Unlocking commercial success through operations excellence

In the rapidly evolving landscape of the pharma industry, companies are transitioning from an era dominated by major blockbusters to a new epoch. This epoch is characterized by diverse portfolios that include more personalized treatments and flexible delivery models for low volume therapies as well as demand spikes such as during Covid-19 or the introduction of weight-loss treatments.

As pharma companies navigate this dynamic and evolving environment along with increasing geopolitical tensions putting pressure on certain supply countries, it becomes increasingly crucial to develop integrated strategies that cut across different functions throughout the global end-to-end pharma value chain. This holistic approach is essential to support pharma companies in realizing their commercial ambitions. In this article, we present our perspective on how operations can enable commercial teams to meet their ambitious targets, from shaping a robust commercial vision to executing precise operations tactics.

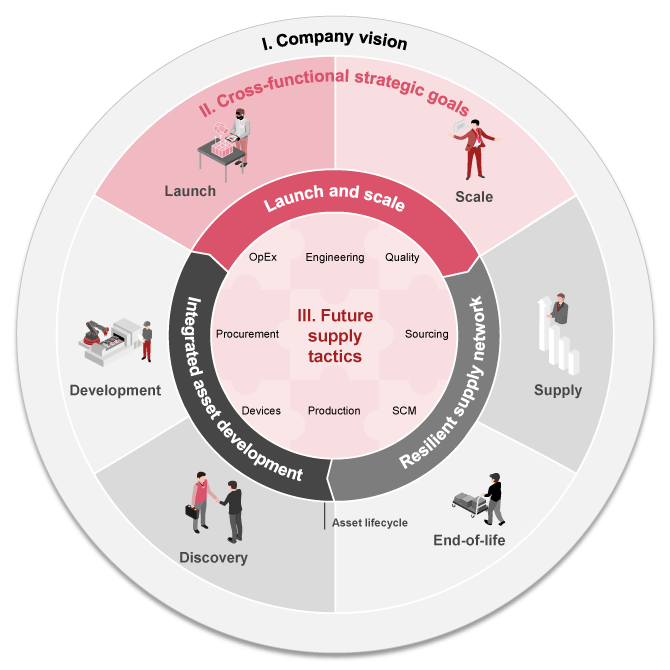

This cross-functional strategy must encompass the entire pharma lifecycle, from development to commercialization and sustained market success, to effectively address the associated challenges (see Exhibit 1).

These three building blocks span across the pharma value chain from R&D to launch and scale-up as well as long-term supply.

- Integrated asset development: Enabling future success through early and joint decision making

Enhance coordination across R&D, manufacturing, and commercialization through integrated development and strategic partnerships. Factoring in market and customer preferences early helps optimize production decisions and outcomes. - Launch and scale excellence: Unlocking sustainable commercial value

Ensure timely market entry, reliable supply, and flexible scaling by building capabilities like market-driven planning, proactive regulatory navigation, and scalable supply chains, including CDMO ecosystems. - Resilient supply network: Building long-term supply networks of the future

By planning for capacity expansion and end-of-life early, pharma companies can build resilient supply networks and maintain a balanced global footprint. Scenario planning helps mitigate risks from shifting trade regulations and tariffs.

This article focuses on how pharma companies can prepare and be successful to deliver on their commercial ambition through launch and scale excellence.

Successful launch and scale activities are critical for long-term success

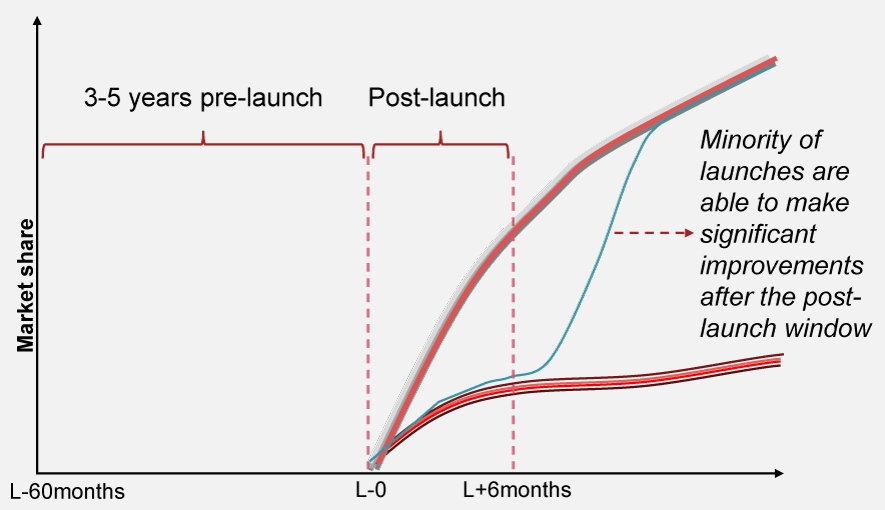

Launches play a pivotal role in the pharma industry, demanding significant time and resources from companies. There exists a narrow window of opportunity, typically around six months, that sets the tone for long-term success. Once a launch deviates from its success trajectory within this timeframe, it often struggles to correct its course, underscoring the importance of a strategic and well-executed launch plan (see Exhibit 2).

