A challenging environment for SMEs

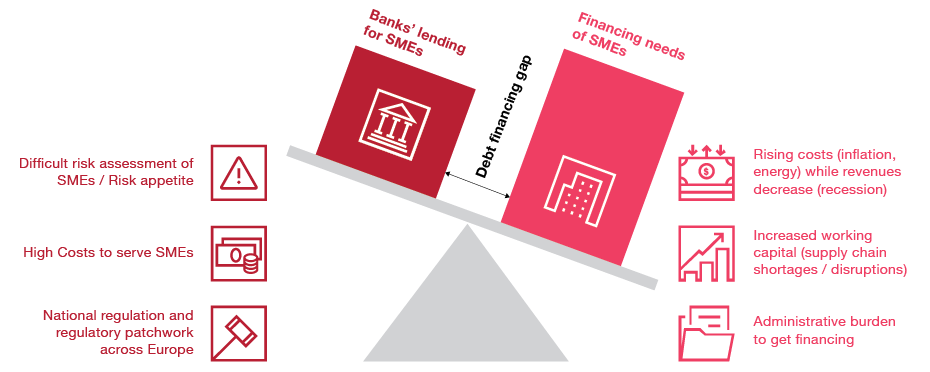

A wide variety of macroeconomic and microeconomic factors shape the financing landscape for small and medium-sized enterprises (SMEs), which constitutes the backbone of European economies. What is striking is that many of these factors are currently coalescing to make external sources of finance less accessible and affordable for SMEs.

Moreover, assessing SME risk is challenging for many banks due to asymmetric information. Therefore, lending to them is often commercially less attractive. Many SMEs also do not conform to the risk appetite of most banks. Moreover, the costs to serve SMEs are rather high, as they have similar fixed costs to larger clients but offer less revenue potential. Furthermore, regulatory requirements such as the Basel III & IV regulation, SREP (Supervisory Review and Evaluation Process) and TRIM (Targeted Review of Internal Models) are further limiting the availability of capital and thus loans, including to the SME segment. The patchwork regulatory picture across Europe is also making it more difficult for international financial product providers to operate across different jurisdictions.

Meanwhile, current economic circumstances are placing immense pressure on the financial stability of many SMEs. Rising inflation and high energy costs are constraining their budget. Shortages and disruptions in global supply chains have raised working capital requirements, as companies have had to increase their inventory to reduce uncertainty across their supply chain. Indeed, according to an Ifo survey, 73% of SMEs have increased their inventory since 2020, and at a higher cost too.1 The imminent recession is also adversely affecting revenue, driving down SMEs’ profit margin further. To compound matters, default rates are rising among SMEs’ customers, with a negative impact on realized revenues. Meanwhile, the evident increase in delayed customer payments lengthens the cash conversion cycle for SMEs.2

The combined impact of these factors has led to a situation in which SMEs require more financing. However, at the same time, the supply of financing from banks is becoming more restricted or too costly for them.

1 Ifo: German Industry Increases Warehousing (2022)

2 Intrum: European Payment Report, Country Snapshot Germany (2022)

According to recent Ifo research, approximately 30% of German SMEs seeking financing reported a limited supply of loans from banks.3 When we consider the heavy reliance of SMEs on bank financing, this is an alarming finding. It is all the more concerning when we take into account that the share of external financing emanating from bank loans in Europe is around 70%, compared to 40% in the United States.4 One in four SMEs in Europe now report severe difficulties in accessing finance, and others point to a liquidity squeeze.5 As a result, the issue of underfinancing has become a substantial concern for the wider economy.

