Heading into 2026, fashion retailers face a compressed window to operationalize what 2025 made clear: Winners will build trusted product data and transparency (Digital Product Passport readiness), faster and more resilient sourcing models (nearshoring and micro-manufacturing), and AI-native shopping journeys (agentic commerce), while sharpening their smart-value equation to protect margins and sustain growth.

What happened to last year’s trends?

At the beginning of 2025, we set out four trends poised to shape the fashion retail industry. So how did they evolve over that year?

-

Trend #1 – Revolutionizing the customer journey

The shift towards hyper-personalized shopping experiences remained very relevant in 2025 – retailers increasingly used AI to find the right customers for their products and to tailor every touchpoint (not just product recommendations). Young consumers (esp. Gen Z) are pushing for even more individualistic, bespoke experiences, forcing brands to elevate personalization from nice-to-have to core capability.

-

Trend #2 – Re-innovating business models from tele- to modern livestream shopping

In 2025, livestream shopping matured – shifting from hype to disciplined, category-focused execution. We expect it to remain relevant next year as retailers use TikTok Shop, Amazon Live, Walmart Creator, Whatnot and eBay Live for drops, auctions, and clearance – especially in beauty, streetwear, and resale.

-

Trend #3 – Integrating new technology in fashion

The market for e-textiles and smart garments continues to grow (~30% CAGR over the next decade1). However, while potential and innovation are high, real-world adoption outside sports/technical apparel remains selective. This trend is therefore still in its early phase.

-

Trend #4 – Regulatory priorities and trade compliance

This trend is more relevant than ever, as escalating tariff regimes, tightening import/export rules and the new EU requirement for Digital Product Passports in 2027 are forcing fashion brands to elevate trade compliance from a back-office cost to a strategic capability (see our first trend for 2026).

2025 solidified AI-led personalization, matured livestream shopping, tempered smart-textile adoption, and heightened compliance. Creating data, operational discipline, and trust represented areas of challenge and opportunity in pursuing last year’s trends, and this will remain the case for the following key trends we anticipate shaping 2026.

Be the one who…

Click boxes to read

Proactively integrate Digital Product Passports (DPPs) to meet upcoming EU requirements, build consumer trust, and unlock new customer touchpoints.

Digital Product Passports (DPPs) are set to transform fashion retail, moving from a regulatory checkbox to strategic advantage. As the EU Ecodesign for Sustainable Products Regulation (ESPR) will make Digital Product Passports mandatory by 20272 for categories such as clothing, footwear and accessories, the countdown for businesses to prepare has begun. Early adopters of DPPs are poised to set industry standards, enhance transparency, and build lasting consumer trust.

Currently, only 1% of clothing is recycled3, and nearly 40% of Millennials and Gen Z say they are not given the information needed about where, by whom, and how their fashion items are made4. DPPs address this gap by offering verified, product-level data on provenance and sustainability. Notably, nearly half of consumers (49%) show a higher intent to purchase for fashion items when product origin and materials are verifiable through a Digital Product Passport, according to our survey of 2,000 consumers in Germany and Austria we conducted with Appinio5.

This also translates into monetization potential: 74% of consumers surveyed are willing to pay a price premium for fully traceable and sustainability-verified fashion items, including 26% willing to accept a premium of up to 20%. DPPs are no longer a concept of the future but are already being implemented at scale by leading brands, for example through initiatives like the Aura Blockchain Consortium. Led by LVMH, Prada, and Cartier, the consortium has already registered over 70 million fashion items with digital passports6. The perceived value of Digital Product Passports, however, extends beyond luxury: our survey respondents see the greatest relevance for everyday categories such as jeans/trousers (40%) and footwear (39%), rather than luxury items (27%)7.

Beyond transparency, Digital Product Passports offer additional opportunities for retailers by creating new touchpoints for engagement across the whole customer journey. While most retailers are not yet fully equipped for large-scale DPP implementation, the window to secure a first-mover advantage is rapidly closing.

To stay ahead of regulatory changes and rising customer expectations, fashion retailers should:

- Build digital infrastructure and data governance to manage product traceability information end-to-end and ensure interoperability with partners

- Collaborate with suppliers, recyclers, and tech providers to align data standards and streamline implementation

- Redesign customer touchpoints by integrating DPP access points (QR/NFC) into physical stores and online platforms

- Upskill staff on compliance, tech, and consumer communication to make DPPs part of the customer journey

- Leverage DPP data to create value-added services (e.g., authenticated resale, repair, recycling) and to unlock related use cases (e.g., supply chain efficiency)

With regulatory requirements looming, DPP readiness is no longer optional – retailers must act now to be compliant by 2027 and build lasting consumer trust.

