As we step into 2026, consumer packaged goods (CPG) companies are faced with a marketplace shaped by complexity and fast-changing consumer expectations. Traditional sector boundaries are fading, and consumers increasingly demand integrated solutions and tangible benefits rather than just products. After years of cost cutting, companies are reaching the limits of efficiency-driven strategies. To remain competitive, CPG companies must shift their focus more strongly onto growth and reinvent their capabilities like artificial intelligence (AI), real-time consumer insights, and ecosystem collaboration. These capabilities, combined with agentic commerce and a growth-oriented culture, will determine how effectively companies can get ahead in the upcoming years. This outlook delves into the key challenges and opportunities set to shape the CPG landscape in the months ahead.

Be the one who…

Click boxes to read

The lines between product categories are rapidly fading, as consumers increasingly seek integrated solutions that support their broader lifestyle goals. CPG companies that fail to adapt their portfolios to evolving consumer lifestyles risk losing relevance and market share. In 2026, portfolio strategy must go beyond category definitions and reflect lifestyle trends around health or well-being. Legacy CPG business strategies – once relying on controlling shelf space – are losing relevance and risk being left behind, as price increases and package size reductions will not lead to sustainable growth. Consumers are moving toward brands that truly understand and address their evolving needs by delivering added value and affordability. CPG companies that are proactive in reviewing offerings and shaping portfolios around consumer priorities will capture growth.

To stimulate consumer demand, aligning portfolios with emerging consumer priorities will be key. PwC’s Voice of the Consumer Survey reveals that more than half of the 20,000 respondents want to make healthier food choices, reflecting a broader shift in lifestyle priorities.1 This shift is closely linked to the rapid rise of GLP-1 medications, which typically reduce total food intake and increasingly prioritize nutrient-dense, functional options. The first CPG companies have anticipated these changes and adapted their portfolios accordingly. Nestlé’s Vital Pursuit food line launched in late 2024 and is designed specifically for the new dietary needs of GLP-1 users by offering smaller portions of 200 to 400 grams - rich in protein and fortified with essential vitamins and fiber. The range supports weight management while reducing the risk of muscle loss and nutrient deficiencies associated with lower food intake. Similarly, Danone introduced Oikos Fusion drinkable yogurt in 2025. The liquid nutrition product provides high protein concentration along with prebiotic fiber and vitamin B, helping to maintain muscle mass for individuals on GLP-1 therapy.

The trend toward more holistic lifestyle choices is reinforced by the widespread adoption of healthcare apps and wearable technologies. About 70 percent of consumers interviewed in the PwC Voice of the Consumer Survey use these technologies, with 90 percent of those users reporting that wearables have influenced their daily habits – helping them to exercise more, eat better, and improve their overall well-being.2 As technology embeds lifestyle optimization into everyday behavior, expectations for convenience, wellness, and functional benefits continue to rise. Helping consumers quickly find products that align with their personal values – such as health, sustainability, local sourcing, or specific dietary needs – will be critical, supported by clear, accessible information and increasing integration with AI tools and wearables. CPG companies that fail to align their portfolios with these expectations risk falling out of step with consumers’ daily routines.

In 2026, consumer-focused portfolios are more critical than ever. In the past, growth could be driven by product innovation or pricing within well-defined categories. Today, consumers demand solutions that address multiple aspects of their lifestyles. They expect functional benefits, wellness outcomes, and seamless digital experiences. CPG companies must translate these shifting preferences into value-driven offerings. Portfolios need continuous optimization to remain relevant. This includes detecting micro-trends early, assessing products against evolving consumer preferences, prioritizing resources for high-growth areas, and aligning investments with lifestyle trends. Building a truly consumer-focused portfolio is no longer just about individual products. It is about delivering integrated solutions that fit into consumers’ daily lives.

