Accelerating eMobility with innovative powertrain and BEV progress

The landscape of eMobility is evolving, driven by innovations that address current challenges and improve economic viability. Powertrain advancements are central to this transformation, with battery electric vehicles (BEVs) at the forefront. Multi-energy platforms and plug-in hybrid vehicles (PHEVs) are becoming more important. However, battery electric vehicle (BEV) platforms are still vital as they can meet a wide range of customer needs.

Key innovations in energy density, powertrain efficiency, and charging speed are making eMobility more convenient. Battery cells continue to be the primary cost drivers for electric powertrains, heavily influenced by raw material prices. However, existing production capacities are helping lower market prices across suppliers and chemistries.

Today, most segments achieve total cost of ownership parity, and experts expect powertrain cost parity by 2030. As innovation speeds stabilize, experts anticipate that the residual values of used BEVs will become more consistent. Short- and mid-term forecasts predict that the demand for BEVs will be about 20% by 2025. Long-term expectations may reach 60% by 2035. This growth will result in an estimated battery demand of 5 TWh.

In Europe, the successful transition to BEVs will require ongoing performance improvements within short innovation cycles and enhanced commercial competitiveness, supported by local and independent battery cell production. The focus remains on achieving transformation through strategic advancements in powertrain technology and eMobility solutions.

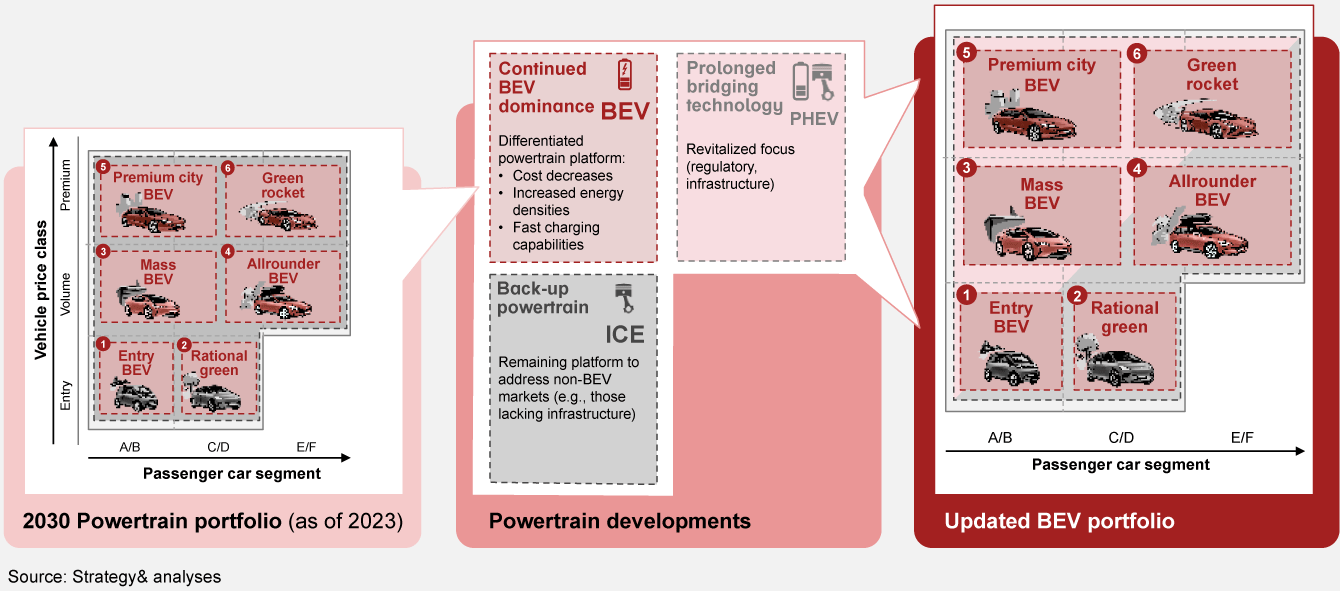

The evolution of the powertrain portfolio

We expect a stable powertrain portfolio by 2030, dominated by BEVs, while PHEVs are revitalized as a bridging technology.

Differentiated BEV platforms will be the core of the future powertrain portfolio, with a further increase in charging speeds.

Over recent years, energy efficiency has improved by 5-10% across vehicle segments. In the coming years, we anticipate increased efforts to further reduce energy consumption by 10-15%.

To avoid the high costs of bigger battery packs, we expect the industry to focus on better powertrain efficiency. With advancements in charging technologies, BEVs will get much closer to ICE refueling speeds, achieving a 400 km recharged range in 10 minutes by 2030.

Battery cells are likely to remain the key cost driver for electric powertrains. While product costs are primarily driven by battery and cell costs, components are heavily affected by the value chain and market ramp-up.

Optimizing operations costs and market diffusion in eMobility

The eMobility landscape is poised for change with total cost of ownership (TCO) parity across vehicle segments expected by 2025 and powertrain cost parity by 2030. Lower EV powertrain costs are key to making battery electric vehicles (BEVs) a compelling alternative to internal combustion engines (ICEs).

By 2035, the share of BEVs in the global vehicle market is expected to reach 60%, with battery demand growing nearly fivefold from 2025 to 2030, reaching 5.0 TWh. This growth is driven by increased adoption, with battery capacities stabilizing from 2030 onwards.

Global battery demand

Battery demand in GWh

The European Union and China will lead in adopting battery electric vehicles. This is due to new rules, better charging stations, and stronger economic factors. In the United States, BEV adoption will accelerate around 2030.

Regional BEV diffusion

Europe

United States

China

Despite challenges, transformative growth continues. Global ePowertrain revenue will more than double in the next five years, reaching over €600 billion each year.

Strategic recommendations for the European automotive industry

China's dominance in the battery value chain presents a dependency challenge for both the EU and the USA. For the European OEMs, maintaining flexibility, momentum, and scale is crucial. It is imperative for the EU to reclaim its leadership in innovation and operational strength within the eMobility sector.

Jan-Hendrik Bomke, Dr. Patrick Treichel, Sarah Wennemar, Dr. Luca Tendera and Steven van Arsdale also contributed to this report.