For many retailers, trying to get value from collected data still feels like a quest for the holy grail. There are some companies, however, such as Albertsons and LIDL, that are moving ahead of their peers. So, what differentiates those frontrunners from others? To start, they’ve heavily invested in customer data. For example, their loyalty programs and apps, in which almost half of their customers are enrolled, provide seamless omnichannel shopping experiences that allow them to gain customer insights. In turn, they can offer more personalized deals, subsequently increasing wallet share and frequency of purchases.

Some companies are going even farther with customer data. Walmart, for instance, turned its data into a monetizable product by selling customer insights to suppliers. The platform “Walmart Luminate” provides both channel performance and shopper behavior insights to help Walmart and its suppliers make better decisions.

Our belief is that, with a proper customer data strategy, all kinds of retailers can unlock their own value-generating use cases — ranging from customer-facing solutions to internal optimization. Of course, this strategy takes a well thought-through approach, commitment, and investment, but over time, it can both drive revenues directly by capturing a greater share of customers’ wallets and be monetized across the entire value chain, including with external suppliers — essential gains retailers do not want to miss out on. On the other hand, if retailers do not focus on recognizing the strategic value of their customer data, they’ll not only sacrifice revenue, but also lose customers as they flock to the competition and become locked into their respective programs. In the long run, the longer retailers wait to set up customer engagement programs, the higher the acquisition costs down the road and the more significant the gap in learning curves to their competitors. Convinced, but not sure how to start?

In this article, we will look at common types of customer data, trending data use cases for retailers, as well as the typical range of benefits that retailers can expect by introducing these use cases. We will also show you crucial steps to take now to build the right digital capabilities and capture this value in the future.

Common types of customer data

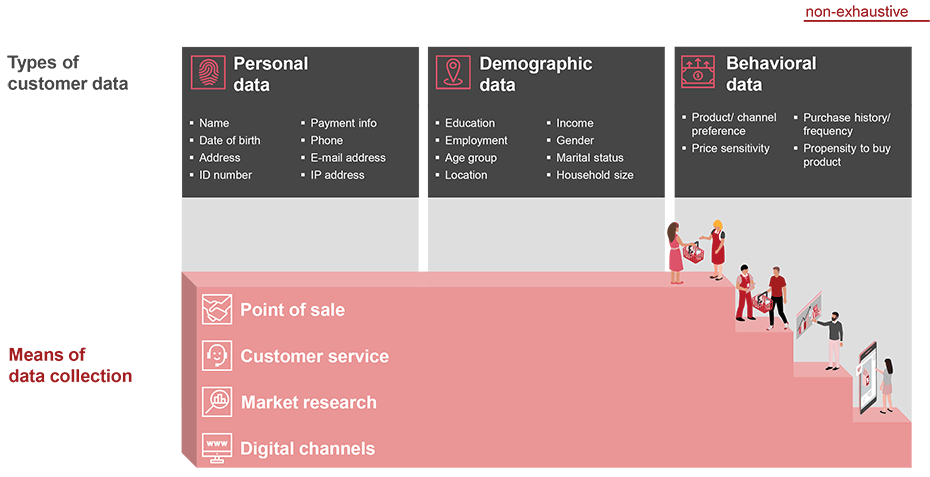

Before deep diving into capturing value from data, we must first establish a common understanding and nomenclature of what we mean by customer data. Nowadays, these data come in different forms and can be collected across a range of touchpoints. In the context of this article, we differentiate between three major types of customer data.

- 1Personal data: Information directly connected to an identifiable individual. For instance, this data could include a name, date of birth, address, or any type of payment information.

- 2Demographic data: Any available information on socioeconomic factors such as the education, age group, or income.

- 3Behavioral data: Traceable actions (e.g., product or channel preferences, purchase history, or the propensity to buy and willingness to pay for a product) and provides insights into how customers potentially buy products.

Common types of data storage

Once data is collected across physical and digital channels, it needs to be stored in databases and, ideally, linked to existing customer accounts. There are various well-established methods to appropriately store, clean, combine, and analyze data and create single customer profiles, including customer relationship management (CRM) tools and customer data platforms (CDP).

Customer data use cases

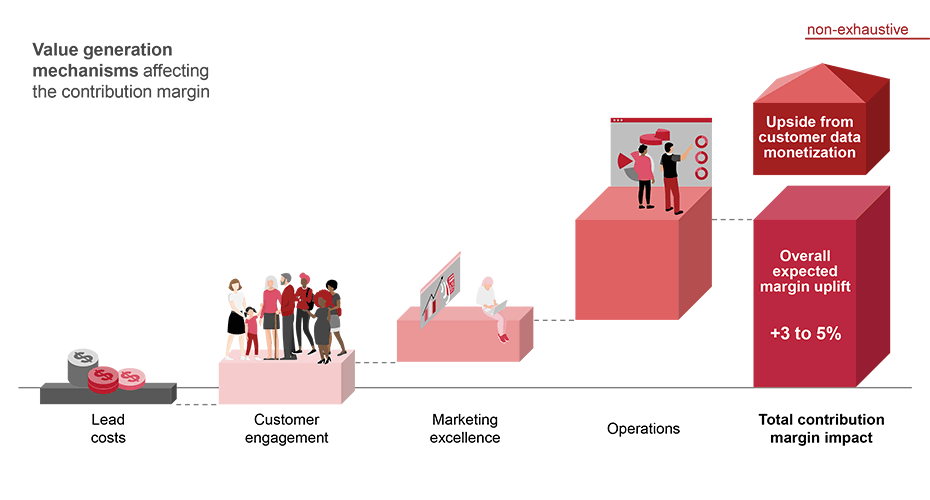

In our experience, retailers that invest in customer data and implement use cases can expect a 3%-5% increase in contribution margin after reductions for initial investments and acquisition costs. To better understand the kinds of use cases retailers could consider, and the benefits that come along with implementing them, let’s examine three of the most common categories.