Flat growth, low margins, and economic volatility are increasing the pressure on CPG leaders. Additionally, the rise of local players in several regions with strong consumer proximity and faster innovation cycles is intensifying these dynamics. Traditional capabilities – built on stable categories, steady margins, and predictable loyalty – no longer support these shifts. Almost half of senior leaders doubt their current structure will remain viable over the next decade. Yet, this recognition hasn’t led to clear actions: Almost 30% of those expecting their model to fail have no plans to restructure. Incremental improvements are no longer sufficient. A PwC survey among >200 respondents from multinational CPG companies highlights that competitiveness in the coming years will require a fundamental redesign of capabilities, embedding speed, adaptability, and intelligence into the core business.3

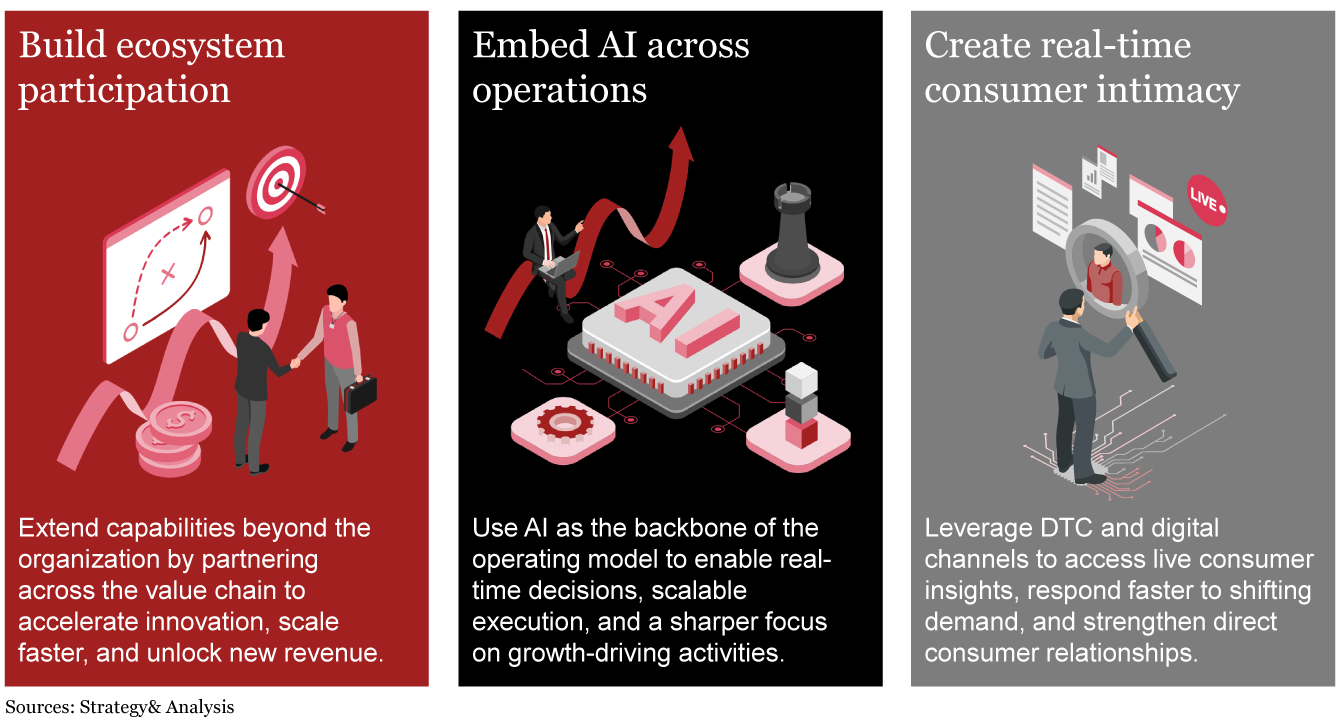

Firstly, ecosystem participation is no longer optional for CPG companies – it has become a critical capability that allows them to extend their reach and impact far beyond what internal resources can achieve and across traditional industry boundaries. PwC projects that ecosystems will account for two-thirds of global economic activity by 2030.4 To succeed, CPG companies must create cross-industry ecosystems together with manufacturers, retailers, technology platforms, and service providers to supplement capabilities across the value chain. In the PwC survey among CPG companies, more than 90% of CPG leaders expect ecosystem collaboration to become pervasive, spanning market insights, commercial platforms, and operational processes.5 These collaborative networks not only accelerate speed to market and unlock new revenue streams, but also increase the importance of strategic deals and partnerships, helping companies navigate a landscape where product categories are increasingly fading.

