In the past years, healthcare systems and the pharmaceutical industry have undergone tremendous changes given technological, regulatory and socioeconomic disruptions. Covid-19 has further intensified and catalyzed these changes in healthcare systems and healthcare delivery. Among others, regulators paved the way for more dynamic and faster decision-making, approved novel technologies including digital health solutions and created new reimbursement pathways. In parallel, medical and biological research has made breakthroughs with emerging technologies including in-silico protein folding prediction, novel cell therapies and other treatment platforms. With those trends materializing, borders between industries continue to blur. This convergence of healthcare, technology and retail and consumer industries will lead to what we call the LIFEcare system. The critical question for each player in that new normal will be: Are you prepared and what’s your right to be successful in this changing future?

Our 2021 global Future of Health study, based on interviews with and survey responses from 150 senior healthcare executives, confirms our belief that this acceleration has only just begun. Over the next decade, the transformation of healthcare will in turn shape the road to success for BioPharma companies in an unprecedented way.

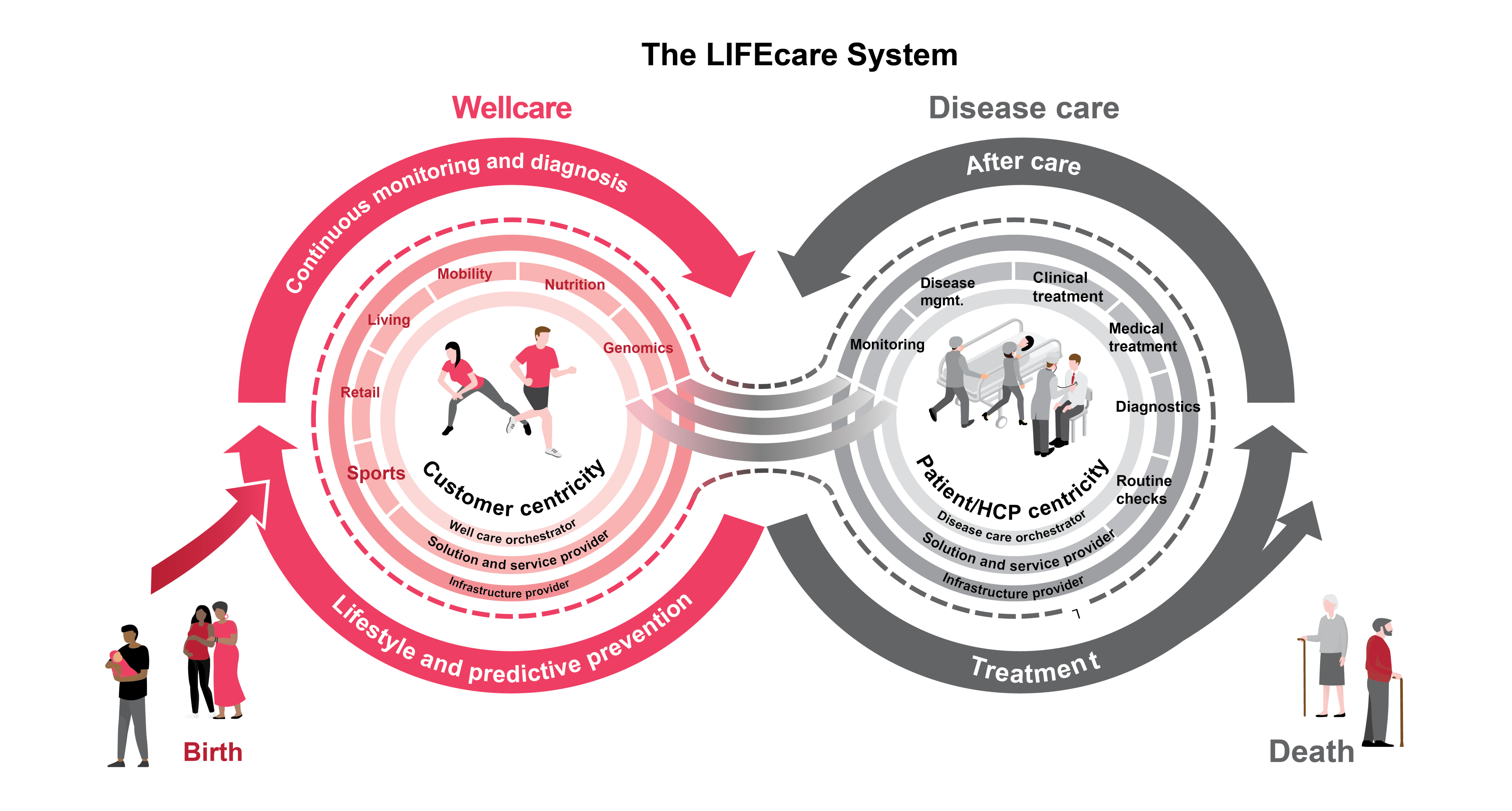

Based on the survey findings and our engagement with clients and partners, we expect the emergence of what we call the LIFEcare system, characterized by a convergence of wellcare and disease care systems. Overall, more than 75% of healthcare executives agree that LIFEcare systems will be widespread by 2035, especially in cardiovascular and metabolic diseases, oncology and neurology.