Ensuring a successful launch involves, amongst other factors like market access, the establishment of a reliable supply chain and incorporation of flexibility to enable rapid scaling in response to demand fluctuations. The initial market penetration during this critical period not only influences market share and competitive positioning but also lays the foundation for a product's long-term success.

A prominent example of a delayed launch is Zolgensma, which faced rollout setbacks in the EU and Japan in 2019 due to misalignment with regulatory authorities regarding manufacturing processes. Novartis addressed concerns by hosting the EMA at its site and secured approval in May 20201. The delay, especially given age-based prescribing limits, led to opportunity costs and illustrates how launch setbacks can result in lost market share and increased regulatory and supply chain risks.

Seven common pitfalls typically jeopardize assets’ launch and scale success

In the realm of emerging pharma launches, a multitude of converging trends are reshaping the strategies of launch teams and operations professionals. These trends necessitate a re-evaluation of launch and scale strategies, emphasizing flexibility and a broader range of capabilities. Factors such as the evolving nature of launches towards smaller scale, driven by personalized medicine and rare diseases, present new challenges. Additionally, global supply chain dynamics, influenced by geopolitical tensions, highlight the importance of establishing diverse manufacturing footprints to mitigate disruptions effectively.

Furthermore, the intensifying competitive landscape underscores the need for secure and rapid scaling options, prompting pharma companies to consider outsourcing and partnerships as strategic commitments with lasting impact. Over the past years, we have observed several pharma companies facing seven common pitfalls that can lead to significant production delays, financial losses and reputational damage, undermining overall commercial success at launch and beyond.

These challenges typically fall into three categories:

Addressing these pitfalls early and holistically can enable pharma companies to build a robust foundation for successful launches and sustained scalability.

Launch archetypes' contribution in aligning operations with commercial ambitions

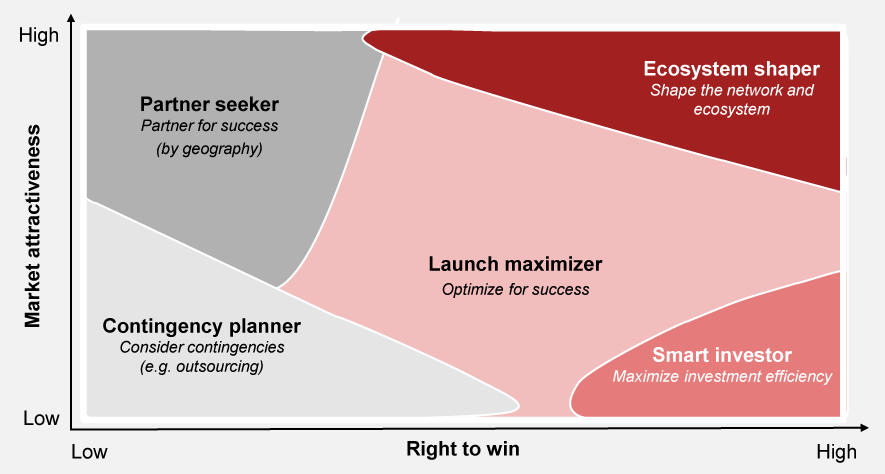

Aligning operations with commercial ambitions is necessary to successfully scale new product launches. While there is no universal approach that fits all situations, each commercial situation requires a nuanced strategy that prioritizes initiatives from both the commercial and operations perspectives.

We have developed launch archetypes which help pharma companies to focus on their most critical pain points based on their right-to-win and market attractiveness (see Exhibit 3). These archetypes consider a wide library of more than 30 different factors aiming for e.g., supply security, cost effective scaling, cutting down time to market or increasing quality of output.

By closely aligning their operations strategy with their commercial ambitions, pharma companies can proactively prepare their launches and set the stage for sustainable growth. This strategic connection enables pharma companies to anticipate market dynamics, address operational hurdles and position themselves for success in a competitive environment.

Pharma companies’ journey towards launch and scale excellence

Pharma companies need a tailored approach to drive excellence in operations in order to successfully launch and scale assets. To get started, pharma companies can follow five key steps to ensure launch and scale excellence:

By addressing these key areas, pharma companies have the potential to better navigate new launches and unlock the full potential of their pipeline assets, whether they prepare for a new product launch or scale existing operations. A standout example of fast-track launch and scale is BioNTech’s rapid tech transfer for Covid-19 vaccine manufacturing. In just six months, the company rebuilt an acquired site, installed new equipment, secured approvals, and began production – highlighting the impact of strategic planning and regulatory alignment in accelerating industry efforts.