The Turkish CEP (Courier Express Parcel) market is growing rapidly thanks to trends such as the e-commerce boom while capacity has already been far away from satisfying demand. At the same time the market landscape is evolving with changes in consumer expectations and increasing competition supported by new business models, leading incumbent players to change.

A rapidly growing CEP market

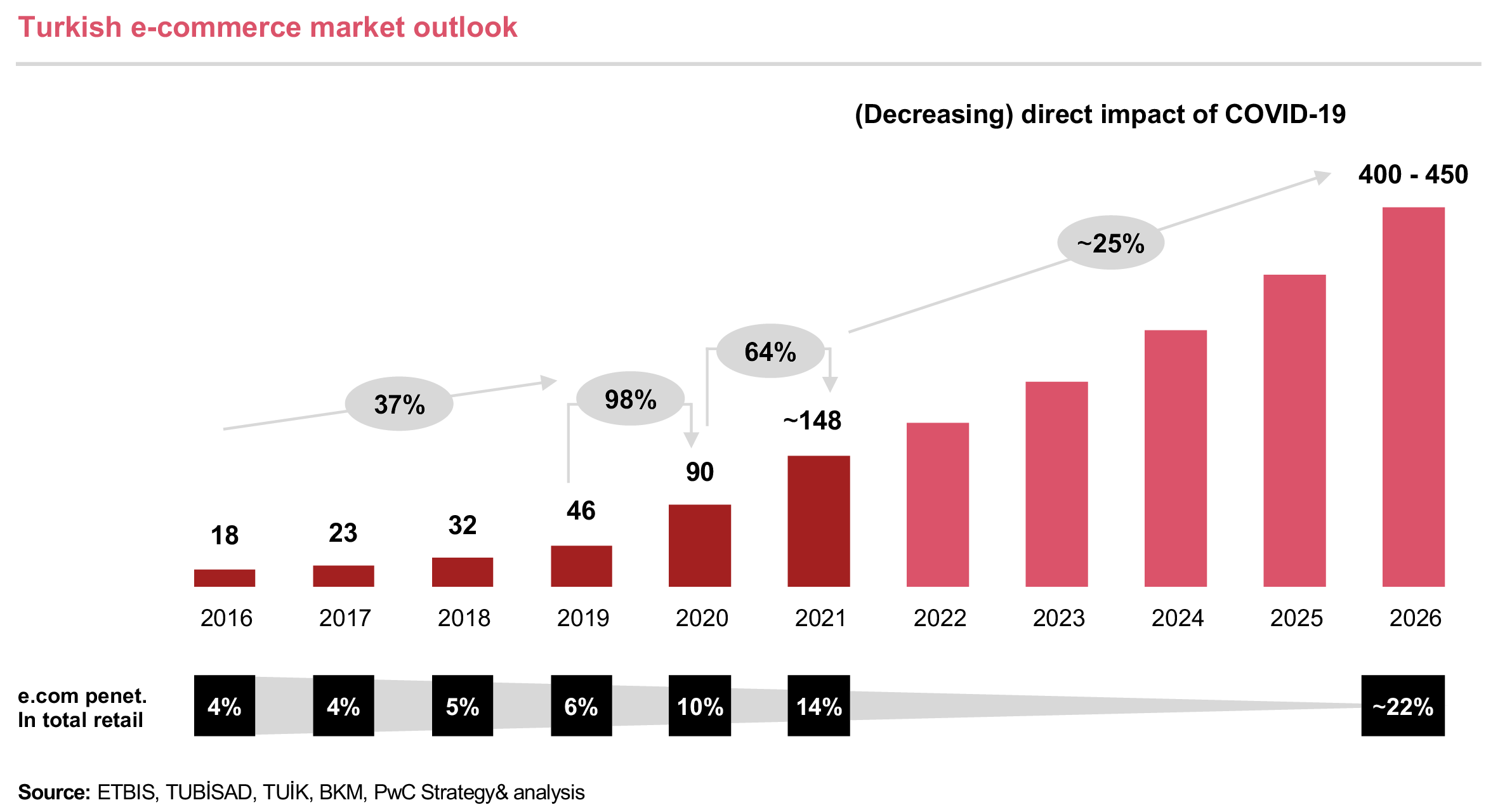

The Turkish CEP market has been growing remarkably in recent years thanks to the underlying boom in e-commerce accelerated by the COVID pandemic (e.g. limited physical shopping, working from home etc.). According to official estimates, 15 million households are receiving a shipment on an average day in Turkey now (Source: Karid). Going forward we expect the market to grow with a CAGR of 15% over the next 5 years (far above pre-pandemic years, where the market grew with a CAGR of 9% in terms of volume between 2015 and 2019)

Taking a closer look1: The Turkish e-commerce market grew in the last two years and it is expected that this high-paced growth will be maintained.

