The healthcare market is experiencing a rapid and dynamic transformation, with artificial intelligence (AI) leading the charge. AI is revolutionizing the industry by creating a LIFEcare system that effortlessly incorporates prevention and personalized treatments into daily life. Building on our previous study, "Re-inventing Pharma with AI", this report explores the economic potential of AI in healthcare, offering strategic insights for pharmaceutical and life sciences companies. Based on a survey of more than 1,000 clients in the pharmaceutical and life sciences sectors, it provides regional and segment-specific guidance to capitalize on this substantial market opportunity.

This evolution will reshape care delivery, management, and experience. Predictive analytics will become commonplace, enabling proactive care by forecasting health outcomes. By 2030, AI could empower pharmaceutical companies to tap into a lucrative US$ 868 billion opportunity, leveraging innovative business models ranging from AI-driven trial management and precision medicine to cutting-edge consumer care platforms. In patient care, AI will enhance diagnostics and revolutionize remote monitoring and telemedicine, facilitating continuous care beyond traditional settings.

Key insights

- The AI healthcare market is projected to reach US$ 868 billion by 2030, yielding US$ 646 billion in cost savings and US$ 222 billion in revenue gains

- The global healthcare market is anticipated to grow at a 5% CAGR from 2025 to 2030, approaching nearly US$ 30 trillion, with significant roles for inpatient and outpatient care

- AI's impact in healthcare will more than double by 2030, increasing its addressable market share from 15% to over 30%, with varying adoption rates by region and segment

AI’s potential in healthcare

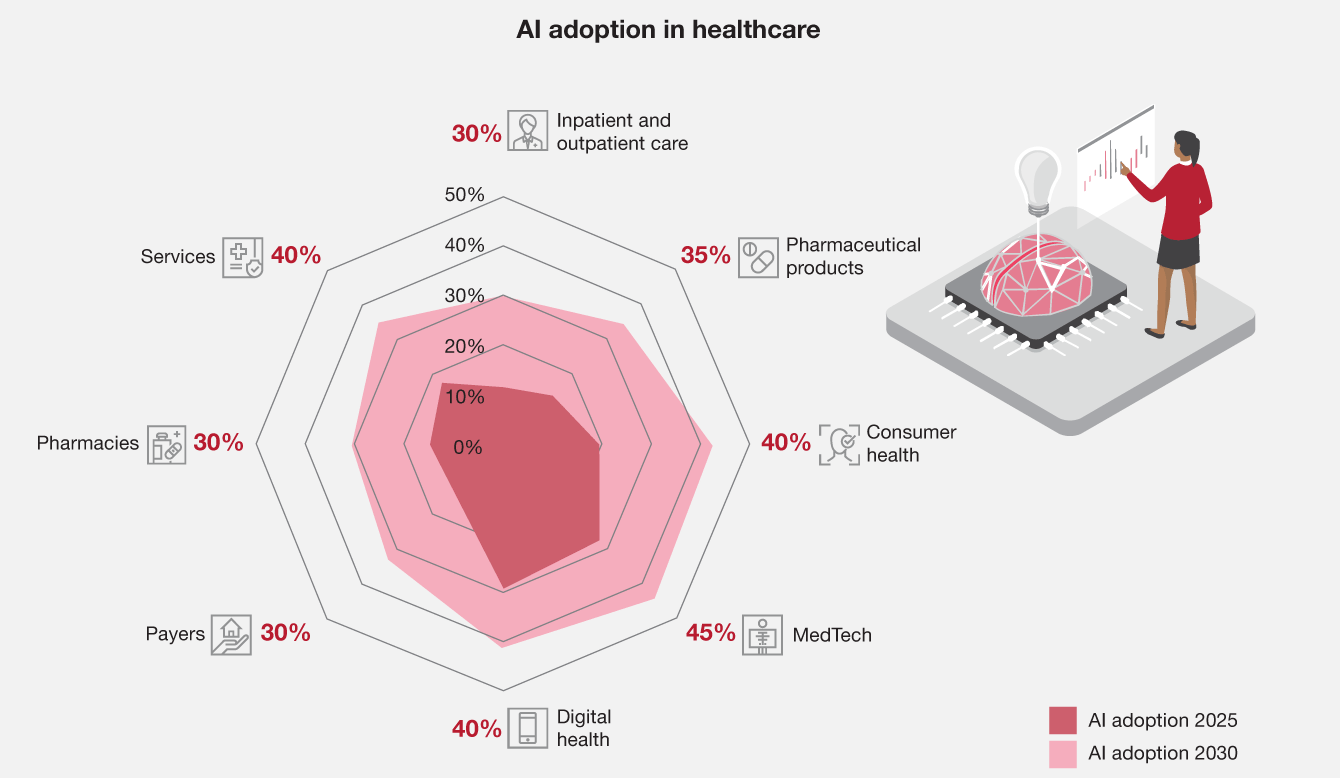

Our findings indicate significant growth in AI adoption within healthcare from 2025 to 2030. Currently, the share of the healthcare market addressed through AI accounts for less than 15% of the global healthcare market, but it is projected to exceed 30% by 2030. Adoption rates will vary by segment and region, reflecting different levels of AI development and focus.

Segment analysis

- Current AI adoption ranges from 10% to 30%, expected to rise to 30% to 45% by 2030

- Digital health and MedTech lead in AI adoption due to their digital foundations and tech-oriented models

- More traditional sectors like pharma products and consumer health will see significant transformation, with AI adoption increases of over 20 percentage points by 2030

- In the pharmaceutical industry, segment growth will be driven by AI-enabled drug discovery, while consumer health will leverage personalized AI solutions

Regional insights

Healthcare systems, regulatory frameworks, and technological infrastructures vary across geographic regions, necessitating market-specific, nuanced AI strategies.

