The future of spare parts is 3D: A look at the challenges and opportunities of 3D printing

Executive summary

The business of making, storing, and shipping spare parts has long been a source of time-consuming and costly difficulties for suppliers of spare parts as well as for their customers. Maintaining inventories of infrequently ordered parts is so expensive that suppliers often simply stop offering them. That in turn forces customers to store large inventories of parts or to turn to third-party manufacturers.

The advent of 3D printing, however, is about to change everything. This additive manufacturing technology, long used in the prototyping of new products, will enable suppliers to make and send parts on an on-demand basis — and do so locally, close to where the parts are needed. Alternatively, companies can opt to print their own parts, bypassing the suppliers entirely.

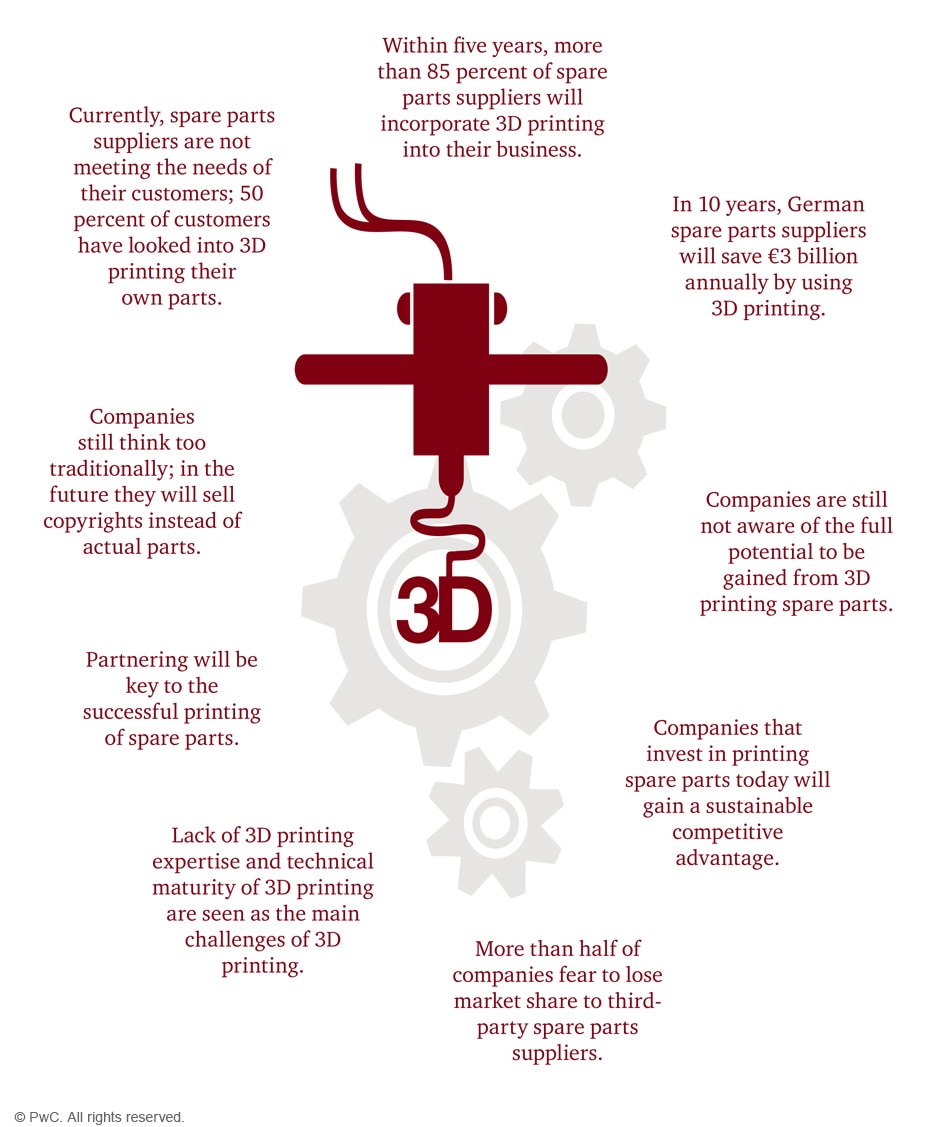

In a survey that Strategy& conducted in late 2015 of 38 German industrial companies, respondents were in agreement that 3D printing will play a major role in the spare parts business. However, not all were aware of the full benefits to be gained from 3D printing. In this report we examine nine key findings from the survey.

Case study: European railway operator: Reducing spare parts inventories with 3D printing

A large German railway company was faced with the challenge of having to stockpile an ever-increasing amount of spare parts in multiple warehouses, for long periods of time, to keep its aging train fleet operational. Once depleted, the stock of parts would have to be replenished with exact matching parts as soon as possible. Considering the negative impact on the total cost of ownership (TCO) from warehousing and replacement costs, the railway was determined to find a way to reduce the size of its inventory and avoid the risk of unexpected costs incurred in having to custom-fabricate replacement parts in small lots.