Customer expectations changing

Not only in Turkey, but in the world “customer is King”;

with this in mind Turkish customers’ main expectations are on-time delivery and without damage. The industry standard for the Turkish market being 1-2 days delivery for up to 600 km distance and 2-4 days delivery for above this distance. Furthermore, price, convenience of reach and prevalence are also among decision making factors for the shippers.

So what do CEP companies need to do as a minimum?

Understanding customer expectations is crucial for CEP companies to position themselves in this rapidly changing CEP market conditions.

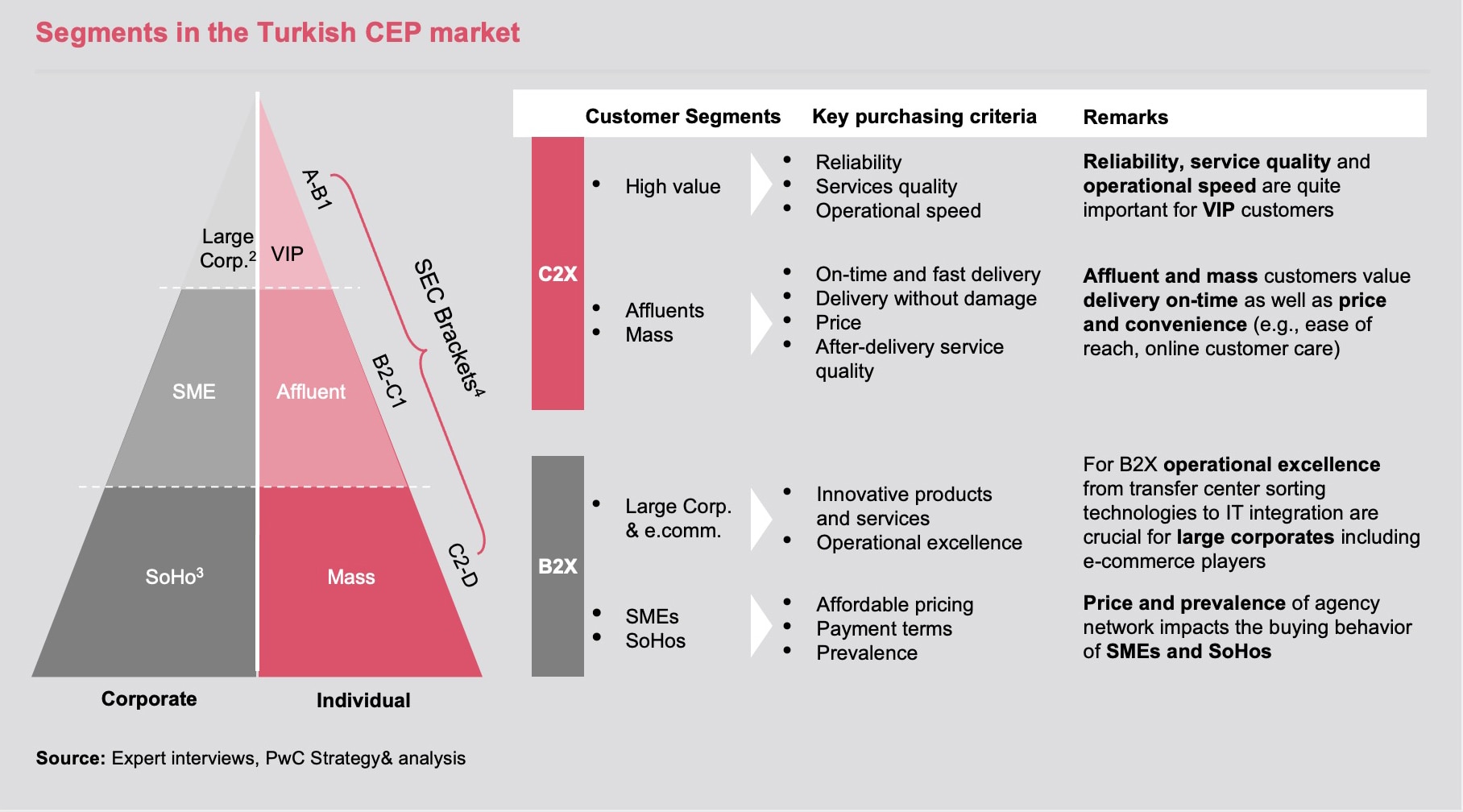

As Strategy&, we have identified various needs for different customer segments regarding to CEP market.