3 Ifo: German Banks More Reluctant to Lend to Companies (2023)

4 Euler Hermes: European SMEs: Filling the Bank Financing Gap (2019)

5 EIB: Gap analysis for small and medium-sized enterprises financing in the European Union (2019)

The bank financing gap

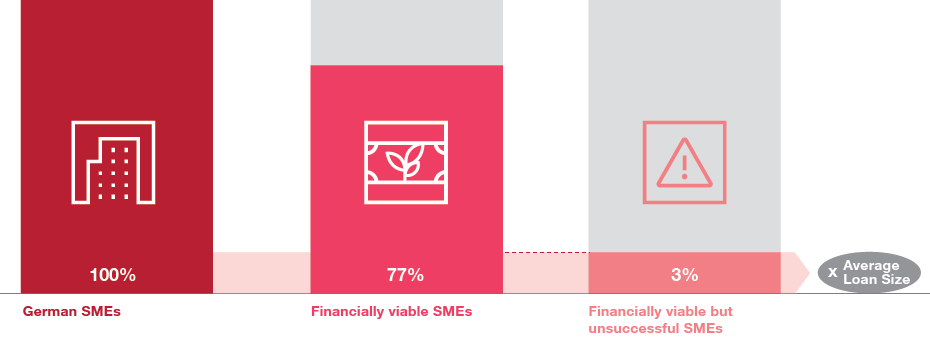

To understand and quantify the unmet financing needs of SMEs in more depth, we can calculate a bank financing gap. This refers to the amount of financing that is needed by SMEs but cannot be covered through bank loans.

Following the methodology used by the European Investment Bank (EIB), and using the latest available SAFE data (from 2022), we have calculated a bank financing gap in Germany of approximately €15 billion6 7 We derive this figure by determining the proportion of SMEs that can be deemed viable for financing because they reported stable or growing revenue (~77%), but were nevertheless unsuccessful in obtaining financing (~3%). We apply an average loan size of approximately €190,000 to produce the financing gap.

6 EIB: Gap analysis for small and medium-sized enterprises financing in the European Union (2019)

7 ECB: Survey on access to finance of enterprises (SAFE)

It is worth noting that the observed financing gap has been narrowing in recent years (the EIB identified a gap of approximately €20 billion in 2018). However, it still remains significant. In fact, the implied conclusion of improved financing conditions for SMEs might well be misleading. The proportion of financially viable SMEs has fallen, as the COVID-19 pandemic has had a long-lasting, detrimental impact on their revenue, financial position and future expectations. Meanwhile, more recent macroeconomic and geopolitical developments have continued to cast a dark shadow on SME prospects.

Indeed, the decrease in the number of viable SMEs is the main factor in the recent reduction of the financing gap. By examining available market data regarding SMEs’ profitability levels in Germany, a comparable share of financially viable SMEs can be observed in past years. Approximately 80% of SMEs experienced positive earnings before interest and tax (EBIT) during the period 2020/2021, very much in line with the finding from the EIB measure that focuses on turnover development.

However, other parameters considered in the calculation did stay stable over time. These factors include structural variables, such as the importance of bank loans and the success rate in obtaining them, and act as strong indicators of a shortfall in SME financing.

The methodology employed to assess the bank financing gap is not an exact science, but rather a starting point to gauge the magnitude of unserved SME financing needs. Many reasons contribute to the bank financing gap. They include the factors driven by banks as outlined above, but also those emanating from the SME side, such as a reluctance to accept bank conditions or an inability to fulfill banks’ eligibility criteria.

Aside from bank loans, other traditional financing instruments (shadow banking, revolving credit, pre-financing, and traditional factoring) pose similar challenges for SMEs. They are typically characterized by complex and lengthy processes, high costs and unfavorable payout periods. High costs ensue, as SME risk assessment is onerous for traditional financing instrument providers (due to a high level of information asymmetry), leading to an overall high cost to serve. Moreover, traditional instruments offer limited flexibility and are generally characterized by a low level of digitalization, thus requiring manual processes for closing.

To sum up, many financing sources, even when available, are prohibitively costly or involve an excessive administrative burden. As a result, they are unfeasible for SMEs to obtain and for banks to provide. Therefore, many traditional instruments are poorly equipped to satisfy SME financing needs and close the bank financing gap.

The extent of the bank financing gap highlights the need to find solutions that can reduce or even prevent the adverse financial situation of SMEs that we have outlined. SMEs are in dire need of digital, low-hurdle and cost-efficient financing.

