Asset management study 2025

Despite rising assets under management, asset managers remain in a tight spot

Dr. Philipp Wackerbeck and Dr. Utz Helmuth

Key findings

- From 2019 to 2024, asset managers in our selected sample realized 37% growth in assets under management (AuM) with a compound annual growth rate (CAGR) of ~5%

- Compared to 2023, AuM increased by an average of 12% in 2024, representing a slight slowdown in growth

- Driven by a comparatively strong market environment in 2024, revenues rose by 8%, suggesting a market recovery in comparison to 2023

- In light of continued fee pressure and rising expenses, asset managers remain in a tight financial position

- Effective cost management remains a crucial focus for C-level executives

Assets under management show strong results despite cost pressures in 2024

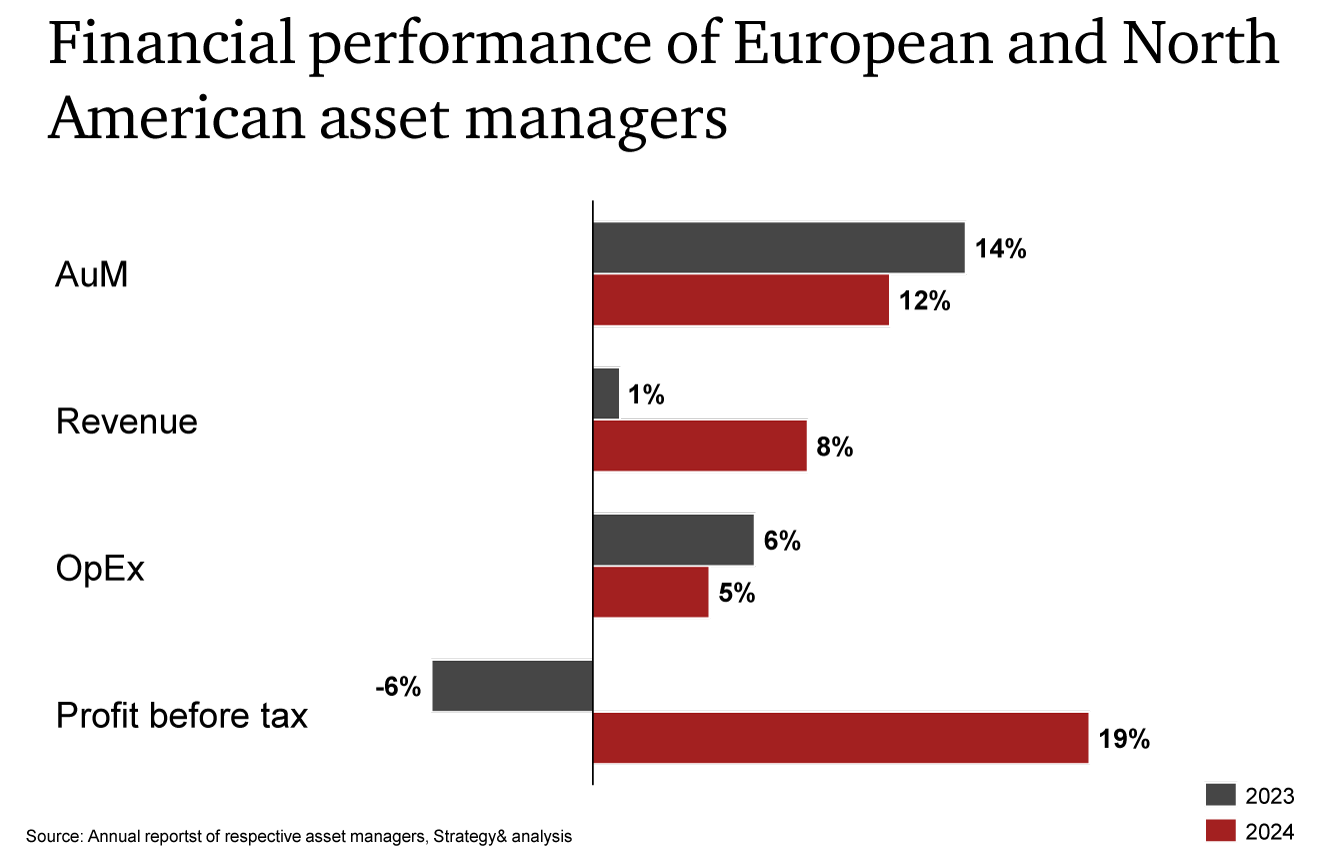

Compared to 2023, assets under management (AuM) grew by an average of 12% in 2024, marking a slight deceleration in growth momentum. However, profits per AuM rose only marginally (approximately 3%), indicating that scale has not translated into proportional profitability gains.