This adjustment will involve significant disruption of the BioPharma value chain. At the same time, we forecast that the creation of new opportunities in areas such as preventative care and personalized nutrition will lead to a two to threefold increase in the global wellcare, creating a total value pool of 2.8 to 3.5 trillion USD by 2030.

Taken together, these forecasts represent a wake-up call for BioPharma companies. Specifically, they will need to:

- Build up capabilities around digital, data and analytics as well as ecosystem partnering

- Transform their value chain, in particular R&D and commercial operations

- Reinvent their business models to sustain success in LIFEcare systems

Amid the ongoing disruption of healthcare, both significant challenges and opportunities are arising. BioPharma companies need to transform their value chain and reinvent their business model. The time to act is now.

How LIFEcare will transform healthcare spending?

Almost unanimously, the 150 healthcare executives in our survey believe that by 2035, healthcare will be centered around human needs, and will be personalized, digitized and preventative, with healthcare solutions being seamlessly integrated into daily life.

To seize the opportunities created by these changes, healthcare stakeholders will need a much deeper understanding of individual human biology and lifestyle, to be able to deliver disease and well care earlier and in a more personalized manner. However, acting on the outlined trends will require access to longitudinal, meaningful data ranging from lifestyle areas such as fitness, nutrition, and the social determinants of health, to healthcare fields such as multi-omics and disease progression and expression.

BioPharma companies will need access to the same data in order to develop and provide personalized health solutions and services, including pharmaceutical drugs and digital health applications. For well care players, the convergence of health and wellbeing presents an opportunity to medicalize their offerings and exploit new, attractive value pools with higher margins.

Realizing this vision of the LIFEcare system requires convergence between current disease care systems, focused on treatment, and well care systems, focused on prevention and general wellbeing.

The wellcare system aims to preserve “good health” and provide wellbeing through additions to an individual’s daily routine, ranging from nutrition and supplements to exercise, social engagement and personal use of digital health solutions. Where wellcare was once seen as marginal, it will be at the core of effective healthcare systems. Future wellcare regimes will increasingly pursue partnership models with corporate health programs and reach partial reimbursement agreements with insurers. This, however, also raises the bar for wellcare providers to generate relevant medical evidence for the positive health impact of their offerings. The broad spectrum of market openings will attract a correspondingly wide and growing range of wellcare players beyond established healthcare and BioPharma companies.

For all non-preventable and non-prevented cases, disease care systems - similar to current healthcare systems - will focus even more on early detection and more targeted and personalized treatment of adverse health conditions. While the goal of returning the patient to a better state of health and improving his or her quality of life remains constant, three key differences emerge.

- Disease care will take a more holistic approach to healthcare - leveraging a broader range of health solutions.

- Patients will play a much more active role in defining the treatment pathway most suitable for their personal situation.

- Decision-making in disease care will not only be based on healthcare data but increasingly incorporate multi-omics and lifestyle data.

How BioPharma’s value creation and business models will change?

With the focus of LIFEcare increasingly shifting towards keeping people healthy, we will also see global healthcare expenditures shift. The healthcare executives in our survey predict that in 2030 around 20% of private and public healthcare expenditures will be spent on wellcare, up from 11% in 2021. Given an overall growing market this would result in a total global well care spending of around 2.8 to 3.5 trillion USD by 2030.

For BioPharma companies this implies several challenges. Future growth in healthcare will predominantly originate from value pools outside BioPharma’s core traditional business model. While wellcare overall is expected to increase by a compound annual growth rate (CAGR) of 10 to 12%, disease care will grow by 3% CAGR. More strikingly, within disease care, the largest growth areas are diagnostics (19% CAGR) and digital health (12% CAGR) while spending on medicines is predicted to grow by only 3%. This increase, however, is due to a higher number of patients being treated with drugs, not by increases in price, which results in overall increasing pressure on BioPharma margins.

This forecast makes clear the financial pressure the BioPharma business model will face in the future. While needing to invest and transform their value chains to be future ready amid increasing technological disruption, BioPharma companies additionally need to evolve and reinvent their business model in order to remain attractive.

Conclusion

The transformation of healthcare is happening at full speed. By 2030, BioPharma companies will face a significantly different market environment than they are currently operating in, with immense risks to their business model. However, one thing is clear: Wait and see is not an option. Instead, BioPharma executives need to transform and evolve their value chains to embrace and leverage the potential of new technology, data-driven approaches and evolving regulatory landscapes. At the same time, they must prepare to revamp their business models.

Focus will be key: we recommend BioPharma firms identify their differentiated offerings and capabilities; understand how market and customer demands are changing in their field of business; and formulate and execute on a focused strategy following one or a combination of the three archetypal roles described in this study.

Dr. Christian Wieber and Sebastian Schwarzler contributed the report.