Providing market-driven solutions for SME financing

The current environment, although challenging for SMEs, presents a major business opportunity for those able to offer innovative solutions. Embedded finance has emerged as one compelling response to underfinancing, confronting pain points for both banks and SMEs.

In general, embedded finance refers to the integration of financial services and products by a non-financial provider into its own customer journey or platform. Services can include a multitude of financial products, from lending and insurance to deposits. In the business-to-business area, meanwhile, those financial services can be integrated into platforms of non-financial providers, such as enterprise resource planning (ERP) systems, or accounting software and e-procurement systems. These services can build a seamless customer journey at the point of need, and also generate opportunities as businesses interact and acquire financial products while conducting their everyday non-financial activities. As the customer journey is jointly created by players in financial services and those outside it, the integration is referred to as embedded.

Embedded finance can be beneficial for both SMEs and finance providers. For SMEs, it helps greatly to simplify processes, certainly in comparison with traditional financing instruments that are beset by lengthy processes and high costs. This is because the acquisition of financial products is embedded into non-financial journeys, such as inventory management, auditing of accounts receivables and payables, or procurement operations.

For financing providers, embedded finance helps to reduce risks by minimizing information asymmetry. An array of available data from the platforms in which the service is integrated (such as past transaction data, payment history, or the metadata of interaction) can be used in real time beyond the data typically available to banks, such as balance sheets. As a result, information asymmetry and the cost of risk assessment can both be reduced, making it easier for financing providers to serve SMEs.

Embedded factoring and embedded trade credit insurance (TCI) are two interesting use cases that illustrate how embedded finance can help to bridge the financing gap for SMEs, while tackling two very current pain points – the rise in both default rates and working capital requirements. These use cases can reduce the risk for the financing provider and serve to resolve the bank financing gap.

Embedded factoring enables SMEs to gain swift access to liquidity from their receivables, with a service fee deducted from the invoice value. From the perspective of the financial service provider, the integration of the factoring solution into, for example, ERP software or invoicing systems, facilitates a high degree of automation, optimized costs, and risk analysis through a large amount of available and relevant data. This system is to replace traditional bank-led liquidity management and empower SMEs to manage their finances independently and within a seamless journey. Companies can factor single invoices or debtor exposures with just one click, and short-term factoring decisions and payouts are possible. For financiers, this means that they can make decisions on specific and more granular deals and invoices, instead of only according to the aggregate risk level of a whole company.

Embedded TCI provides insurance for single invoices, or a portfolio of invoices, with just one click, and enables invoices to be insured at the point of the transaction. With the high level of automation and digitalization the efficiency and speed of the process can be enhanced. It can also be integrated into a factoring platform to boost the appeal of trade receivables as risk is again reduced.

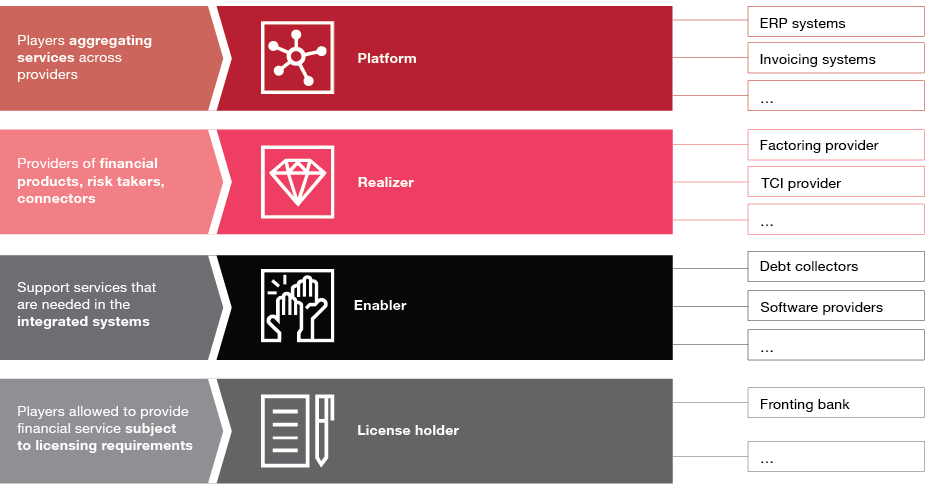

Four types of players inhabit the embedded finance ecosystem: platforms, realizers, enablers and license holders. Other than in traditional banking, where an integrated license holder manages the whole process from the financial, regulatory and technical operations through to direct interaction with the customer, each of the players in the embedded finance ecosystem plays a specific role in the ecosystem, typically combined to create a comprehensive solution for the final customer. However, depending on its service offering, a single company can also cover the services of more than one player.

