot camps for executives. The company is encouraging its employees to develop apps stored on common platforms to improve workflow processes. It has also created a “data lake” of more than 1 petabyte, where billions of data records from global operations are captured and made available to engineers across the firm. A petabyte is a unit equal to a million gigabytes.

- Eni has developed its own supercomputer, the HPC4, which is used to process data on oil and gas reservoirs. With a computing speed of 18.6 petaflops (a single petaflop computer can process a quadrillion calculations per second), this technology saves time and money by allowing analysis of exploration prospects to be done in weeks instead of months. And given that drilling exploration wells can cost hundreds of millions of dollars, drilling in the right place can yield sizable savings.

- Statoil has launched a centralized and integrated digital improvement program. It is setting up a digital center of excellence with a holistic road map for digitization stretching out to 2020. The company has committed an investment of 1 billion to 2 billion Norwegian kroner ($128 million to $257 million) in digital and emerging technologies, to be executed through the center of excellence. Statoil’s objective is to increase significantly its use of data, analytics, and robotics to improve safety, reduce its carbon footprint, and improve profitability.

At the other end of the spectrum, there are smaller exploration and production (E&P) companies starting to explore digital transformation. As a first step, they are setting up pilots across their organizations to assess how best to apply digitization, as well as to identify the key digital capabilities that need to be developed.

In many such cases, interest in digital transformation was triggered by the perceived threat of new entrants as much as by a desire to cut costs. Traditional operators are concerned by the emergence of unconventional players with differentiated, market-leading digital capabilities. Two good examples are Cognite, a technology company focused on upstream operations in the Norwegian part of the North Sea, and Baker Hughes General Electric, which was created in 2017 in an effort to industrialize digital capabilities.

The reason for this fairly piecemeal approach to date is the industry’s aversion to catastrophic risk, which is well known. Given the increasingly sensitive nature of offshore operations in terms of health, safety, and the environment, operators need to be sure digital technologies can be deployed without risk to operations. Moreover, the industry faces a complex set of challenges including geographically dispersed assets, legacy assets that may be in long-term production decline, and operator (the lead E&P company on a project) versus non-operator (a partner in an E&P project) status.

Why are we nonetheless seeing a gradual awakening in this sector? From a technology perspective, the growth of data analytics coupled with the industrial IoT is generating new ways of optimizing workflows. The application of “digital twin” technology opens up the possibility of replicating physical assets from fields to equipment in digital form, allowing companies to model scenarios to optimize everything from production to maintenance. Statoil has created a digital twin of the Johan Sverdrup offshore field to address troubleshooting and process improvements. The growth of cloud computing services has also enabled companies to process massive amounts of data at relatively low cost. Combine these advances in technology with the fact that the sector is heavily focused on making productivity improvements, and it is easy to appreciate why companies are increasingly excited by the potential of digital solutions.

Five guiding principles for going digital

Here are some guiding principles for operators starting out on a digital journey.

- Always view this as a business-led — as opposed to a technology-focused — exercise. Identify the greatest business challenges and assess how digital technology can help. Companies need to ask themselves what they are really good at and what they want to be famous for — and then figure out how digitization can help.

- Digital transformation of a company needs to be holistic and address all the elements of the operating model. Everything from strategy and capabilities to organizational structure and culture will need to be considered and potentially reconfigured to reflect a digitally enabled business. Some oil and gas companies still view digital technology as something peripheral to the core business. “Siloed” digitization does not provide the cross-functional insights across multiple assets that are needed to drive efficiency and value at the enterprise level. Companies need to approach digitization from the perspective of building new capabilities and leveraging technology across all key aspects of the value chain. Aker BP, which aims to become a preeminent E&P independent player on the Norwegian continental shelf (NCS), sees digitization as one of the cornerstones of its strategy to improve efficiency and reduce full-cycle breakeven costs to less than $35 per barrel for new developments.

- Building a digital organization needs to encompass stakeholders beyond the company itself if the full potential of efficient operations is to be unlocked. All stakeholders around new field development —including the host government and the oil service providers and contractors — need to be digitally enabled. For example, Aker Solutions is working closely with Statoil to develop the Johan Sverdrup field using data from a common digital twin.

- There is no one successful digital template to follow. Each company needs to develop its own specific digital transformation road map. Although best-practice examples from leading companies might be emulated, digital solutions ultimately need to be bespoke and meet the business needs and challenges of each individual operator. And E&P companies will likely not be the ones to develop new digital technologies and solutions; these will likely remain the preserve of the largest players with deeper pockets.