- A high-value customer under individual shippers puts more value on reliability, service quality and on-time and fast delivery whereas mass and affluent customers value cheaper price and after-delivery service quality (e.g., ease of reach, online customer care).

- On corporate side, large corporates and e-commerce customers value innovative products and services as well as operational excellence from transfer center sorting technologies to IT integration whereas SMEs and SoHos value more price and prevalence.

However change has just started, following the customer is key:

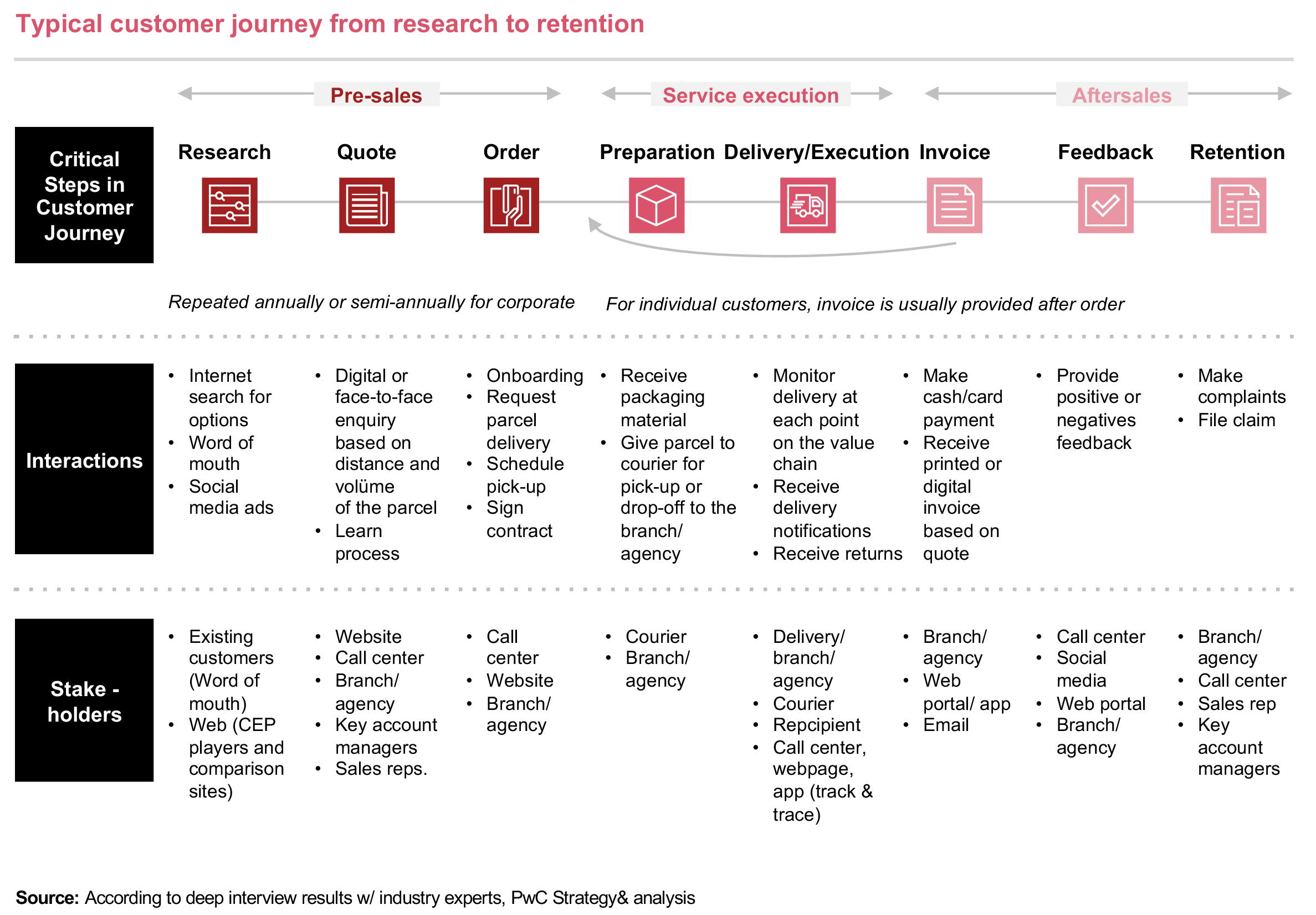

With Covid-19 impact and increasing online adoption, the customer journey of both recipients and shippers started to change and new needs started to emerge from researching for the most suitable CEP service provider to after-sales. Therefore, leading CEP players needs to identify the changing customer needs and current pain points for realizing their expectations along the customer journey to achieve higher customer satisfaction.