The company looked into several manufacturing technologies that would allow for the production of spare parts in small batches at reasonable cost. It identified 3D printing as the most promising option. Then it partnered with industry experts specializing in the 3D printing of custom parts to further evaluate the technological and economic feasibility of integrating 3D printing into the company’s established spare parts replacement program. The exercise showed that spare parts that satisfied all of the railway’s tests could be successfully printed at a reduced TCO — and that the technology will soon become a highly attractive option in prolonging the lifetime of this company’s rolling stock.

The case for printing spare parts

An acknowledged expert in the field of 3D printing, Claus Emmelmann has more than 25 years of experience in laser material processing. He is currently the director of the Institute for Laser and Plant Systems (iLAS) at Technische Universität Hamburg-Harburg and CEO of LZN Laser Zentrum Nord GmbH. In 2015, he was nominated for the German Future Award for his joint work with Airbus on 3D printing in the civilian aircraft industry.

In November 2015, PwC Strategy& Germany interviewed Professor Emmelmann about his high hopes for how 3D printing will transform the spare parts business, and the challenges that remain.

PwC Strategy& Germany: Do you believe that 3D printing will become a game-changer in the spare parts business? If so, why?

Prof. Emmelmann: Yes, indeed. I believe that 3D printing will become a common way of producing spare parts. Firstly, because 3D printing improves the short-term availability of spare parts. At the same time, small-lot sizes of spare parts can be produced economically with 3D printing, resulting in new approaches to the pricing of spare parts. Finally, it facilitates the overall logistics of the spare parts business. The business case will be especially strong for geometrically complex parts.

PwC Strategy& Germany: What is your estimate for the percentage of spare parts that will be 3D-printed in five years?

Prof. Emmelmann: For 2015, the estimate for the metal printing market is about €1 billion, but the current estimates go up to €100 billion in total for the 3D printing market within 10 years. In the near future, I see this market as mostly driven by the printing of spare parts. Hence, within five years we should see 3D printing gaining 10 percent of the market for spare parts.

PwC Strategy& Germany: Why should companies start looking into 3D printing in the context of spare parts now?

Prof. Emmelmann: Besides the reasons I mentioned above, it’s obvious that companies can earn money with spare parts when they offer new services based on 3D printing. The possibility of maintaining high availability — as much as 99.5 percent — of machines and equipment in industries such as railways by providing spare parts with a short lead time makes a strong business case for 3D printing. This is why it isn’t just the OEMs looking into 3D printing, but their customers too.

PwC Strategy& Germany: Do you see a scenario in which third-party suppliers offer 3D-printed spare parts with short lead times to customers? Are there already examples you can name?

Prof. Emmelmann: Yes, I think it likely that third-party suppliers of spare parts will enter the market using 3D printing. We have clients that are working on such a business model now. The driving forces behind these activities are the rising prices of spare parts and their availability. Even though legal barriers have to be overcome and issues of warranties and the like have to be resolved, in some markets, like China, companies are already getting used to purchasing spare parts from non-OEM suppliers.

PwC Strategy& Germany: What are the top three challenges for 3D-printed spare parts?

Prof. Emmelmann: Quality management, machining productivity, and the business case itself. Since standards still haven’t been established, companies have to show that each individual part, and the printing process itself, is able to provide the required physical properties. And the printing process has to become faster, which would make the business case for many parts.

PwC Strategy& Germany: Intellectual property (IP) and copyright issues also have to be addressed. How do you see this issue affecting the rise of platforms on which companies offer printable blueprints, as well as how third-party manufacturers operate?

Prof. Emmelmann: Companies like Amazon and Google are looking into business models based on platforms for 3D printing design files and blueprints. With respect to copyright and IP, it depends on the age of the part. In many cases, IP rights have already expired. In the case of new parts, we see models where IP is shared between suppliers and OEMs, and within these models, the sharing of blueprints is encouraged. IP is certainly an important topic; however, we will see changes in the market in the context of 3D printing as well.

PwC Strategy& Germany: What are your expectations regarding how 3D printing material costs will develop? Is there a trend to a more open, less OEM-dominated market?

Prof Emmelmann: Yes, indeed. The market for 3D printing materials is already changing. Large players like Alcoa are investing in large-scale plants to produce metal powder for selective laser sintering. There will be an OEM-independent market for 3D printing materials in the near future, with the result that materials prices will decrease.

Conclusion

The results of our study of 3D printing indicate that the technology will have a significant impact on the spare parts business. 3D printing will enable suppliers to increase the availability of spare parts, reduce lead time, and decrease costs. And customers see 3D printing as an opportunity to reduce their own costs and increase the efficiency of their operations. Companies that invest in 3D printing today will gain a considerable competitive advantage over those that don’t. The key is to start now.

Methodology

In 2015, Strategy& conducted a study called “How and why 3D printing will capture the spare parts business,” in which we surveyed 38 German companies and conducted 39 interviews with their executives. For a better understanding of the market, we surveyed and conducted interviews with both spare parts suppliers and customers.

The study focused for the most part on both large and small companies in the industrial products, chemical/process, and infrastructure/mobility industries. Most of the participants from spare parts customer companies came from the procurement and supply chain management functions, while on the spare parts supplier side, participants came primarily from customer service and R&D.