Chief Sustainability Officers have gained prominence in recent years

The role of the Chief Sustainability Officer (CSO) is evolving rapidly in response to the increasing importance of environmental, social, and governance (ESG) issues within organizations and in society at large. In 2022, a global Strategy& study found that Chief Sustainability Officer appointments were growing fast: more CSOs were hired in 2021 than in the previous five years combined.

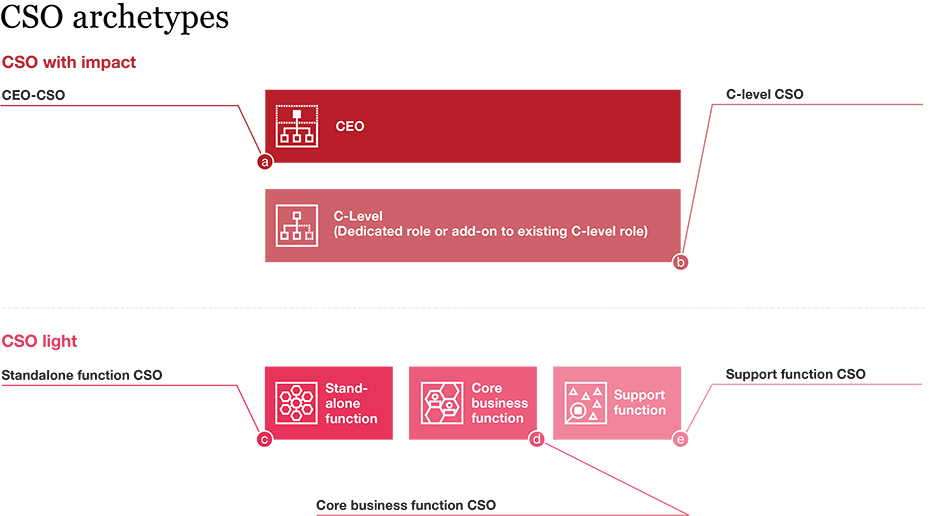

To deepen our understanding of the role and responsibilities of the CSO today, we looked more closely at listed companies in Germany, Austria, and Switzerland. The study of CSOs in 40 DAX, 20 ATX, and 20 SMI listed companies allowed us to identify five CSO archetypes, based on their position within the organization. While some CSOs are members of the C-suite and report directly to the CEO, others hold less visible positions, one or more levels below the C-suite. Some lead standalone sustainability departments, others are subordinated under core business functions such as operations. They all differ in their level of influence and their ability to drive ESG transformation across the business. This plurality of archetypes is not unusual for a relatively new function and mirrors the broad remit of ESG, which allows for different starting points to improve performance across environmental, social, and governance-related factors.

Key results for Germany

Regarding Germany, there are three things you need to know about Chief Sustainability Officers:

“The ESG transformation is now visible in the economy, as the prevalence of CSOs underlines. Of course, the creation of the role is only a first step: CSOs need to be given the right position, mandate, and resources to drive the integration of sustainability in the corporate strategy and all business functions.”

Dr. Peter Gassmann,

Partner, Strategy&

The five archetypes

The finding that some of the DAX CSOs operate on the C-level and have a direct reporting line to the CEO while others do not led us to split them into two distinct categories: “CSO with impact” and “CSO light.” The former tend to have the required seniority and mandate to drive a holistic ESG transformation, while the latter tend to have less influence to shape the pace and depth of large-scale transformative sustainability initiatives.

In this year’s study, we looked more closely at CSOs’ reporting lines and where they sit in the organizational structure. As a result, we were able to further refine the distinction between the two categories with the help of five CSO archetypes:

- 1CEO-CSO When CEOs take on direct responsibility for ESG, it should be the case that they want to direct a profound transformation of the business, putting sustainability at the core of the company’s purpose and managing for long-term, sustainable performance. They take an idealistic view on the sustainability of their business. These CEOs believe only they can orchestrate the necessary change and navigate conflicting stakeholder demands from customers, investors, employees, and other interest groups, including NGOs.

- 2C-level CSO In this case, the CSO has a dedicated role reporting directly to the CEO. He or she is a member of the top management team, on a par with other C-suite roles such as the COO or CFO. As such, they can bring strategies for sustainable transformation to the management board and ensure sustainability performance is considered alongside other corporate goals. A variant of this position is an existing member of the C-suite who takes on the role of CSO in addition to their other responsibilities. While combining two C-suite positions may sometimes make sense, the “add-on” CSO role may be seen as merely a label if it doesn’t come with changes to tasks and actions.

- 3Standalone CSO This is the most common type of CSO among the DAX. The influence of this type of “CSO light” might be more limited. While they typically lead a team of experts spanning the breadth of E, S, and G topics, they rely on the cooperation of counterparts in business units and support functions to implement ESG strategy and collect ESG data. Thus, they often put a great deal of time and effort into educating business units about ESG and winning their buy-in for the implementation of sustainability plans and projects. The mandate of this type of CSO varies from company to company, but often goes beyond compliance to include developing the ESG strategy for consideration of management boards, creating steering KPIs, and managing ESG reporting.

- 4Core Business Function CSO A second type of “CSO light” is the CSO who is located within a core business function, usually the business function that contributes most to the company’s ESG footprint. This CSO’s focus is on transforming the company’s business activities to minimize environmental or social harm. The advantage of embedding a CSO in a core business unit is that this is where the ability to make a quick, tangible impact is the greatest. This model therefore reflects a pragmatic approach to ESG. The respective CSO is able to co-develop solutions together with expert teams on the ground, increasing their chances of success.

- 5Support Function CSO This CSO is subordinated within a support function such as finance, compliance, HR, or marketing and communications. They typically have the most limited mandate, as they are far removed from those who have the greatest influence on the company’s environmental footprint and social impact. Their ability to introduce cultural or operational change within the organization is very restricted. Companies that have this kind of CSO tend to be beginners in ESG. Their main priorities are to minimize legal, safety, and reputational risks, meet regulatory obligations, or to convey that they care about ESG.

Conclusion

Our analysis shows that around half of the top listed companies in Germany, Austria, and Switzerland – those with a “CSO with impact” – have understood the rising importance of ESG regarding their long-term financial future and value creation. At the same time, we believe companies should be paying even more attention to where the CSO sits within the organizational structure, as this is often a crucial enabler of a successful ESG transformation that goes beyond regulatory compliance. While it is true that ESG challenges vary between companies and sectors, in almost all cases, a “CSO with impact” – who reports directly to the CEO and holds a top-level position in the firm – will have more authority to articulate a shared vision of a company’s ESG goals and more influence to achieve them. In short, the CSO’s role is to ensure that ESG becomes integral to financial value.

Chief Sustainability Officers with impact

Methodology

The data in this study was gathered in March and April 2023 through outside-in desk research of the largest publicly listed companies in Germany (40 DAX companies), Austria (20 ATX companies), and Switzerland (20 SMI companies). For each company, the person with overarching responsibility for sustainability was identified (“Chief Sustainability Officer”) and categorized in two categories “CSO with impact” and “CSO light,” whereby the company-specific job title of the CSO, e.g. Head of Sustainability or Sustainable Lead, was not the sole criterion.

The sources used for the data analysis were openly available sources including corporate homepages, sustainability reports, non-financial reports, and annual business reports. Furthermore, information from paid databases such as XING and LinkedIn was used for the analysis.

Dr. Franziska Poprawe, Lina Kaniewski and Francesca Viefhues have also contributed to this report.