Integrate agentic shopping capabilities to meet rising consumer expectations, capture (high-intent) traffic from AI-driven channels, and stay ahead in a rapidly-shifting digital commerce landscape.

Agentic shopping will move from a nice-to-have to a strategic must for fashion retailers in 2026. Consumer uptake is already taking shape: 25% of survey respondents in Germany and Austria say they are likely or very likely to buy fashion directly through an AI assistant8. At the same time trust continues to build, with 26% of consumers convinced that an agentic shopping assistant can match their personal style9.

In addition, our survey shows that AI agents will be adopted first for shoes, denim and trousers, sportswear, outerwear, and basic items10. Within those categories we expect conventional shopping, i.e., human purchase decisions driven by marketing experiences and branded imagery, to become less important – while AI agents will more frequently take rational purchase decisions based on available product data.

Retailers optimizing product data for AI discovery are already seeing measurable benefits. According to Adobe Analytics, visitors arriving via generative AI tools spend 32% more time on-site, view 10% more pages, and exhibit a 27% lower bounce rate compared to average shoppers11.

Moreover, personalized AI-powered recommendations increase consumers’ average order value by 26%12. For example, Zalando’s deployment of an AI-powered fashion assistant across 25 markets in 2024 led to a more than 20% increase in product clicks and a 40% surge in wish list additions13.

- Establish a generative AI strategy that aligns product data, customer experience, and brand visibility across agentic platforms, supported by AI governance that is embedded in the retail organization

- Build a modular commerce infrastructure as a backbone to allow autonomous agents to interface with retail systems, enabling agentic shopping through system interoperability and secure data exchange (e.g., integrate product data and checkout APIs into platforms)

- Mobilize cross-functional teams to pilot agentic use cases, upskill talent and incentivize the continuous development of agentic shopping capabilities

- Implement a responsible and ethical AI framework, including regular audits and behavioral testing, to ensure agents operate within defined boundaries and avoid unintended actions

- Engineer AI agents to align with the business strategy, e.g., prioritizing own-brand products, managing promotional hierarchies, or tailoring recommendations to strategic categories

As consumers in Germany and Austria increasingly adopt agentic shopping, customer journeys designed purely around emotional decision-making will become less important compared to agent-driven decision journeys. Hence, now is the time to invest in agentic shopping capabilities.

Leverage nearshoring and local micro-manufacturing to accelerate agility, cut customs frictions and enhance brand perception.

Recent shifts in U.S. trade policy, escalating geopolitical tensions, and supply chain flexibility are the top challenges in the operations of today’s organizations14. As made-to-order production and shorter production cycles gain traction, wage inflation in traditional offshore hubs – illustrated by Bangladesh’s recent 56% minimum wage hike15 – heightens the relevance of local manufacturing. In response, leading fashion retailers are increasingly pivoting toward a Fabric-to-Consumer (F2C) model, emphasizing proximity sourcing within EMEA markets. For instance, Inditex now sources over half its product volume from nearby regions such as Spain, Portugal, Morocco, and Türkiye16.

Strategic nearshoring supports direct deliveries to consumers and faster product availability, while simultaneously reducing transportation costs and emissions. By minimizing time zone and cultural barriers, retailers benefit from stronger communication and enhanced quality control. Furthermore, reliance on distant suppliers is reduced, which not only bolsters resilience against geopolitical disruptions and tariffs, but also streamlines regulatory compliance (e.g., as required by the ESPR) through greater transparency in local networks. Notably, this transition offers brands a reputational advantage, as >80% of consumers in our survey are willing to pay a premium for products manufactured in Europe17.

To harness this opportunity, here are our key recommendations for fashion retailers:

- Set explicit nearshore targets by category to rebalance the sourcing portfolio

- Build and tier an EMEA vendor base, e.g., with strategic anchors in Türkiye, Portugal, Spain, Morocco, and Tunisia, as well as knitwear hubs in Italy or Portugal

- Identify opportunities to cut out warehousing and establish direct deliveries

- Pilot micro manufacturing for selected use cases, e.g., establish urban or regional “micro factory” cells for on demand personalization, capsule drops, and rapid replenishment of top sellers

- Actively steer tariffs and optimize regional supply chains for additional resilience in volatile markets

Taking these steps will position fashion retailers at the forefront when it comes to supply chain resilience – rather leading than lagging behind in tackling logistics pain points and tariff challenges.

Win value-driven consumers by shifting from price competition to a smart value equation that balances price, trend relevance, and quality.