Revenues surged by 8%, fueled by a comparatively robust market environment that signaled a decisive recovery from 2023, when asset managers struggled to translate AuM growth into top-line gains. Yet operating expenses (OpEx) continued their upward trajectory, reflecting persistent challenges around talent acquisition, private equity and alternative investments expansion, and elevated compliance costs amid increasing operational complexity.

Despite these cost pressures, pre-tax profits soared by 19% as revenue growth outpaced cost increases – demonstrating the industry's ability to convert market recovery into bottom-line performance, even as efficiency gains per unit of assets remained modest.

Growth of largest and selected other asset managers

US asset managers continue to outperform European peers in terms of scale and growth. European asset managers have achieved an average AuM growth rate of 25%, vs. 62% for their North American peers over the last five years, leading to significant market share shifts.

Why effective cost management remains essential for asset managers

Over recent years, average operating expenses per assets under management have remained relatively stable at a high level, while cost-income ratio (CIR) levels have trended upward – though 2024 marked a welcome reversal of this pattern.

This trajectory stems primarily from operating cost growth exceeding 5% year-on-year, which has persistently outpaced even robust AuM expansion of over 10% annually and rising revenues. Looking ahead, disciplined cost management will be mission-critical to reduce costs, drive CIR lower, and unlock operational efficiency, particularly as top-line growth faces continued headwinds.

Outside-in competitive cost benchmarking

Asset management archetypes

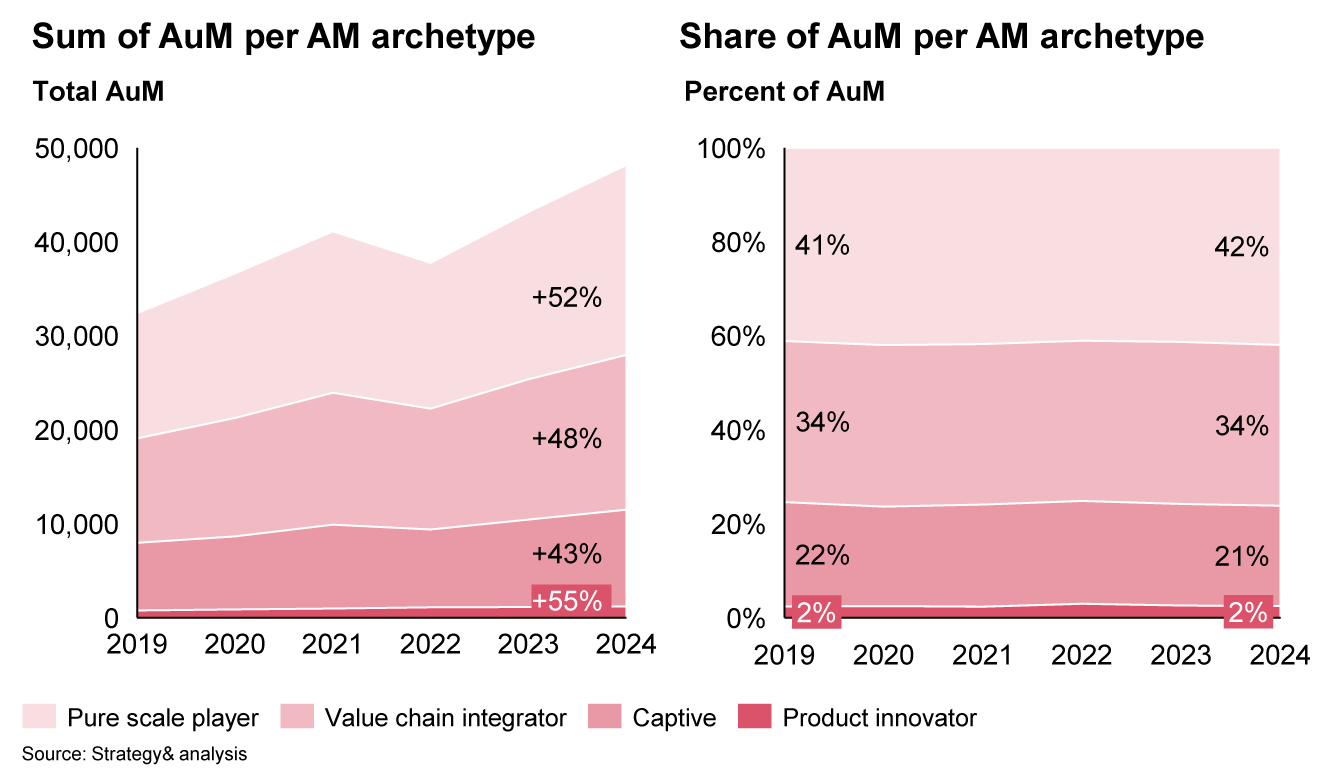

We categorize asset managers into four strategic archetypes, with scaling and specialization as the key themes:

Pure scale players and value chain integrators are driving the lion's share of industry growth, capturing approximately 75% of assets under management. In contrast, captive asset managers are growing significantly slower than their independent counterparts, relying predominantly on insurance premium inflows and mutual fund distribution as their primary source of assets.