Customer engagement

Retailers can use collected data to segment customers into different groups, for instance, based on demographics and behavior (such as preferences). This segmentation then allows to create more targeted offerings and personalized experiences, often resulting in improved customer engagement. In addition, this use case also entails the creation and management of loyalty programs that reward customers for their purchases and encourage repeat business. From our experience working with several retailers, a well-designed loyalty program can be a differentiating vehicle to track and understand customer behavior. Once a program like this gets started, it can become a self-enforcing use case, as the data collected is leveraged to continuously enrich and improve an existing program.

Associated benefits: Retailers can generate revenue through customer segmentation and engagement by capturing higher shares of existing customers’ wallets and attracting new customers. We estimate that this use case has an impact of 10%-20% of the overall attainable margin uplifts from the use of customer data. To name a few KPIs, ROI-driving changes should be expected in cost per acquisition, customer retention rate, and customer lifetime value from higher basket sizes and shopping frequency.

Marketing excellence

Reaching out to (potential) customers, retailers can use data to create targeted marketing campaigns with high relevancy based on individuals’ preferences and purchase history (i.e., behavioral data insights). In this use case, retailers can opt to launch their own omnichannel campaigns or use the insights to create commission-based profits from partner advertising. Commonly referred to as “retail media,” this allows suppliers to place branded content across retailers’ channels (e.g., product sponsorships and collaborations in physical stores, branded content and advertising in apps, newsletters, and other ecommerce channels). In recent years, this play has become very popular. A higher marketing efficiency can also be achieved by shifting advertising expenses away from the traditional “spray and pray” approach of printed media (i.e., classic leaflets distribution) to more targeted digital channels.

Associated benefits: More targeted marketing campaigns can lead to reduced costs (i.e., improved ROI and ROAS). Partner ads on retailers’ own channels also generate revenues. Retailers can expect a share of 20-30% of the overall possible margin uplift.

Operations

To further increase the quality of customer data usage, it is critical that retailers take a holistic view on leveraging the data. This means looking for opportunities to apply insights along the entire value chain, from procurement and assortment to value-adding services. Examples include:

- Assortment and inventory: Retailers can use behavioral data to forecast demand for certain products and optimize inventory levels to avoid stockouts or overstocking.

- Price optimization: Optimal pricing strategies for different products can be determined based on demographic and behavioral data (e.g., location, customer demand, willingness to pay).

- Cross-selling and upselling: Demographic and behavioral data can support more targeted basket suggestions for additional products or higher-value alternatives.

- Customer service: Personal, demographic, and behavioral data can be used to provide more personalized customer service, such as offering tailored recommendations and resolving issues more efficiently.

Importantly, retailers should use data collected in different parts of the enterprise to break organizational silos, collaborate across units, and align initiatives strategically. For instance, combining data from the customer domain with assortment data can help improve category management and listing.

Associated benefits: Using customer data in operational areas promises the largest revenue uplift potential. This use case can help increase basket sizes through cross-selling, upselling, and optimized pricing and promotion. It can also yield cost reductions through improved shelf-planning and logistics. If done correctly, this can drive up to 50%-60% of the overall attainable margin uplifts from using customer data.

In addition to the use cases outlined above, retailers can realize measurable upside from consistently monetizing their customer data, for instance by sharing anonymized access to insights and dashboards with suppliers (see Walmart’s Luminate). This is particularly relevant as suppliers — typically not involved at the point of sales — often have little insights into their customer base. Eventually, retailers could provide and orchestrate a data marketplace among interested public and private stakeholders — a concept not uncommon in other industries (e.g., the public sector, transport, and automotive: Mobility Data Space).

By and large, the outlined benefits materialize over mid- to long-term timeframes. Retailers often see breakeven points around 2-3 years, with full recurring effects after 5-7 years. The graphic below shows how margin improvements typically stack up across the previously introduced use case categories.

Building sound foundations

Admittedly, launching a customer data strategy, retailers will have to take a leap of faith — requiring some upfront investments and lead costs to establish the right personnel, operational systems, and infrastructure. Typically, that investment will be in the range of 10%-20% of the margin uplifts realized down the road. So, as a retailer, to start capturing benefits from customer data, you should build a data strategy that drives real business value. How?

- 1Identify your way-to-play. For example: What are our business goals? Why do you want to act? Then, prioritize the best use cases with persuasive customer value propositions.

- 2Ensure top management and company stakeholder buy-in, with a strong tone from the top. Ask yourself: Why is this a priority? Why do we need to invest?

- 3Align your data acquisition strategy across the organization and get your technology in place (i.e., infrastructure, apps, compliance and security measures). Questions to consider: What do we need to collect? Do we need to acquire external data? Which analytic capabilities do we need?

- 4Leverage marketing power and find the right story. In other words, why should customers share their data? What’s in it for them?t

- 5Build a data-driven mindset across the company and provide upskilling where needed. This may involve an update of your data organization including governance, CDO appointment, and analytics and AI labs.

Eileen Dahlen, Clarissa Knorr, and Natalie Sophie Jehle also contributed to this article.