In conclusion, the embedded finance ecosystem is a dynamic and interdependent set-up that relies on the cooperation of enablers, realizers and platforms to achieve success. The interplay between these three types of players creates a comprehensive solution for the end customer, ensuring that their needs are met and that their experience is positive.

Way forward for banks

Embedded finance offers tremendous potential for traditional banks to utilize and refine their existing core capabilities, and provide a more comprehensive solution for their customers. This is essential if they wish to keep pace with recent market trends and maintain their position in the competitive landscape.

Banks can make use of their existing infrastructure to offer a contextual, seamless, more personalized and relevant customer experience that meets the needs of underserved or unserved segments. In this way, they can gain a competitive edge by expanding their customer base and revenue through developing new segments, while also reducing the cost to serve (through improved availability and data) and cutting risk. They can achieve these objectives by assuming the role of a license holder and realizer in the embedded finance ecosystem.

To achieve this growth, incumbents need to emphasize different aspects:

- Market positioning/ target customer segment: Organizations should decide on a clear positioning, committing to an identity in the market and choosing where to play. These are critical steps to avoid the cannibalization of existing revenue streams. Banks should focus on vertical segments that offer potential and align with their core competencies. With a clear target segment in mind, the customer experience needs to be aimed at the relevant users. Gaining access to the relevant client base and respective assets, in close collaboration with the platform partner, should therefore be a priority.

- Go-to-market/ partner selection: The transformation towards digitally embedded distribution channels is having a profound impact on the relationship between customers and traditional banks. As a consequence, banks need to define a clear go-to-market strategy. This may involve a land-and-expand approach, or targeting specific market niches and selecting strategic partners with access to targeted clients, to become or remain competitive and relevant in the market. To realize sustainable growth, joint operations with the partner need to be scalable and robust. Moreover, partners should be trained in the scaling and sales of solutions, as they typically lack experience in financial services.

- Monetization and growth strategy: To support scaling, banks need to develop a profit participation scheme for stakeholders and selected partners. This would ensure that incentives for scaling solutions are aligned, while also distributing risk among stakeholders.

- Technological requirements: Banks should exploit their capabilities and rethink their core competencies. Convenient and interoperable products (i.e., APIs) are crucial for banks in enabling seamless integration with third-party systems and helping customers to access their products. For the minimum viable product (MVP), the scope needs to be kept flexible to ensure timely product-market validation. Banks should also provide support to partners to make the most of the collaboration.

- Risk: As banks move into new markets and offer new products, ensuring proper risk management in the remodeled value chain is critical. The combination of financial products at the point of sale can lead to an increase in shared interest, which needs to be reflected in how risk is managed. Moreover, orchestrating risks in the remodeled value chain demands a clear allocation of responsibilities between partners, while incumbents need to have the capacity to accept certain risks on to the balance sheet.

Conclusion: Realizing the embedded finance opportunity

In summary, embedded finance presents a significant opportunity for traditional banks to gain a competitive edge over rivals and offer a more comprehensive solution for their customers. By using their existing infrastructure and existing capabilities, banks can expand their revenue streams, while reducing the cost to serve and cutting risk. Embracing the embedded finance ecosystem requires a commitment to adapt and rethink core competencies. However, the potential benefits for banks and their customers that would flow from such an exercise are substantial.

Ultimately, embedded finance is a way for traditional banks to close the financing gap for SMEs and provide a more personalized and relevant customer experience. This opportunity is clearly highlighted by the specific use case in the B2B factoring market.