- Senior executives need to make sure they have the right capabilities in place when it comes to the mix of engineers and data scientists. In the past, capabilities may have focused on technical expertise to deliver excellence in engineering projects. Now, with a growing focus on data analytics, companies will need engineers who are more digitally savvy. Finding this balance between technical and technology capabilities is likely to prove one of the trickiest challenges for chief strategy officers and chief information officers. Note the iconic hires for the NCS, such as Statoil recruiting a new chief digital officer. Similarly, Aker has a stake in the new technology startup mentioned above, Cognite, which is headed by a former Microsoft executive. Cognite is in effect the oil services player of the future, focused on digital solutions with the objective of accelerating and driving digitization on the NCS. It is critical that the oil and gas sector attract and retain talent that is technologically focused. As the industry evolves digitally, HR executives will need to think carefully about how they attract a new generation of technologically savvy younger people.

Picturing an upstream digital company

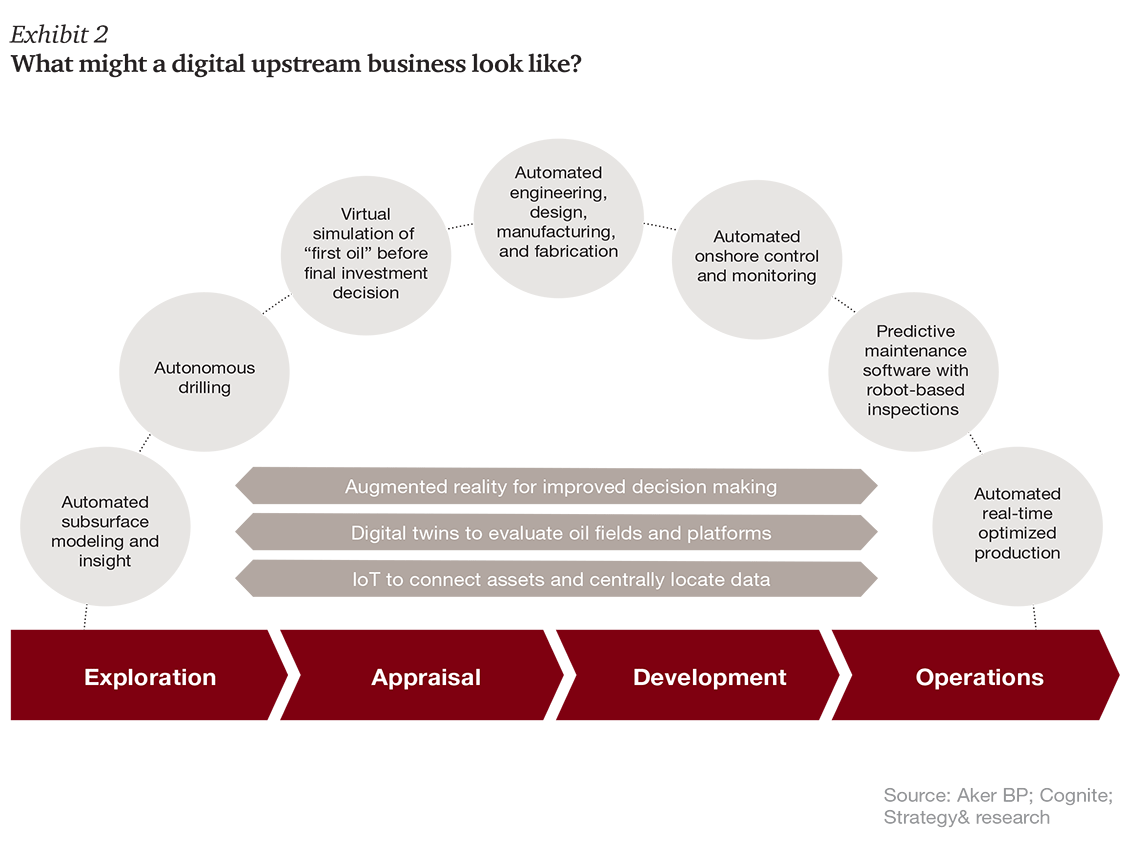

In the not too distant future, the image of oil workers manipulating drill pipe on platforms could be replaced by something dramatically different. Drilling, performance monitoring, and production optimization could become highly automated. Decision making could be transformed, as the use of augmented reality and digital twins would underpin the simulation of “first oil” — the initial amount of oil that emerges from a field that’s being commercially drilled — before final investment decisions are made. Operational excellence, with assets operated much more efficiently, could be achieved through the use of predictive maintenance and drone technology. As illustrated in Exhibit 2, next page, digital technologies could affect all elements of the value chain in a future E&P company.

As with all new business models, there will be associated risks. One key risk will be cybersecurity. As assets become increasingly connected to the network, it is important to protect critical digital infrastructure against cyber-attacks — by monitoring threats, identifying vulnerabilities, building robust controls, and promoting a culture of security awareness.

As operators explore new ways of working, some companies will be pioneers in digital solutions, and others will be fast followers. Those operators that can design and embrace a digital strategy that works for them will be well-placed to succeed in a new digital era of oil and gas. Those companies that simply view digitization as a technology play and fail to transform are likely to become digital dinosaurs and risk extinction.