The telecom price wars continue to rage in the global wireless industry

02/23/18

Re-differentiation strategies aim to stem the rising tide.

Amid the product launches and eye-catching devices next week at Mobile World Congress, wireless markets around the globe remain on a slippery slope toward becoming telecom utilities.

PwC’s new study, Grasping at differentiated straws: Commoditization in the wireless telecom industry, presents the second annual analysis of commoditization in wireless markets across the globe. The report provides a close-up view of the state of the industry, including regulatory and pricing factors, market differentiation strategies, and the overall value of product and services offerings.

The commoditization of the global wireless telecom industry continues at full tilt. A potent mix of saturated markets, booming data demand, new market entrants, ongoing consolidation, and vicious price wars is pushing wireless service providers to battle for market share. Average revenue per user (ARPU) continues to decline in many markets around the world — and dropped 5% last year alone across the 59 markets studied.

The trend toward commoditization is not, however, entirely uniform. Several markets are maintaining a comfortable level of differentiation, while others have even reversed the commoditization trend. Many companies are pursuing “re-differentiation” strategies to gain an edge on the competition. This year’s report measures the degree of commoditization in 59 markets using two key metrics:

- “ARPU spread” (difference between the highest and lowest ARPUs among the operators in a particular market); and

- “market share spread” (difference between the largest and smallest shares).

“Analyzing these factors gives us a detailed picture of each market’s efficiency,” explained Dr. Florian Gröne, a principal with PwC’s Strategy& strategy consulting group in the US. “Specifically, we can assess to what extent price wars have impeded market players’ ability to create and sustain value, and the willingness of consumers to switch from provider to provider.”

Overall, the news is better for consumers than wireless operators. PwC’s global aggregate commoditization index rose from 0.66 in 2016 to 0.67 in 2017, a 2% increase from 2016 and a 9% increase since 2007. “The primary driver for this shift is that operators are having a harder time extracting revenue from their customers,” said Udayan Gupt, manager with Strategy& US. ARPU has fallen 3% just since last year, and 34% over the past 10 years.

Market share spread has also declined: by 2% since last year, and by 11% since 2007. This decrease suggests providers have been reasonably able to maintain their market positions, even in the face of the greater pricing efficiency of their markets.

Regional distinctions

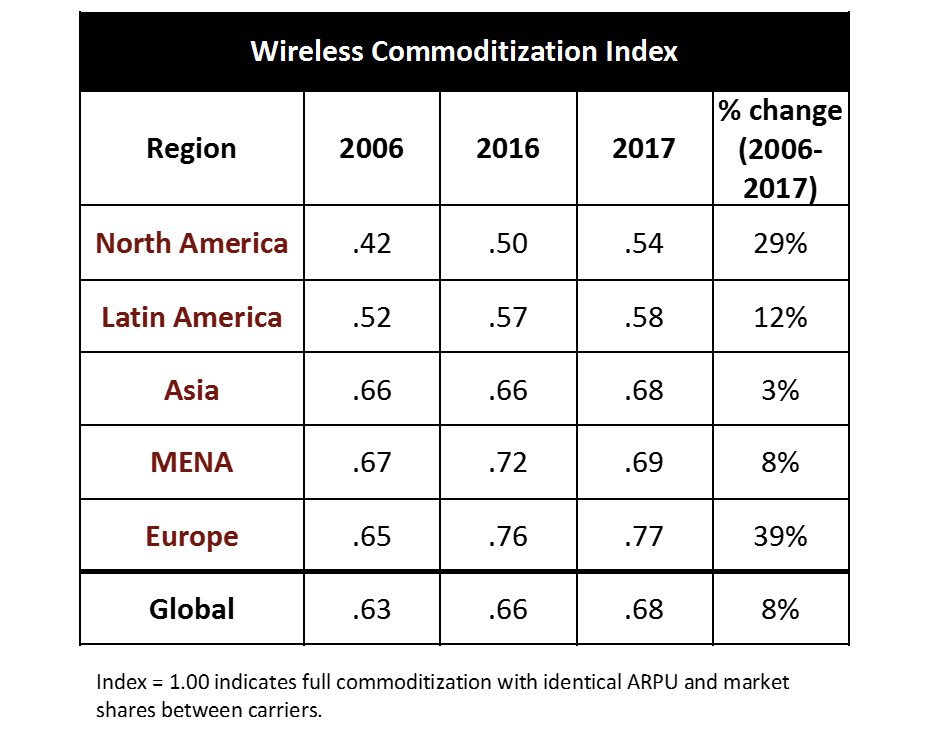

The picture shifts when viewed at a regional level. No region has managed to stave off the commoditization trend since 2006, and only the Middle East and North Africa have become less commoditized in the past year (see Exhibit 1). Among the regions studied:

- North America remains the least commoditized region, but the rate of commoditization appears to be speeding up, as both technology and new regulatory schemes reduce barriers to entry.

- Latin America has highly saturated markets, but the shift away from prepaid to post-paid plans is allowing premium segment players to retain market share. Still, average ARPUs continue to trend downward.

- Asia-Pacific sees most markets on the edge of commoditization. Only Indonesia, still dominated by a single player, remains considerably differentiated.

- Europe has high saturation in every market, and in most, revenues are shrinking, due to declining ARPUs and very tight market share spreads.

- The Middle East and North Africa region too is now highly saturated, especially in the Gulf Cooperation Council markets.

Exhibit 1: Wireless Commoditization Index, 2006-2017, by region

Bucking the trend through re-differentiation strategies

While increased commoditization appears inevitable, several providers are deploying strategies to “re-differentiate” by creating more value from product and services offerings. “In most instances, we see providers increasing revenue per user through different pricing mechanisms, but some focus on growing their market share through M&A or new convergent bundles that combine wireless, wireline and other offerings,” said Rawia Abdel Samad, manager with Strategy& US. The study identifies several strategic areas of focus to fend off commoditization:

- Pricing and packaging;

- Micro-segmentation;

- Value-added services;

- M&A-driven consolidation and convergence;

- Investments in differentiating network capabilities;

- Brand value; and

- New takes of value-added wholesaling.

With a perfect storm of widespread market saturation and enormous demand for data, the telecom price wars are in full effect. Regional market analysis and differentiation strategies will be important tools as providers chart the path forward.

Click here to download PwC’s new report, Grasping at differentiated straws: Commoditization in the global wireless industry, and explore the interactive data tool for 59 markets worldwide. Talk to PwC at Mobile World Congress 2018, Hall 4, Booth 4C20.

About PwC

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 158 countries with more than 250,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com.

About Strategy&

Strategy& is a global team of practical strategists committed to helping you seize essential advantage. We do that by working alongside you to solve your toughest problems and helping you capture your greatest opportunities. We bring 100 years of strategy consulting experience and the unrivaled industry and functional capabilities of the PwC network to the task. We are part of the PwC network of firms in 158 countries with over 250,000 people committed to delivering quality in assurance, tax, and advisory services.