Secondly, AI-enabled operations form the backbone of a future-ready organization. Integrated across the value chain, AI enables frictionless data flow, real-time decision-making, and dynamic scaling, unlocking the potential of human talent to focus on strategy, creativity, and long-term growth. L'Oréal, for example, is collaborating with NVIDIA to leverage the NVIDIA AI Enterprise platform, fundamentally transforming its operating model from product creation to consumer engagement. AI-driven content generation accelerates scalable marketing, while the AI Beauty Matchmaker delivers personalized product recommendations at speed and scale.6

Thirdly, real-time consumer insights and engagement, particularly through Direct-to-Consumer channels and agentic commerce, is becoming a defining driver. As consumer behavior is shifting faster than ever, traditional, retrospective tools like surveys or focus groups weaken the ability to respond to rapidly changing trends. DTC removes that barrier, giving firms real-time access to purchase data, preferences, and emerging needs. This allows companies to make faster, more confident decisions in product development, marketing, and assortment planning, while also deepening consumer relationships. Up to 62% of CPG executives interviewed in the PwC CPG survey expect an increase in DTC revenues. Combined with agentic commerce, this will lead to shorter decision cycles, more personalized experiences, and reconfigured brand touchpoints.7 Leading CPG firms must go beyond selling products – they need to engage directly with consumers to capture actionable insights and continuously feed these back into strategy, innovation, and operations.

Continuous disruption is the new normal. To thrive in 2026, CPG leaders must lead the capability reinvention with speed, adaptability, and intelligence in mind. Those who wait risk falling behind in a faster, more connected, and consumer-driven world. Importantly, this is not about investing in everything at once. Leaders must make strategic, company-specific choices.

The emergence of agentic commerce, driven by autonomous AI agents, marks a fundamental shift in how consumers interact with CPG companies. Unlike traditional online shopping, AI agents interpret intent, compare options, and increasingly complete purchases on behalf of consumers. This represents a structural overhaul of the retail funnel: traditional brand and retail touchpoints mattering less at the moment of choice.

