Five ways fashion brands can win in a growing market

Streetwear is one of the most striking retail and fashion trends to have emerged in recent years, involving the production, promotion, sale and resale of casual fashion in ways that bypass traditional retail channels.

Customers are often rallied via social media to be the first to buy products that are only available directly from the brand, either in-store or online. The anticipation of a time-limited chance to buy helps create a tight-knit and almost cult-like relationship between streetwear brands and their consumers.

This has helped propel streetwear from being an eye-catching fashion phenomenon that drew its inspiration from the counter-cultures of the 1980s and 1990s into a multi-billion dollar retail market. We estimate the size of the global streetwear market at $185 billion by sales*, making it by some estimates about 10% of the entire global apparel and footwear market.

Streetwear’s impact – both on retail culture and the numbers involved – has caught the attention of some of the most iconic, established brands in the retail and luxury goods sectors and fashion industry generally. Streetwear players come from various parts of the fashion industry. There are pure streetwear brands, while sportswear names are developing their traditional portfolio of sports equipment into a growing streetwear portfolio with the concept of cool, hip sneakers and hoodies. In addition, luxury brands are also working to gain a significant stake in the streetwear market.

That is in large part because it is opening up a whole new target market of younger consumers. Streetwear’s audience is very young: mostly under 25.

A second reason for the interest from established brands is that Streetwear has subverted the way fashion trends have taken off. The fashion industry has typically operated a top-down model, with insiders acting as gatekeepers to the newest styles and trends. Streetwear has turned this on its head. Customers have the power to determine what is cool as much as industry insiders. Exclusivity and desirability are conferred by scarcity and insider knowledge rather than high prices. In short, streetwear has redefined how “cool” is made profitable.

Third, streetwear fans’ democratic approach to buying clothes are increasingly shared by all consumers, for whom the opinion of peers is an ever-more influential part of decision-making: 32% of respondents to PwC’s recent Global Consumer Insights Survey (GCIS) said positive reviews on social media influence what products they buy.

Small wonder, therefore, that fashion brands have been buying into the streetwear trend in recent years. Among the highest profile examples are Louis Vuitton’s collaboration with leading streetwear brand Supreme, and the luxury giant’s decision to hire Virgil Abloh, founder of streetwear brand Off-White, as artistic director of Louis Vuitton menswear last year.

*Streetwear market size estimate based on US Streetwear Market Report (2015) data and applying same growth rate for subsequent years as for global fashion market in data from Euromonitor, 2019.

Strategy& and Hypebeast, a leading online media platform for men’s contemporary fashion and streetwear, recently conducted two surveys to show how fashion brands can best succeed in selling streetwear: one covering more than 40,000 consumers worldwide, and another involving around 700 people working in the industry. The results showed that:

- Streetwear consumers are young: more than 60% of consumers surveyed were under 25.

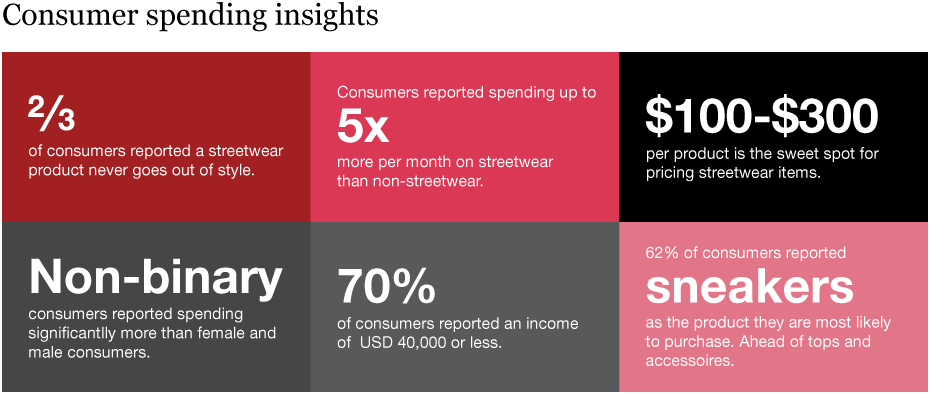

- They are not all that wealthy, either: about 70% of respondents reported an annual income of $40,000 or less.

- But they have money to spend on their favourite brands: 56% reported spending an average of $100-$300 on a single item. Asian consumers spend more, with 32% of Japanese respondents spending an average of $500 or more per product.

- They connect directly with brands both offline and online: 53% are most likely to buy streetwear products in the brand’s own store; 42% from its website.

- Social media is their top source (84%) of influence, followed by the other young, urban people they see around them.

- Successful brands have strong links to the cultures out of which streetwear grew: musicians have the most credibility among consumers in our survey (65%), some way ahead of social-media influencers (32%).

- Streetwear’s young fans think of themselves as being socially conscious, a trend that is spreading to all consumers: 70% said social awareness and brand activism were important to them, while 29% of PwC’s GCIS participants responded they buy brands that promote sustainable practices.

The evidence shows that growth expectations for streetwear are robust, even as there are some clouds gathering over the retail industry amid a global economic slowdown. As many as 76% of industry respondents in our survey expected the market to continue to grow significantly over the next five years.

With this landscape in mind, we have explored how brands can play – and win – in the streetwear market. Five factors should be borne in mind for success: authenticity; scarcity; democracy; affordability; and seamlessly linked online and offline activity.