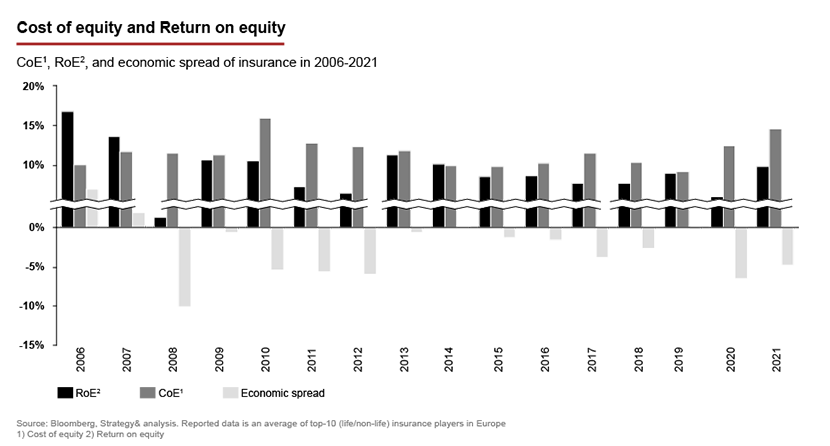

The European insurance industry’s underwriting results have been negative for much of the past 15 years (2006-21): non-life insurers’ combined ratio averages 96% over that period while among life insurers the benefit ratio averages 120%. To offset these continuing losses, insurers have relied heavily on returns from their investments - but recent weakness in financial markets means this approach is running out of road. Moreover, life and non-life insurers’ economic spread has been mostly negative over the past 15 years, with larger shortfalls since 2019, as the chart below shows:

Market trends suggest that these pressures will not ease up: economic uncertainty and inflation are pushing up claims costs; continuing regulatory change is increasing operating costs; evolving demographics are increasing longevity; outdated technology infrastructure must be replaced to improve service levels, and insurers are under increasing pressure to embed ESG in the core strategy as climate change becomes an increasingly urgent concern.

These factors will force insurers both to invest and to address the corresponding cost implications. With inflation and the economic slowdown limiting their scope to grow real premium income or make significant investment gains, insurers must cut costs in the near term by around 10% just to stand still.

Many insurers are responding with tactical moves that provide some short-term relief. They are amending policy conditions to reduce levels of cover, for example, and rationalizing third-party repair and care providers to increase buying power and hold down costs. But moves such as these are not enough to address the fundamental cost challenges they are facing. There is no alternative but to approach cost transformation as a core strategic priority.

The strategic rationale for cost transformation

The critical considerations for insurers undertaking cost transformation programs must be their strategic goals and the capabilities they will require to differentiate themselves in their market. Cost transformation must enable and support the strategic direction they have chosen, for example to become a digitally focused auto insurer. As far as possible, programs must also be self-funding. The aim is to use short- and medium-term cost reduction levers to release funding that can be directed toward the longer-term changes that differentiate the proposition and position insurers for growth.

In our work with clients, we use a set of simple archetypes to place insurers into one of four broad groups and so help them decide which cost transformation levers are most relevant for their situation and the order in which they should be applied. We divide insurers into Global Leaders (international, multi-line insurers built through M&A), Regional Champions (driven by organic growth and specialist products targeted at individuals and SMEs), Commercial Specialists (serving multinational corporate clients with M&A-driven growth) and Reinsurers (regional and global players driven by organic growth).

The starting point for any strategic cost reduction program is to determine the order in which the cost transformation levers should be applied. There is no single answer to this question. Instead, the levers need to be prioritized depending on the deep-rooted challenges that confront each insurer. Our archetypes can help to diagnose these challenges and so clarify which steps should be taken first.

A Commercial Specialist, for example, is likely to have grown inorganically, resulting in multiple legacy systems and processes and divergent cultures across the network. In this instance, the first lever should be to simplify and standardize the operating model, adopting outsourced services where relevant. From there, the focus can move to digitalization and then optimizing distribution and the product range. A Regional Champion, on the other hand, with a diverse basket of products should concentrate first on rationalizing its product range and distribution before streamlining processes through digitalization and outsourcing.

In designing strategic cost transformation programs, we focus on the three major cost categories in an insurer’s P&L – operating expenses, commissions and claims – and apply strategic cost reduction levers to each of them:

Operating expenses

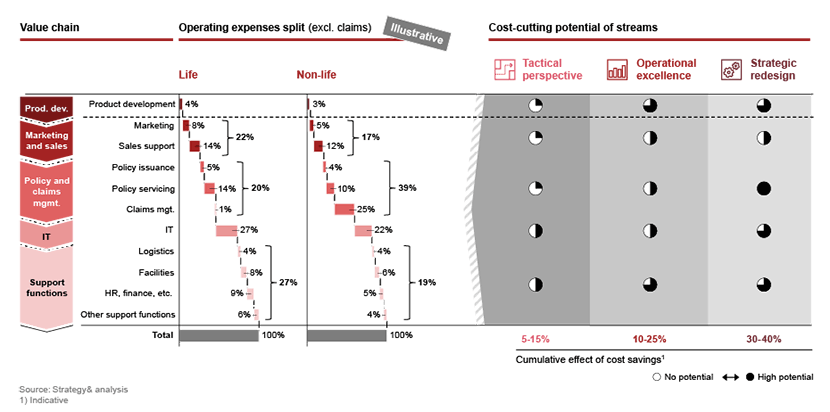

Although specific cost structures vary across life and non-life insurers, we divide operational cost transformation into three streams: short-term tactical changes, medium-term operational excellence initiatives and longer-term strategic redesign. We then apply each of these streams to the key areas of the insurance value chain: product development, marketing and sales, policy and claims management, IT and support functions, as the following chart shows:

The project we undertook with a leading European reinsurer to define a new target operating model for its finance function provides an excellent example of what insurers can achieve. The project took a finance function that had become larger and more complex than its peers and gave it a simpler, leaner structure. The simplification steps we identified reduced the cost base by more than 30% and created a finance function much more focused on generating insights that can inform day-to-day decision making, rather than simply reporting.

In another case, we helped a mid-sized insurer in the Netherlands, focused on mobility solutions, to achieve 10-20% cost saving from its mid- and back-office operations by digitalising key process steps. We also provided a dashboard for the commercial function, highlighting product, claim, and client insights in a single view, which helped drive further growth. A top-down peer comparison, along with a detailed bottom-up analysis of its activities, also identified further potential cost savings of 10% in addition to the initial reductions.

Commissions

As set out in our deep dive article on Distribution and Growth, we identify six imperatives that insurers should address to ensure their propositions, value exchange and project execution combine to optimize distribution.

They should reassess their propositions to get the experience right (physical and digital) and strengthen their ties with ecosystem and embedded finance partners to enrich data assets and open new channels to the client. They need to optimize their value exchange with distribution partners by setting competitive commission structures for each channel and build mutually beneficial relationships that are organized around the constraints of different distribution partners. Finally, effective execution depends on achieving a step change in sales productivity using data analytics to target areas for improvement and getting the change management right by designing a program that uses formal and informal means to implement the transformation smoothly and effectively.

Claims

There are three areas of focus in addressing claims-related costs – prevention, detection and resolution. To address prevention, for example, South African health insurer Discovery, through its Vitality platform, has developed a service-focused approach that incentivizes clients to follow personal health plans and track progress toward their goals. This strategy rewards clients for taking proactive steps to improve their health, which will lead to fewer claims.

Automation and digitalization can streamline the claims handling process from end to end. Several innovations are taking hold including Metromile’s digital-first notification of loss solution, which illustrates what improved detection can look like. Clients can use its REPORT function to file claims digitally and upload pictures and information to support their claim. REPORT tracks each claim and generates follow-up questions based on the client’s real-time responses. Similarly, MotionCloud uses AI image recognition and deep learning to automate claims handling, including a live video function to allow claims managers to inspect damage remotely and talk to the client.

At the resolution stage, non-life insurers can benefit from steps such as introducing preferred supplier networks to better control the cost of repairs and replacements. For life insurers, steps such as introducing active management of the “return to normal” process for clients that have suffered ill-health, and increasing data exchange with suppliers to get a better view of treatment costs, can bring big advantages.

Conclusion

Cost reduction is a sector-wide concern and is often undertaken only for the costs to creep back in over the succeeding years. Strategic cost transformation addresses this problem proactively and closes the loop by implementing structures and processes to stop costs creeping back in, so that the savings they realize can be redeployed to generate higher returns.

Our experience of working with life and non-life insurers on strategic cost transformation programs has helped us develop principles to address “cost creep”:

- 1Cost categorization – Insurers should categorize their costs in a way that makes clear the drivers that lead to them increasing. They should distinguish between “lights on”, “table stakes” and “differentiating activities” and monitor these against competitors. Operational teams must understand the way costs have been categorized and every cost category should have a dedicated “owner” who is accountable for its performance.

- 2Transparency – Full cost transparency is essential to aid understanding and embed cost awareness. Transparency allows insurers to establish direct and indirect cost ownership and accountability, and incorporate KPIs that link cost reduction measures to strategic objectives.

- 3Planning and control – The planning and funding process should be closely controlled. Business cases to support additional costs should incorporate evaluation criteria that link them to the differentiating capabilities the insurer wishes to invest in, or to the “lights on” and “table stakes” cost categories.

- 4The human element – Performance evaluations should be engineered to align individual incentives with the insurer’s overall strategic goals. Employees are the most expensive resource and therefore insurers should embed a cost-conscious culture reinforced with well-designed objectives and individual incentives that support strategic cost transformation objectives.

At every stage, it is critical to remember that the objective is not simply to reduce cost, but to do so sustainably. Success enables life and non-life insurers to maximize investment in the differentiating capabilities that will underpin their future profitability.