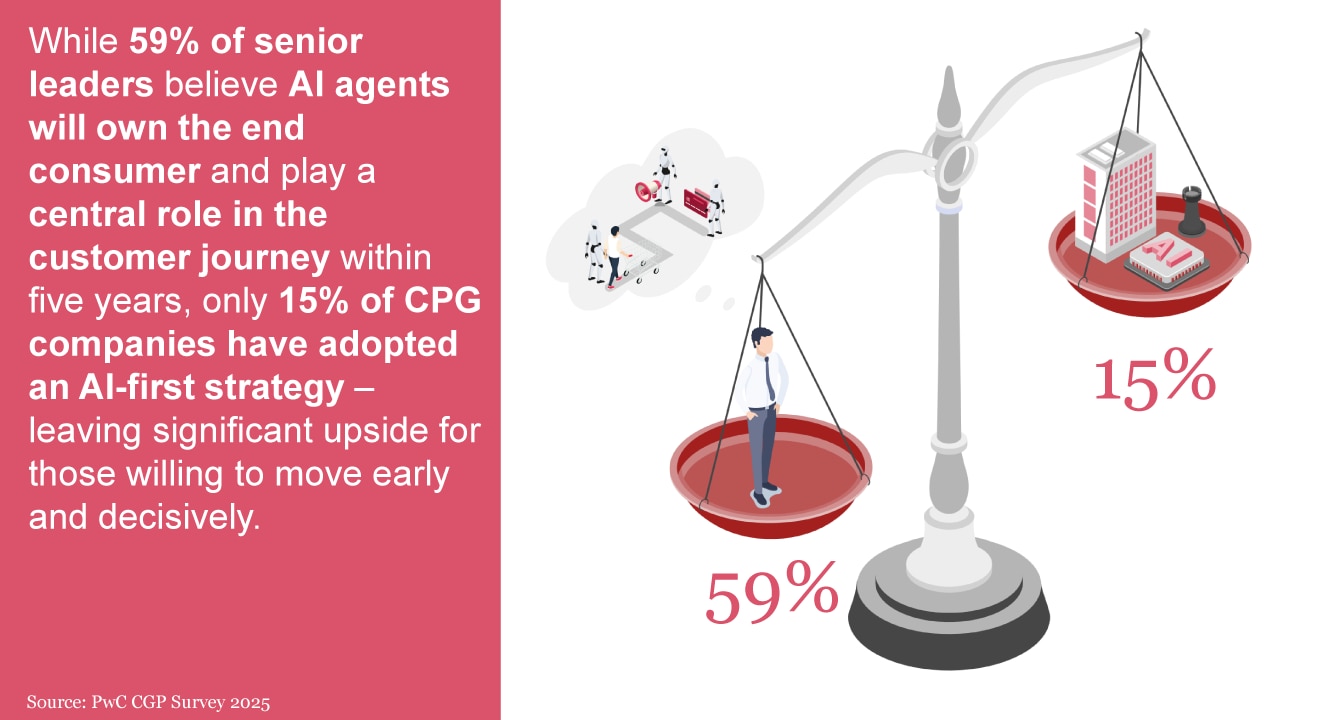

Evidence of this shift is already visible. According to the PwC CPG survey, 59% of senior leaders believe AI agents will own the end consumer and play a key role in their customer journey over the next five years.8 At the same time, AI-generated traffic to retail websites has surged by over 1,200% in just six months, indicating that discovery increasingly begins with AI agents rather than retailer-owned touchpoints.9 Companies that fail to optimize for agent-led discovery risk losing relevance and market share to AI-native competitors.

Instead of browsing or scrolling, consumers increasingly engage through conversational or task-based prompts, such as “I’m hosting Sunday brunch, what should I serve?” or “Restock my office supplies”. AI agents evaluate products across brands and retailers, weigh trade-offs such as price and availability, and execute purchases automatically. Winning CPGs will be those that design AI-readable, occasion-based bundles that agents can easily discover, recommend, and reorder.

To compete, CPGs can no longer rely solely on their existing digital infrastructure. Competitive advantage now requires enabling AI-mediated commerce end-to-end, from structured product data and programmable bundles to frictionless transactions. Agentic capabilities must be embedded across functions, including merchandising, supply chain and customer support, so AI agents can reliably discover, evaluate, and purchase products.

Many companies are already taking the first steps. OpenAI and Stripe’s partnership enables agentic transactions directly within ChatGPT, allowing consumers and AI agents to discover and purchase products inside the conversational interface itself.10 Companies such as Walmart, Etsy and Shopify are beginning to deploy comprehensive agentic commerce capabilities to enhance discovery, evaluation, and shopping in AI-native environments.

This shift is also transforming how CPG companies approach direct models, enabling what is referred to as DTC 2.0, or Direct-to-Agent (DTA). While many CPGs have struggled to scale DTC models in the past due to high acquisition and logistics costs, agentic commerce introduces a more efficient, AI-driven fulfillment path. CPGs fulfil from plants or micro-distribution centers, with intelligent agents planning inventory, bundling products, and optimizing last-mile delivery.

Alongside direct fulfillment, CPGs must rethink channel strategies to capture the full value of AI-driven commerce. Agentic commerce is driving new partnership models spanning revenue sharing, data access, marketing collaboration, and operational integration across retailers, platforms, and technology providers. How CPGs manage these partnerships will define future data ownership, pricing control, and brand visibility. Structured, AI-readable product information becomes foundational – not only for discovery, but for dynamic bundling, personalized recommendations and automatic reordering.