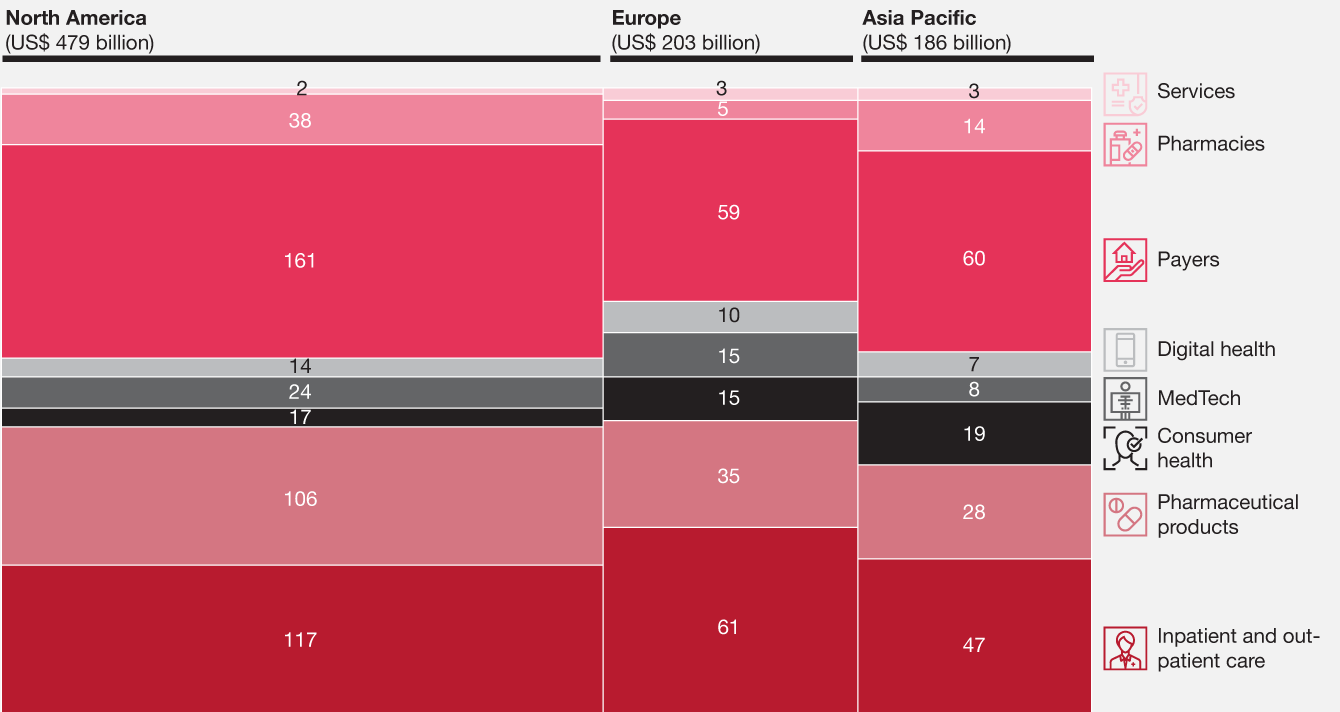

- North America: The commercial customer-centric frontier

Predicted to harness an AI potential of US$ 479 billion by 2030, North America is at the forefront of the AI revolution. Its robust direct-to-consumer models and advanced clinical trial infrastructure, paired with a keen openness to innovation, position it as a leader in AI-powered healthcare advancements. - Europe: The AI healthcare mosaic

Europe paints a diverse picture of AI adoption, healthcare systems, and regulations with an anticipated AI potential of US$ 203 billion by 2030. With promising opportunities in precision medicine and federated health data networks, the continent offers rich grounds for innovative AI business models. - Asia Pacific: The emerging AI giants

With an AI potential of US$ 186 billion, the Asia Pacific region is marked by significant heterogeneity in development, combining both advanced and mass-market environments. This diversity enables sweeping AI-driven access expansions through superapps and highlights AI-enabled manufacturing excellence opportunities.

Ways to play for global pharmaceutical and life sciences companies

To leverage AI's anticipated US$ 868 billion impact on healthcare by 2030, pharmaceutical companies must develop strategies that address regional differences and overcome existing challenges. Our survey shows that only 15% of organizations feel fully prepared to implement AI business models. While some companies have started integrating AI, most lack comprehensive strategies, struggling with scalability and expanding beyond internal efficiencies to realize commercial applications.

To boost AI adoption and develop commercially viable business models, pharmaceutical companies should adopt a hybrid approach that combines global strategy with regional execution:

- 1Establish global AI governance: Standardize data management and ensure compliance with regulations and ethical standards, supported by technology platforms.

- 2Implement a "build once, deploy many times" strategy: Create foundational AI capabilities that can be adapted to regional needs, reducing redundant investments.

- 3Build new business models: Additionally, develop region-specific business models tailored to unique market characteristics

Practical implementation roadmap

- Phase 1 (0-12 months): Establish global AI governance with regional representation to achieve strategic alignment and local relevance

- Phase 2 (12-24 months): Deploy initial regional business models in highest-opportunity segments while establishing value measurement frameworks

- Phase 3 (24-36 months): Expand successful models across therapeutic areas and regions

Discover more about AI potentials, regional business models, and key takeaways for pharmaceutical and life sciences companies in our report, available for download as a PDF.

Johannes Dizinger, Jonathan Müller, Fabian Ahrens, Christelle Azar, Isabel Bayer, Florian Blaich, Niklas Klotz, Simon Gruber, and Lena Geier co-authored this report.