Notably, standalone asset managers are outpacing captives in overall AuM growth. Among captives, the contribution of asset management to group profitability varies considerably, with their OpEx per AuM typically running higher than the industry average, reflecting reduced economies of scale and operational efficiencies.

Three potential equity market scenarios

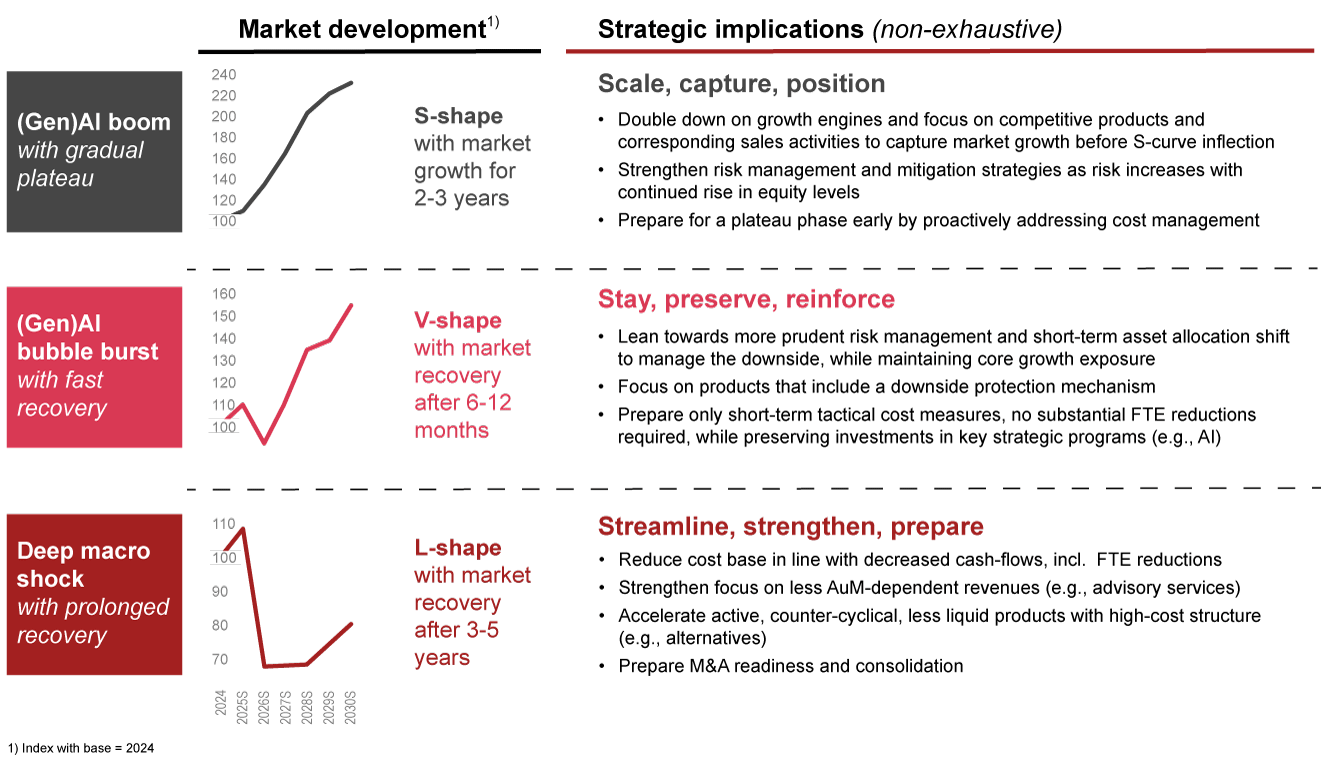

The World Uncertainty Index reveals intensifying macroeconomic and geopolitical pressures in an increasingly volatile world. While US equity markets and GDP – as the most important reference market for asset managers – have reached all-time highs, this growth has been fueled by surging public debt: The US Debt-to-GDP ratio is projected to hit ~135% in 2025, nearly double the 69% of 2008. The convergence of extreme uncertainty, elevated valuations, and record debt levels exposes asset managers to heightened correction risk.

Against this backdrop, we have developed three distinct scenarios for the years ahead. The implications for asset managers' revenue, profitability, and long-term growth trajectories will differ considerably across these scenarios.

Strategic implications for European asset managers

Based on our findings, we identify three scenario-agnostic strategic imperatives for European asset managers:

Sandro Kanzian and Dr. Clarissa Knorr have co-authored this report.