As agentic commerce scales, competition shifts from being visible to being chosen. Success depends not only on consumer perception, but also on how products perform within the decision-making logic of AI agents. Owning an agentic strategy therefore becomes a leadership priority, requiring clear decisions on where to partner, where to build capabilities, and how to protect consumer access. While AI is widely recognized as the top lever for cost reduction, surprisingly few CPG companies have an AI-first strategy in place – creating a significant opportunity for those willing to act. Companies that succeed will understand how agentic commerce works in practice, prepare their organizations accordingly, and position their brands as the natural choice in an increasingly automated world of commerce.

A culture of growth is increasingly recognized as a critical driver of relevance and resilience in the CPG sector. It empowers teams to experiment, learn continuously and collaborate effectively – supported by agile ways of working that enable faster decision-making and responsiveness. Without it, firms risk slower innovation, misaligned strategies, and missed opportunities as consumer expectations shift and technologies like agentic AI reshape the market.

In the PwC CPG survey, CPG leaders identify the biggest barriers to transformation as organizational rather than financial or technological, with misaligned stakeholders, unclear strategic direction, and deeply-rooted legacy mindsets as the main obstacles. If these challenges persist, nearly half of CPG leaders believe their current business models could become economically unsustainable, underscoring the urgency of building a growth-oriented culture that aligns vision with action.11

High-growth organizations tackle these barriers through three key actions: investing in holistic talent and leadership development, clearly articulating a growth vision, and empowering teams to pivot rapidly. They balance incremental improvements with breakthrough innovations, foster cross-functional collaboration, and leverage emerging technologies to drive measurable value. Unilever, for example, has institutionalized a culture of experimentation through the Unilever Foundry, enabling teams to rapidly test, learn, and scale new ideas by working across internal and external ecosystems.12

Prioritizing talent and cultural transformation are equally critical – especially in a market where digital adoption, consumer alignment, and supply chain resilience are all seen as vital for future readiness. Companies must develop future-fit skills such as data literacy, digital fluency, consumer insight generation, and adaptive leadership, while forming diverse teams that blend functions, experiences, and perspectives. Proactive change management – aligning stakeholders early, anticipating resistance, communicating consistently, and equipping teams with the tools to adopt new operating models – helps embed these changes into day-to-day work.

Modernizing operations and breaking down silos further strengthens a responsive growth culture. Integrating business functions and enabling agile, cross-functional teams improves decision-making and allows rapid, end-to-end value capture. Establishing clear transformation metrics – covering innovation cycle time, speed-to-market, capability adoption, and employee engagement – and linking leadership incentives to these outcomes ensures accountability and momentum.

In summary, cultivating a culture of growth goes beyond leadership mindset alone. It requires rethinking how work is organized and executed – investing in talent, embedding agile and collaborative ways of working, and fostering continuous experimentation. Companies that do so will be better positioned to navigate disruption, capture new growth opportunities, and thrive in an evolving CPG landscape.

Conclusion

2026 is a turning point for CPG leaders, as success will no longer come from traditional levers like brand strength or shelf space alone. The need for bold actions is clear, from redefining customer premises to integrating core capabilities into a future-ready business model. To succeed in 2026 and beyond, AI and growth-oriented culture will be equally critical, enabling continuous innovation and rapid adaptation to changing consumer needs. CPG leaders need to define their unique way to play and set the right priorities to capture the most value.

This article was created in global collaboration with contributions from Sean Tickle (PwC UK), Luciana Medeiros (PwC Brasil), Alberto Vigada (Strategy& Italy), Ravi Kapoor (PwC India), Peter Vermeire (PwC Belgium), Sam Waller (PwC UK), David McGee (Strategy& Ireland), Martijn Peeters (PwC Indonesia), and Sabine Durand-Hayes (PwC France).