Exploring the future of payments and open banking: A visionary outlook

Our fourth edition of the Payments and Open Banking Survey, conducted across 11 countries, arrives at a pivotal moment of dramatic change within the European payments landscape. As digital wallets and challenger banks see massive adoption, non-traditional players are gaining considerable traction. In addition, the upcoming FiDA and PSD3 frameworks will open new possibilities for open finance.

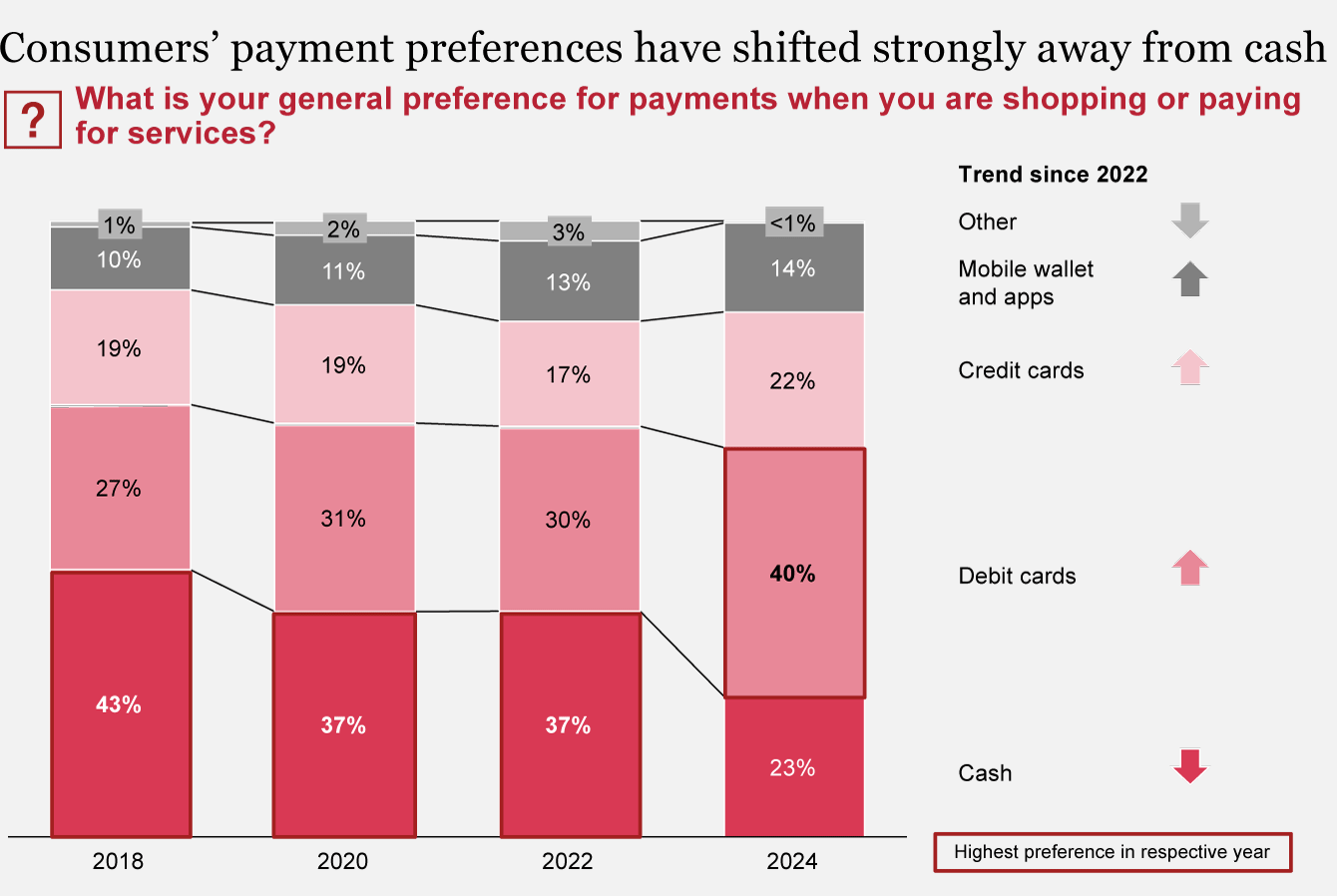

With consumers' preferences moving decisively away from cash, many are seeking an integrated financial view that facilitates the seamless management of bank accounts, cards, and pensions on a single platform. In the realm of open banking, there is a willingness to share data in exchange for benefits, with notable openness observed in Turkey, Spain, and the UK.

This report explores evolving consumer behaviors in payments, open banking, and broader banking trends, and provides four strategic areas to harness these emerging opportunities.

Strategic actions to harness changing trends

- 1Ensure competitiveness with non-bank offerings and wallets

- 2Leverage open banking data for personalized offerings that fit

- 3Capture the cash displacement potential and organize alternative access to cash

- 4Tailor approach to the specifics of individual markets

Mischa Koller, Ramon Papavlassopoulos and Carolin Eiting co-authored this report.