ESG in the industrial manufacturing industry

ESG standards are, and will continue to, drive the strategic agenda of the industrial manufacturing (IM) industry. IM companies are key suppliers to emissions-heavy sectors including the automotive, chemicals and energy industries, putting them under pressure from regulators and customers to make clear how they will reach net zero emissions throughout their value chain.

In this report, we compare the progress being made by 44 leading industrial manufacturing companies from Germany, Switzerland and Austria when it comes to reducing emissions and other environmental impacts.

The information analyzed includes quantitative data such as CO2e emissions in Scope 1, 2 and 3, CO2e reduction targets and ESG investments, as well as qualitative information such as specific CO2e reduction measures.

Progress on sustainability by industrial manufacturers

As seen in last year’s study, almost all industrial manufacturing companies have ESG on their radar, but fewer companies had detailed and quantifiable CO2e reduction measures in place. However, we see some significant improvements that show companies are putting more emphasis on establishing the transparency needed to effectively reduce CO2e emissions.

% of IM companies...

In comparison to our 2022 study, there is a clear positive trend that industrial manufacturing companies are being more transparent and diligent about reporting Scope 3 emissions stemming from upstream and downstream operations along their value chain. In addition, there is a greater match between the Scope 3 emissions reported and the applied CO2e reduction measures. Despite this positive development, the majority of IM companies are not reporting the full range of their Scope 3 emissions yet.

Percentage of companies reporting and measuring Scope 3 emissions

CO2e reduction measures and their impact along the value chain

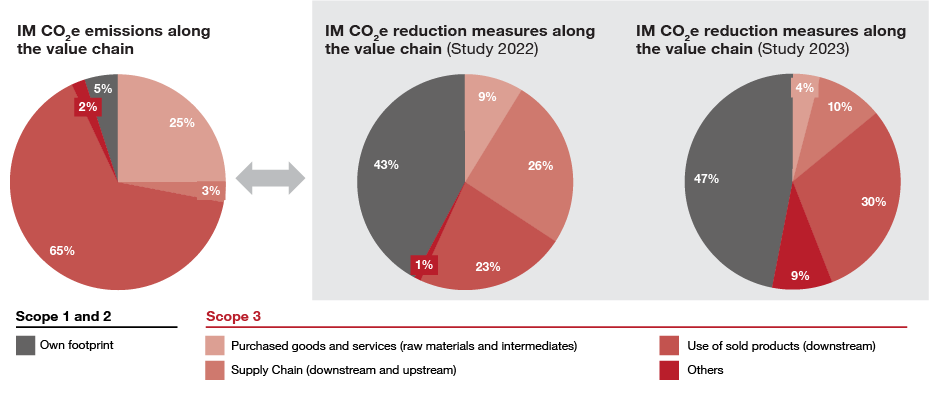

95 percent of the CO2e emissions associated with industrial manufacturing companies are included within Scope 3, with 65 percent of the emissions occurring downstream when the product is in use. ‘Own footprint’, representing Scope 1 and 2 emissions, only accounts for an estimated 5 percent.

We reviewed more than 200 CO2e reduction measures and analyzed which value chain segments they address. We also compared the progress made since last year’s study. The measure split in the graphic below, clearly shows that CO2e reduction efforts are still not aligned with where CO2e emissions occur along the value chain.

However, there are also signs of progress. Companies appear to be putting more emphasis on measures to tackle emissions in the ‘use of sold products’ category - increased from 23 percent to 30 percent. Measures such as the energy efficiency or electrification of products, as well as more eco-friendly designs using fewer resources, address downstream emissions. We would expect such measures to increase over the coming years, as IM companies comply with new regulations such as the European Union’s Corporate Sustainability Reporting Directive (CSRD), which passed in January 2023.

ESG in value chain transformation will help to gain competitive advantage

While investors see ESG among their top five priorities, 81 percent of investors will accept only a 1 percentage point or smaller reduction in returns to advance ESG objectives. This means being a sustainable company at the cost of long-term competitiveness is not an option. Instead, competitiveness needs to be ensured and enhanced while driving the ESG value chain transformation, even in today’s challenging economic environment.

The analysis makes clear that the measures that are expected to have the biggest impact on the value chain, as well as on CO2e reduction, are also the biggest drivers for increasing a company’s competitiveness. However, they also require most investments.

| Transparency creation | Communi- cation |

Sustainability quick win | Sustainability through improvement of products/ pocesses | Sustainability through value chain changes | |

|---|---|---|---|---|---|

| Supply chain resilience | 10% | 18% | 15% | 12% | 93% |

| Cost savings potential | 3% | 21% | 55% | 27% | 100% |

| Product/ service/ process innovation | 0% | 15% | 6% | 94% | 64% |

| Investment | 14% | 36% | 45% | 90% | 64% |

Sustainability impact

Actions to reach sustainability targets and increase competitive advantage

In the 2022 study, we laid out five specific actions for industrial manufacturing companies to reach their sustainability targets. The results of the 2023 study show some of these recommended actions have been addressed, while others remain as relevant as they were a year ago:

| Status | |

|---|---|

| 1. Make sustainability a strategic priority |  |

| 2. Create transparency |  |

| 3. Develop a decarbonization roadmap |  |

| 4. Make decarbonization a focus of product development |  |

| 5. Re-evaluate cross-value chain emission reduction potential through circularity |  |

| 6. Understand how CO2e reduction measures drive competitive advantage |

Our study shows that CO2e reduction measures drive competitive advantage in terms of supply chain resilience, cost saving potential and product, service and process innovation - especially those measures that address the entire value chain. While investment costs need to be considered, it is clear that sustainability and competitive advantage go hand in hand for the industrial manufacturing companies that act upon it.

Michelle Beck, Alexander Brandenberg and Isabella Heimann also contributed to this report.