Disruptive and differentiating initiatives have started to create unique value propositions especially in pre-sales and service execution steps of the customer journey.

CEP is not only about delivery, who would you purchase from?

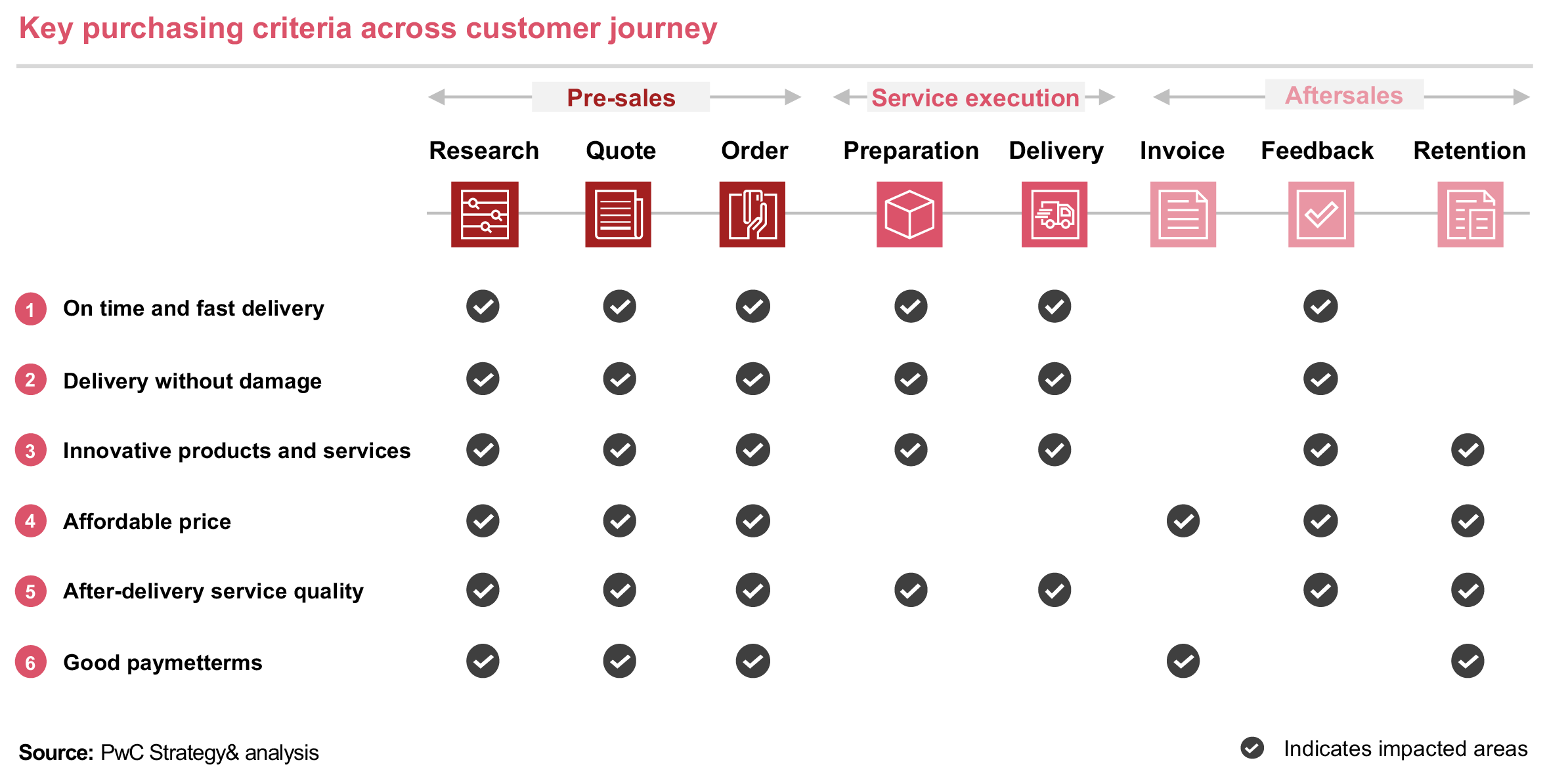

Key purchasing criteria impact the level of customer satisfaction across all phases of the customer journey.