Pure price competition is no longer a winning strategy in fashion – value, not price, has become an increasingly important purchase driver, fueled by inflation, economic uncertainty, and the widespread availability of comparison tools. Delivering “smart value” – the right calibration of price, trend relevance and quality – has thus become essential for fashion retailers. Notably, frequent offers and discounts (51%), trend-relevant assortments (42%), and assurance of quality (41%) are the top motivators for repeat purchases from the same brand3. However, the right blend is not uniform – it depends strongly on brand positioning, requiring fashion retailers to calibrate their smart value equation accordingly.

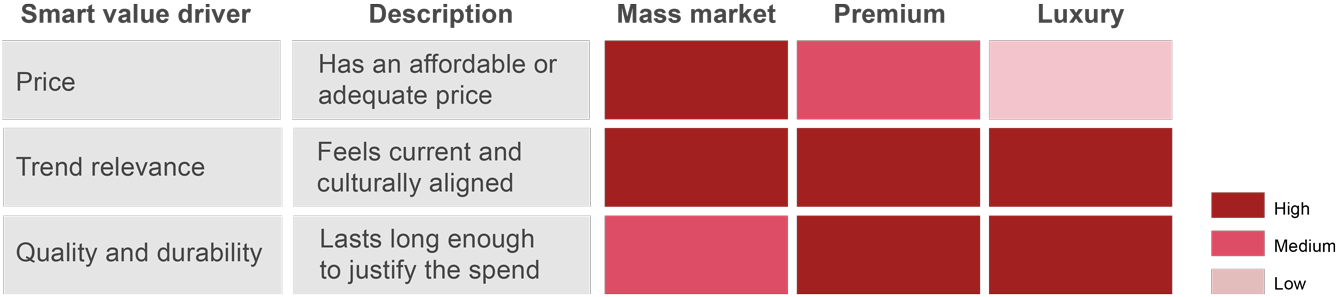

For mass market brands, price and trend relevance remain the primary considerations, with quality and durability serving as important but secondary factors. In contrast, premium and luxury brands must prioritize trend relevance and quality, as their customers are less price-sensitive and more focused on exclusivity and lasting value.

Across all income segments, consumers actively evaluate the trade-off between price, trend relevance, and quality and adjust their purchase behavior accordingly. This results in increased use of outlet and off-price channels as a way to optimize this trade-off: 56% of consumers in our sample have increased their purchases of discounted fashion in the past 12 months, with 22% reporting a substantial increase in off-price purchases18. In addition, one in three customers considers the resale potential of fashion items, especially in premium and luxury segments19, demonstrating that smart value is not just about the initial purchase but considered over the whole lifetime of a fashion item.

To capitalize on the shift towards value-driven purchasing, these are our recommendations for retailers:

- Define your right to win in smart value: Pinpoint the optimal smart value equation for your positioning (mass market, premium, luxury) and identify how your brand can deliver it more credibly than competitors

- Regardless of positioning, increase trend responsiveness through faster interpretation and execution of trends to reduce inventory risk and lower reliance on markdowns (e.g., enabled by local micro-manufacturing, see trend #3)

- As a premium or luxury brand/retailer, focus on ensuring brand credibility and exceptional quality that maximizes the lifetime value of products

- As a mass market brand/retailer, leverage off-price channels strategically using dynamic inventory and pricing tools to efficiently redirect unsold goods

Translate smart value into action by aligning pricing, product design, and channels around what your customers truly value in 2026 – as rising expectations leave no room for miscalibration.

New year, new trends? - In a nutshell

Be the one who… leads in traceable and transparent fashion. Retailers should proactively integrate Digital Product Passports (DPPs) to meet new EU regulations in 2027 and build consumer trust by building an end-to-end traceability infrastructure, integrating DPP access points into customer touchpoints, driving collaboration across the value chain, and leveraging DPP data for circular services.

Be the one who… harnesses the next era of shopping through agentic commerce. Retailers should leverage AI-driven shopping to capture (new) demand and future-proof their business. They should establish a generative AI strategy, build a modular commerce infrastructure, mobilize cross-functional teams, and introduce agentic commerce capabilities.

Be the one who… boosts supply chain resilience through strategic nearshoring. Retailers should leverage nearshoring and micro-manufacturing to protect themselves against tariffs, boost agility and increase speed-to-market by setting category nearshore targets, building a tiered EMEA vendor base, piloting micro-factories, and enabling direct deliveries.

Be the one who… masters the smart value equation. Retailers should define a position-adjusted smart value equation: Identify the ideal calibration of price, quality and trend responsiveness, and translate it into a credible, differentiated offering versus competitors.