According to our perspective as Strategy&, innovative products and services and after-delivery service quality might be the most impactful purchasing criteria with a wide-spread coverage across seven phases.

On time and fast delivery is the most important criteria to satisfy especially individual customers. Recipients especially value deliveries on on-time or communicated time. Having right capacity, effective technology usage and competitive performance metrics from sorting centers to last mile are critical for on time and fast delivery.

Delivery without damage is an important topic for majority of customer groups (e.g., ecommerce, individuals etc.) and CEP companies need to track their performance across different regions and compensate for any damage or loss. Having opaque and complex compensation policies and defected deliveries repel customers and hurt brand image.

Time-window delivery, home delivery in the evening, same day delivery, estimated time of arrival and delivery redirections (e.g., to a neighbor or a parents) will be key examples of innovative products and services that will shape the future of the Turkish CEP industry.

Affordable prices and good payment terms are relevant to all customers. In the CEP industry, customers have growing demands for innovative services while at the same time having a rather low willingness to pay a premium for these services. Differentiated pricing policies can be a tool to attract more customers: For instance, the impacts of charging less for deliveries in non-peak than peak hour deliveries can be assessed.

Additionally, customers would like to have seamless service quality from first contact to last with easy to access customer services. Transparency in delivery, improved branch experience, and easy change procedures for delivery details are critical for delivering a seamless service quality.

So what is expecting us going forward?

Going forward, working on each customer journey step to meet increasing customer demand and needs is critical for CEP players to stay ahead of the curve. All improvements from digitalization to operational excellence and sustainability needs to focus on improving customer experience along pre-sales, service execution and after sales customer journey steps. In this way, CEP players can ensure their right to win in the market or increase their resilience against the rising competition.

Let’s just look at what needs to be done for delivering an enhanced experience across the customer journey; taking service execution as an example.

Service execution

a) Preparation

CEP players can sustain advantage over its competitors by providing ease of mind and flexible and personalized offers in the preparation phase of the service execution, which is a critical touch point with customers. Personalized offers can create commercial advantages for CEP players, especially for the ones with extensive customer data. CEP companies can offer customized packaging and pick-up solutions to customers based on their past shipment behaviors or they can assign pick-up personnel to whom the shipper has a familiarity.

b) Delivery

Operational excellence is an enabler to deliver fast, on time and with quality while being flexible. Right network capacity and delivery transparency and visibility are quite critical results from operational excellence. For this purpose, various CEP players invest in sorting center technologies, hub & network optimization and last mile delivery technologies and efficiencies.

Network capacity: Right network capacity is a foundation for effective and efficient operations. CEP players need a long-term capacity planning considering the growth of their delivery volume, service level commitments, geographical footprint (including possible international operations) and technological improvements in delivery fleet (e.g. introduction of drones).

Delivery transparency and visibility: More transparent delivery can be achieved by live order tracking, which is mostly used by quick commerce and food delivery players, which ensures customer confidence.

Alternative last mile delivery models: Last-mile delivery is the last part of the journey to the customer's doorstep. Pick-up drop-off (PuDo) lockers, parcel shops, redirections, click & collect service, and same-day delivery are some new last-mile delivery models penetrating the Turkish CEP market.

To become and remain one of the leading CEP players in the Turkish market, the players need to answer various strategic questions clearly:

- Which purchasing criteria are the most important for the existing and potential clients? How can we respond to our customers’ emerging needs?

- What are the existing pain points that adversely impact the purchasing criteria across the customer journey?

- How can we fix or improve these pain points and turn them into a satisfactory moment of truth for our customers? How can we avoid the mistakes of the previous examples in the industry?

- Which of our differentiating capabilities should we leverage for excelling on the most critical purchasing criteria against the competition?

- How does the target customer journey need to be shaped to stay ahead of the curve?

1 Please also refer to our new, separate thought leadership on our web-page entitled: Turkish E-commerce Ecosytem Outlook

2 Includes e-commerce companies

3 SoHo means small office home office

4 SEC: socio-economic class

*Only categories relevant to CEP market are added, other categories (e.g., accommodation, travel, betting) are excluded in Turkish e-commerce market graphics.